Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5.Economic Report for February 22, 2012

1. Market Commentary

Hello Traders,

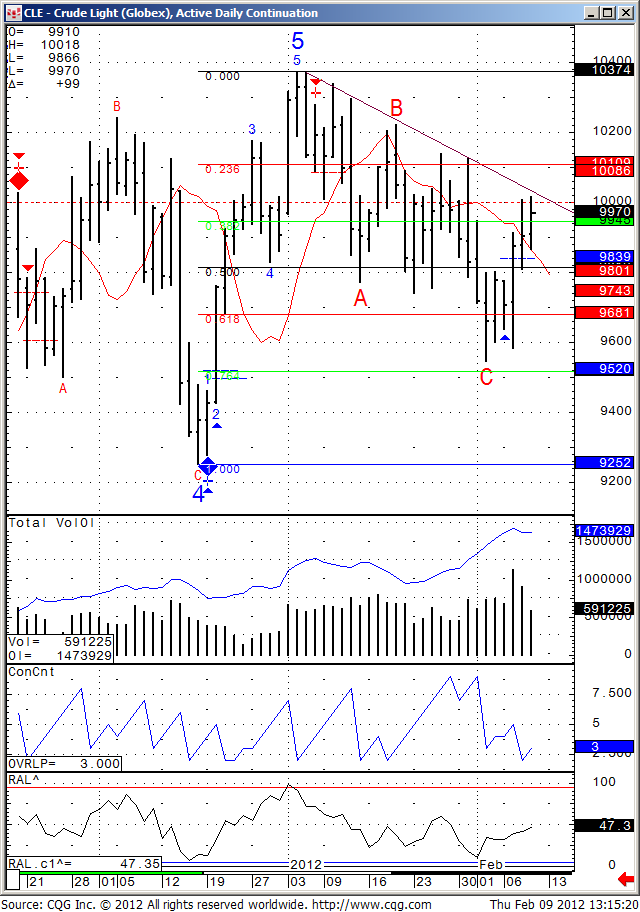

We came back fro President’s Day long weekend to find crude up over $2.00.

Gold followed on the same uncertainties and finished up $35

Our stock market on the other hand, finished unchanged on another less than avg. volume.

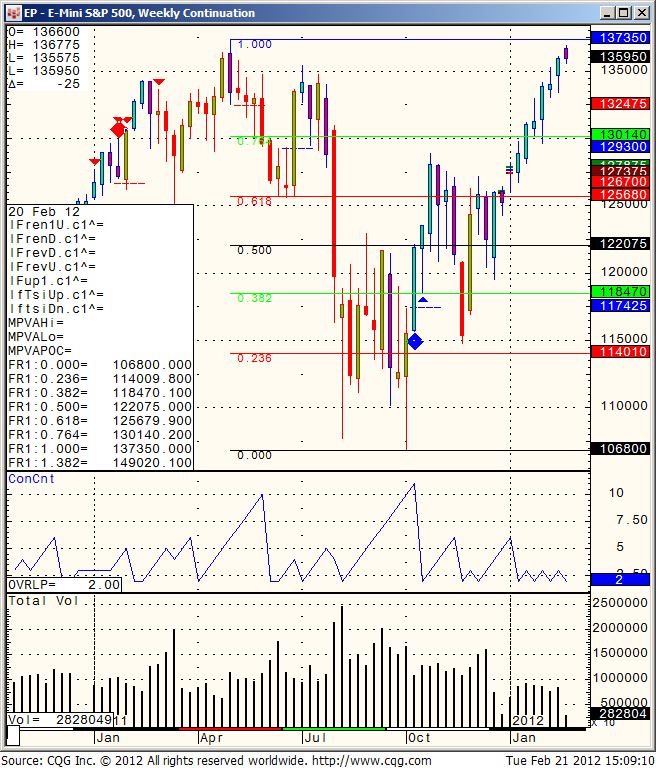

WEEKLY chart of mini SP 500 for your review below. We are trading against the high from last May and it will be interesting to see what type of price action and volume we will see here.

Continue reading “WEEKLY chart of Mini SP 500 | Support and Resistance Levels”

Continue reading “WEEKLY chart of Mini SP 500 | Support and Resistance Levels”