Learn more about trading S&P Futures here.

When it comes to trading S&P futures, having the right partner can make a significant difference in your trading success. Cannon Trading Company has emerged as a reputable brokerage firm with a strong track record and a range of services tailored for traders interested in S&P futures. In this article, we will explore the reasons why trading S&P futures with Cannon Trading Company can be a wise choice, highlighting their expertise, cutting-edge technology, personalized support, and commitment to client satisfaction.

- Expertise in S&P Futures:

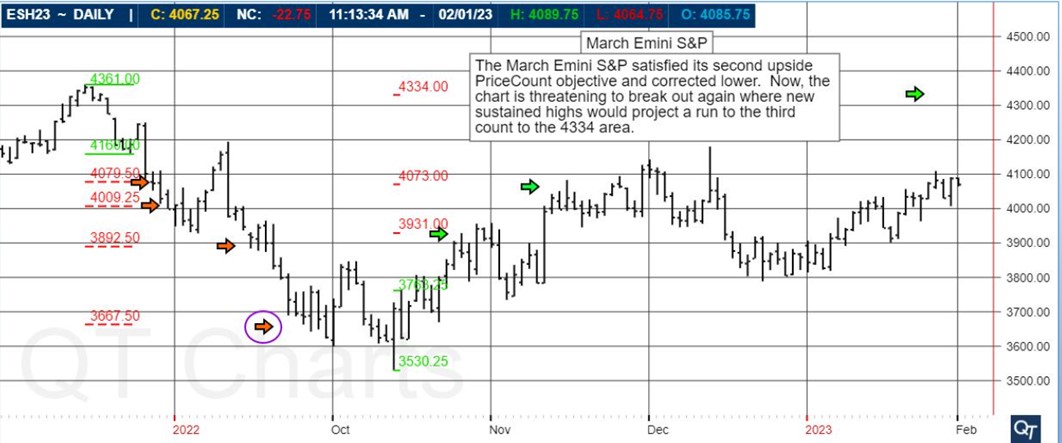

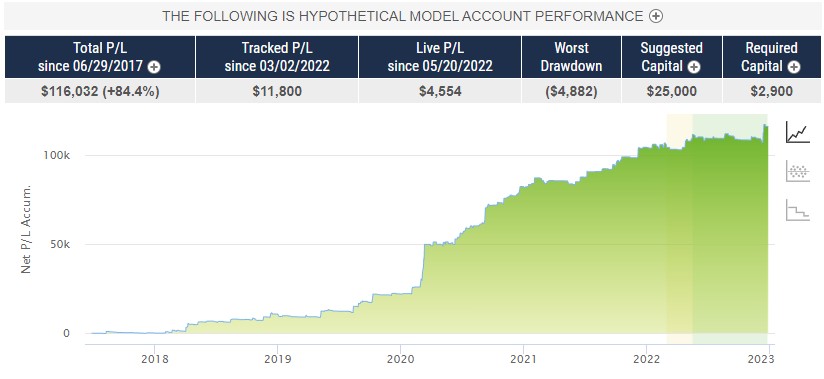

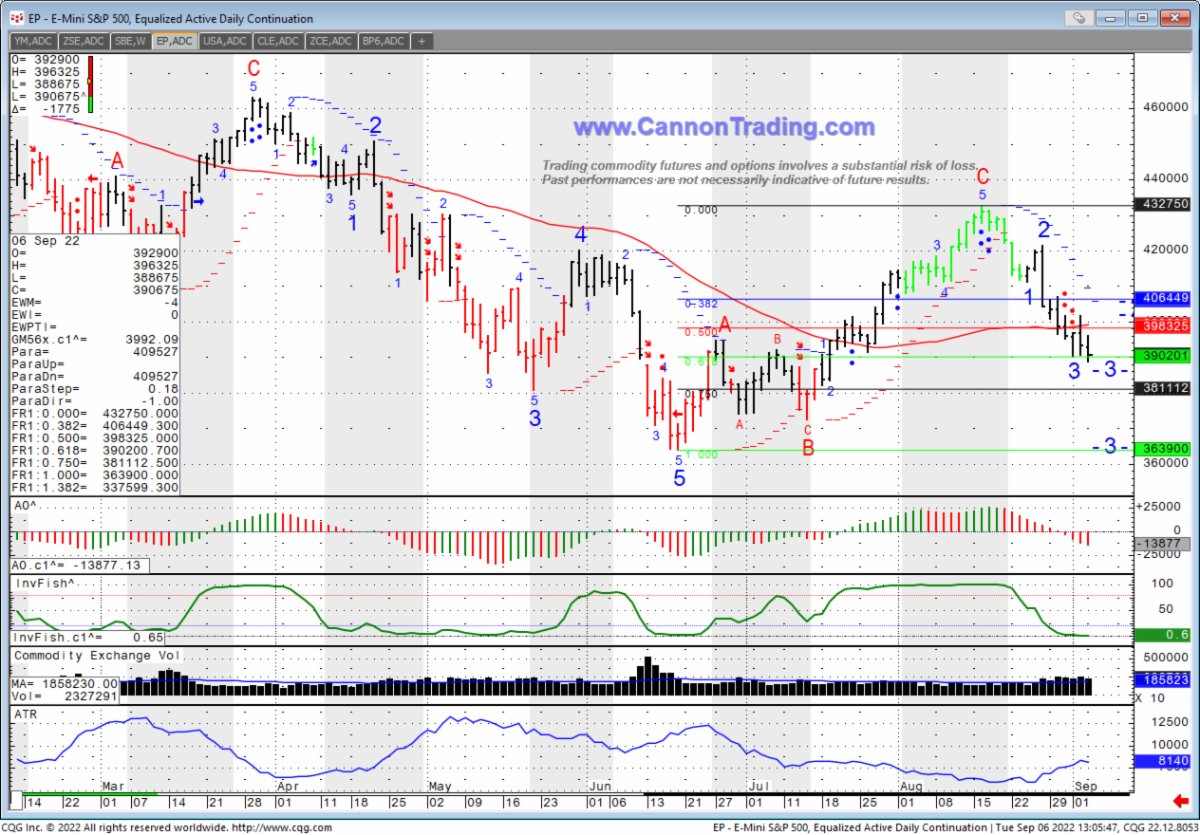

Cannon Trading Company has established itself as a leading brokerage firm with extensive expertise in trading S&P futures. With years of experience in the industry, their team of professionals possesses in-depth knowledge of the S&P 500 index and the intricacies of trading futures contracts. This expertise allows them to provide valuable insights, market analysis, and trading strategies specific to S&P futures, empowering traders to make informed decisions and maximize their trading potential. - Advanced Technology and Platforms:

Cannon Trading Company understands the importance of advanced technology in today’s fast-paced trading environment. They offer cutting-edge trading platforms, such as CannonPro, championed by Cannon Trading Company brokers and clients alike for its reliability, speed, and comprehensive charting capabilities. CannonPro provides traders with access to real-time market data, advanced order types, customizable indicators, and automated trading systems, empowering them to execute their S&P futures trading strategies efficiently and effectively.III. Personalized Support and Education:

One of the key advantages of trading S&P futures with Cannon Trading Company is their commitment to personalized support and education. They prioritize building strong relationships with their clients and offer dedicated support throughout the trading journey. Their team of knowledgeable brokers is readily available to assist traders with any questions, concerns, or technical issues they may encounter. Furthermore, Cannon Trading Company provides educational resources, including webinars, tutorials, and market commentaries, to help traders enhance their understanding of S&P futures and refine their trading skills.

- Wide Range of Trading Tools and Services:

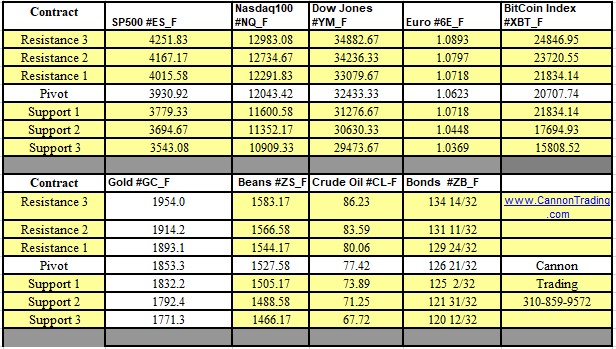

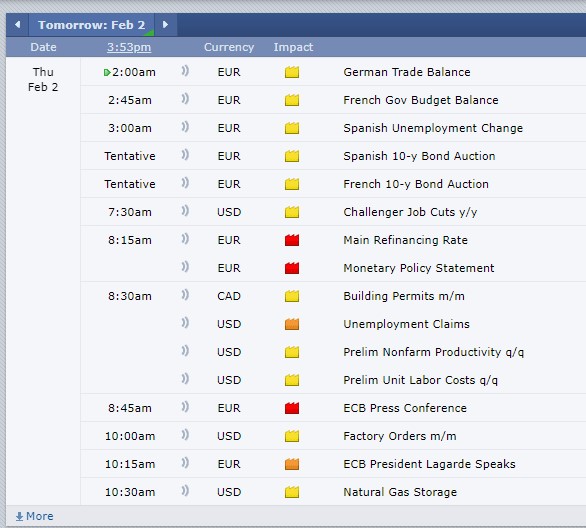

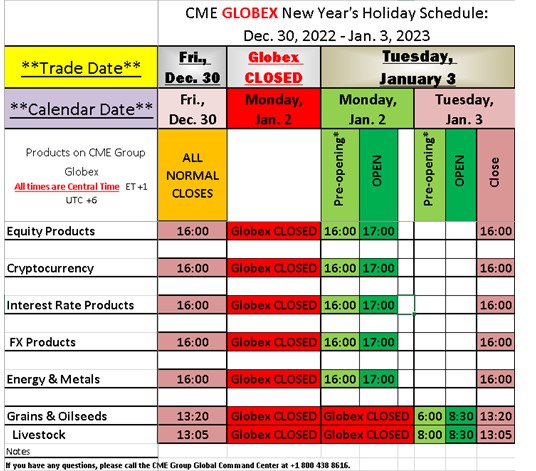

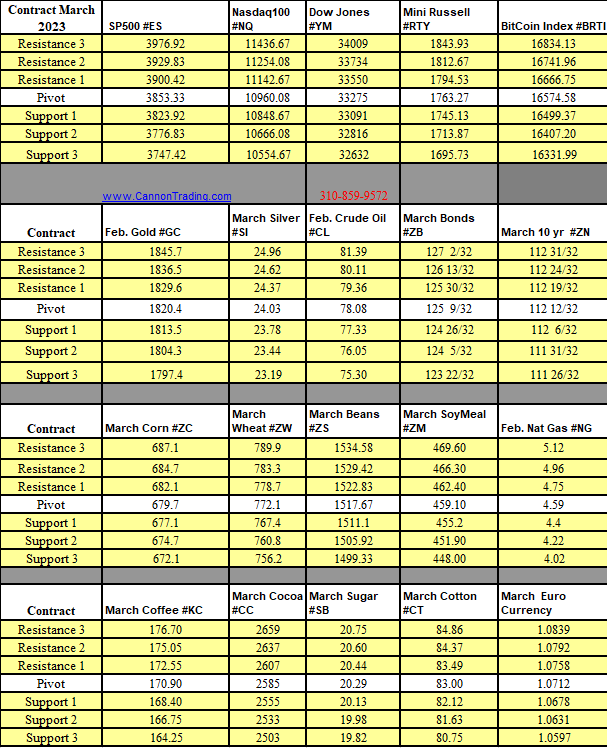

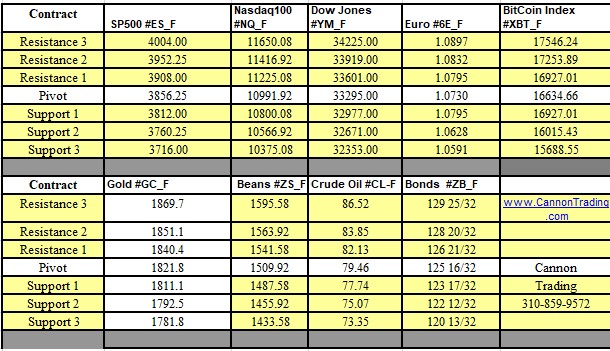

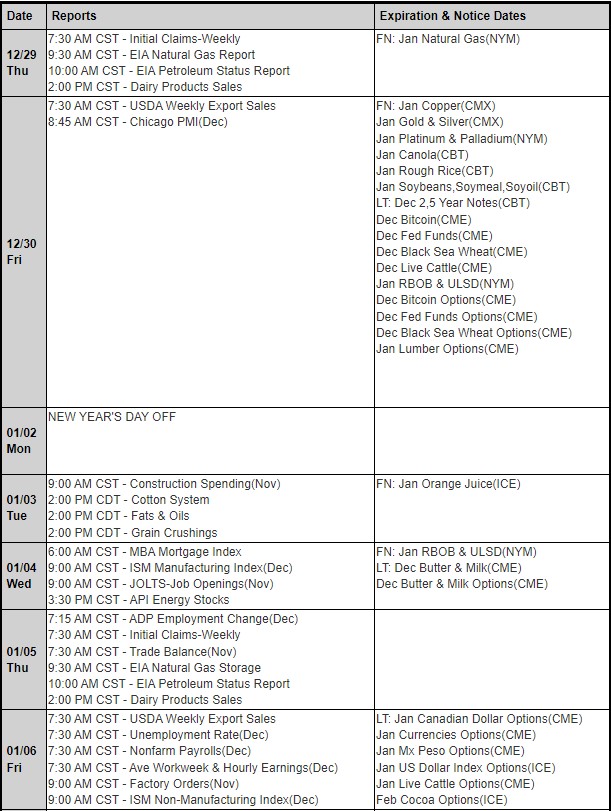

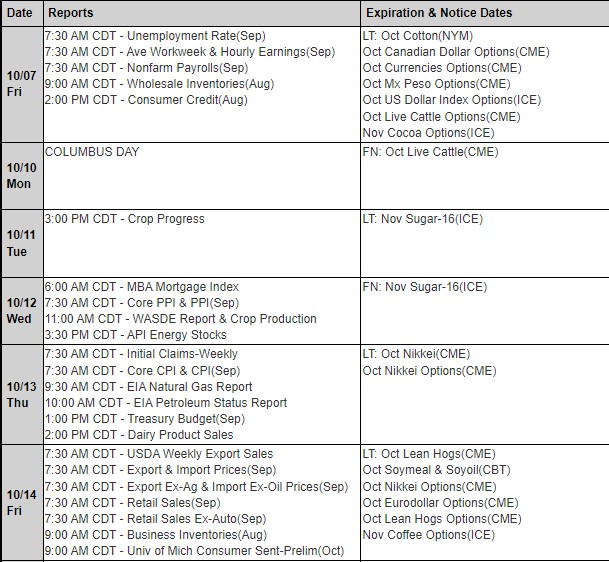

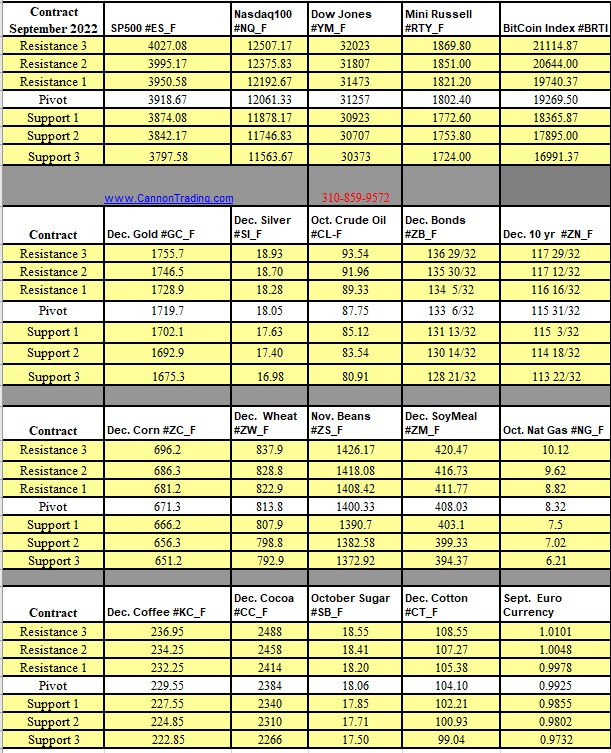

Cannon Trading Company goes beyond providing access to S&P futures markets by offering a wide range of trading tools and services. They offer comprehensive research and analysis tools, including market reports, technical analysis, and economic calendars, to help traders stay informed and make well-informed trading decisions. Additionally, Cannon Trading Company provides access to historical data, risk management tools, and order execution services, enabling traders to manage their positions effectively and optimize their trading strategies. - Competitive Pricing and Low Costs:

Cost-efficiency is a crucial consideration for traders, and Cannon Trading Company understands this. They strive to offer competitive pricing and low costs, ensuring that traders can execute their S&P futures trades with minimal expenses. By providing access to tight spreads, competitive commissions, and low margin requirements for day traders, Cannon Trading Company aims to enhance traders’ to succeed and create a favorable trading environment. - Commitment to Client Satisfaction:

Cannon Trading Company places a strong emphasis on client satisfaction and aims to build long-term relationships with their traders. They prioritize transparency, integrity, and reliability in their operations, ensuring that traders can trust their services and have peace of mind while trading S&P futures. Cannon Trading Company’s commitment to client satisfaction is evident through their responsive customer support, user-friendly platforms, and continuous efforts to meet the evolving needs of traders.

When it comes to trading S&P futures, partnering with a reputable and experienced brokerage firm is essential for success. Cannon Trading Company offers a range of compelling reasons to choose them as your trading partner. With their expertise in S&P futures, advanced technology and platforms, personalized support, comprehensive trading tools and services, competitive pricing, and unwavering commitment to client satisfaction, they provide a robust trading environment for S&P futures traders.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.