Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

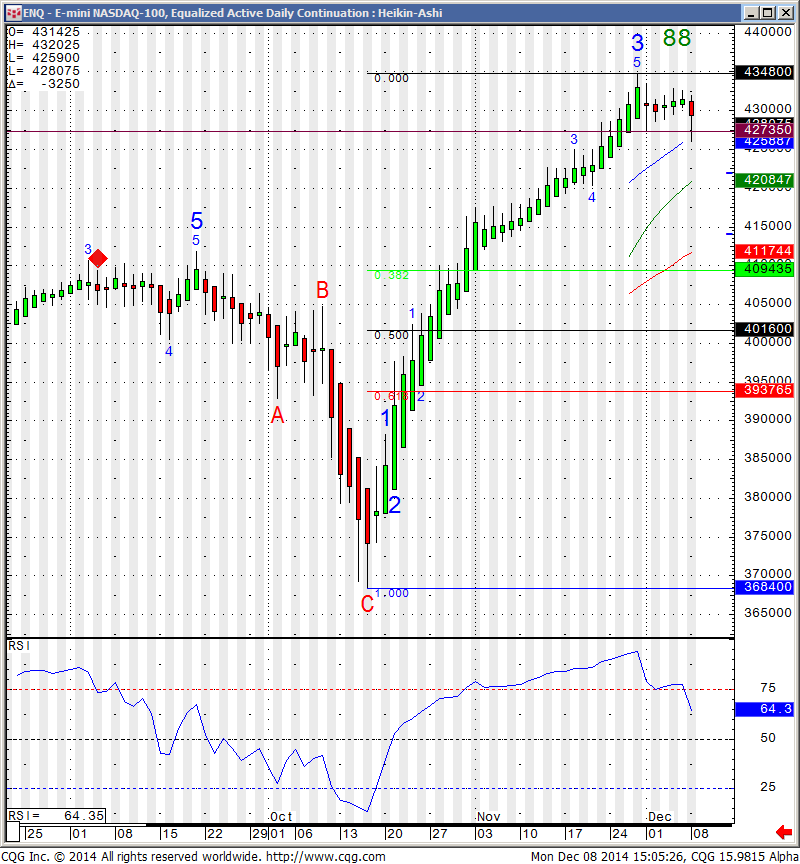

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday June 10, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

I personally start trading the September mini SP this Friday but most traders will rollover tomorrow:

Rollover Notice for Stock Index Futures

Important notice: For those of you trading any stock index futures contracts, i.e., the E-mini S&P, E-mini NASDAQ, E-mini Dow Jones, the “Big” pit-traded S&P 500, etc., it is extremely important to remember that tomorrow, Thursday, June 11th, at 8:30 am CDT Time is rollover day.

Starting June 11th, the September 2015 futures contracts will be the front month contracts. It is recommended that all new positions be placed in the September 2015 contract as of June 11th. Volume in the June 2015 contracts will begin to drop off until its expiration on Friday June 19th.

Continue reading “Rollover Emini Futures Day & Economic Reports 6.11.2015”