Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

1. Market Commentary

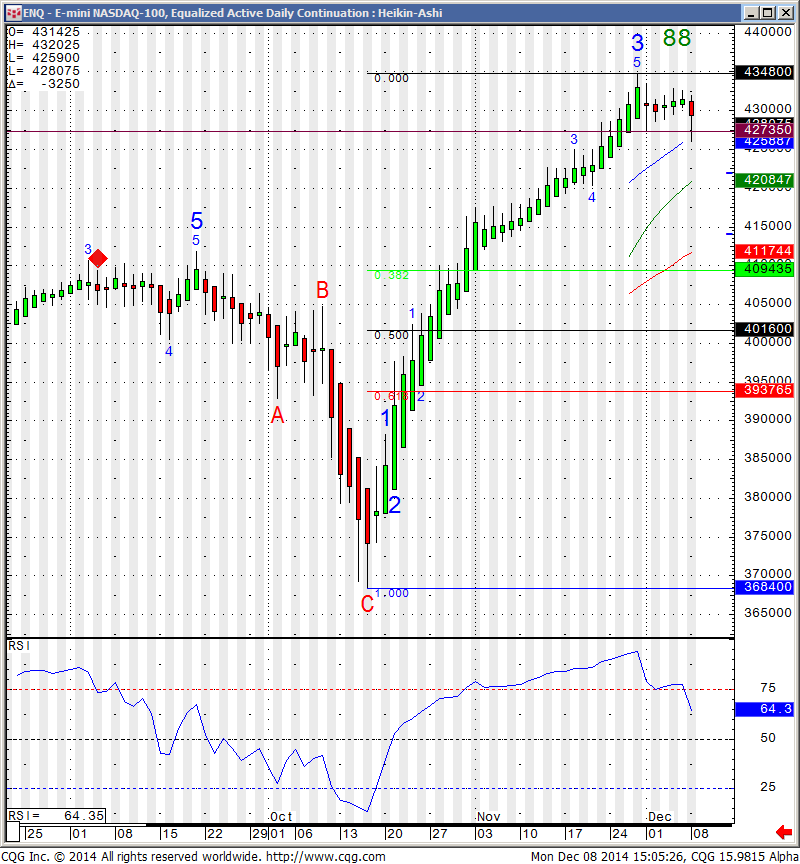

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

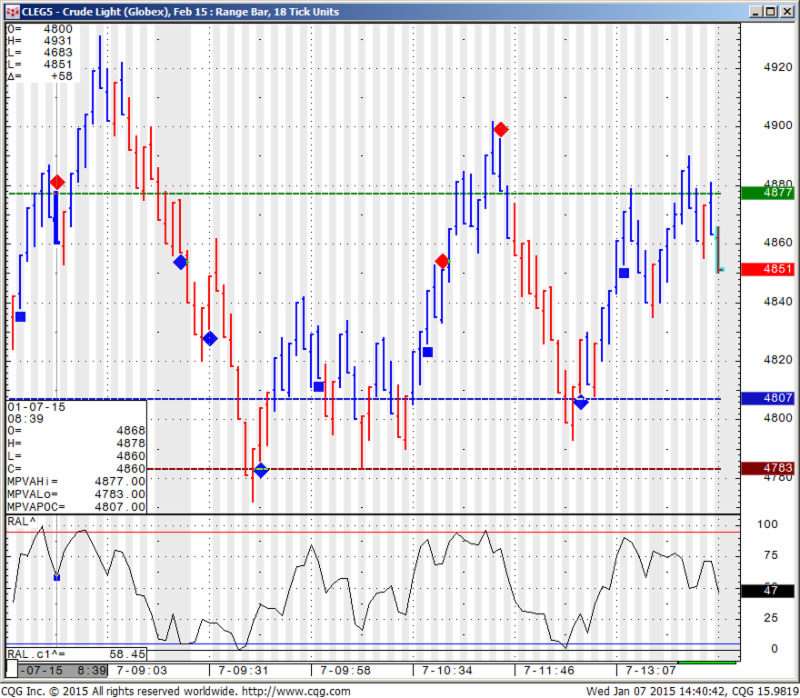

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday January 6, 2014

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

I wish you and your family a happy, healthy 2015 and of course a successful trading year in 2015!!

If the first two trading days of 2015 are any indication of what to come the rest of the year…then hang on as it may be a wild ride…..

Some of what is making the markets move from our friends at www.tradeTheNews.com

TradeTheNews.com Weekly Market Update: New Year’s Blues

Trading volumes were very light in the New Year’s holiday week. Global equity markets dipped during the final session of 2014 and then fell lower on the first day of trading in the New Year as weak data and jitters about upcoming Fed and ECB action drove risk appetite into the deep freeze. Manufacturing industry data from around the globe out this week was not especially positive, adding to the tepid atmosphere.

Looking back, 2014 was very good for major US equities: the S&P 500 rose 11% to 2,059, its sixth year of positive returns and its third straight year of double-digit gains. The DJIA added 7.5% to 17,823 after slipping below 18,000 on the final two days of trading, and the Nasdaq advanced 13%. Small-cap stocks were not quite as solid: the Russell 2000 climbed 3.5%. Europe’s EuroStoxx 600 Index gained 3.9% on the year and Germany’s DAX Index added 2.7%, although France’s CAC40 dropped 1.2%. Chinese equities had their best performance since 2009 even as overall emerging-market shares posted the first back-to-back annual loss in 12 years.

US housing market data out this week remained tepid. The S&P/CaseShiller October home price survey showed that real estate price gains slowing a bit. The y/y gain dropped to +4.5% from +4.8% in September. Yale economist Shiller commented that the housing market is fragile and is still reliant on low interest rates. The November pending home sales m/m figure beat expectations and returned to positive territory after October’s contraction. The December Chicago Purchasing Manager survey and the ISM Manufacturing Index missed expectations, hitting their lowest levels since mid-2014.

Continue reading “Futures Levels and Economic Reports 1.06.2014”

![]()

![]()

![]()

![]()

![]()

![]()