Get Real Time updates and more on our private FB group!

More Grain & Soy Product Volatility: Corn & Wheat Focus:

by Mark O’Brien

December

corn posted its fourth consecutive new contract high yesterday, likely still finding support from last week’s smaller-than-expected planted acreage number in the year’s USDA Prospective Planting report. For both

corn and

wheat, the war in Ukraine has traders worried about global grain supply, given Ukraine’s significant contribution to both. China’s

wheat crop has been described as a “potential disaster,” by the Hightower Report’s Stephen Maass and he’s not alone in his assessment of the country’s crop conditions, due to last fall’s record-breaking rain and flooding and subsequent planting delays. Additionally, record fertilizer prices may cause producers to use less, affecting this crop year’s yield. Phrases like ‘food inflation’ and ‘food scarcity’ are finding their way into commentary on future prices for a range of base commodities like grains, softs (

orange juice,

sugar,

coffee) and other “off exchange” staples.

This all sounds like the stage is set for price increases rarely seen for some commodities, particularly grains, but caveats abound. We’re way too early in the U.S. crop year to foresee how things will play out at harvest. Weather – anywhere in the world – is a fickle element and grain futures prices can seesaw at the slightest hint of change. We’ve already seen commodity prices react – or over react – to even hints of cessations of the war in Ukraine: peace talks, cease fires and the like. This should continue to be the expectation for price moves reacting to more of the same.

Updates:

- CME has launched Aluminum futures! more info available here, contact us if you would like to trade Aluminum futures.

- Would you like to get access to daily research? Access info on what is moving the markets both technically and fundamentally? FREE TRIAL

- Would you like a FREE CONSULTATION? Set up a time to talk with an experienced broker on variety of topics such as trading methods, indicators, concepts, questions on options/spreads/platforms and much more!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

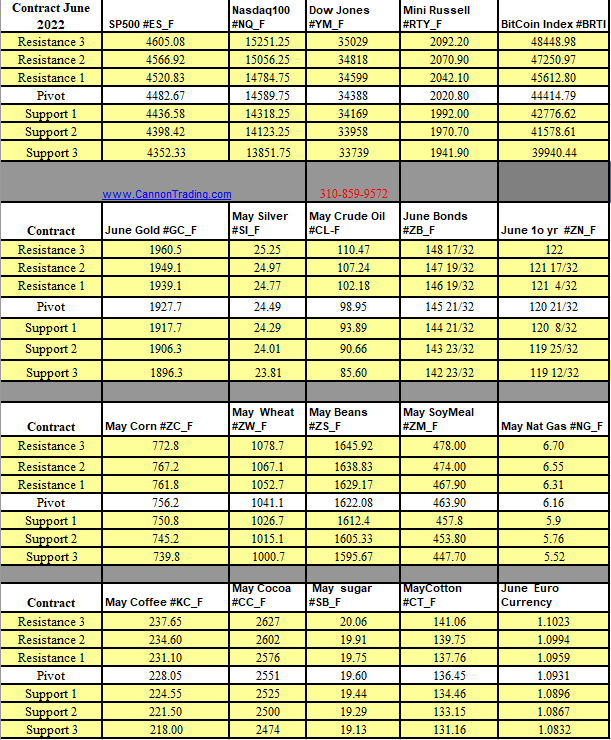

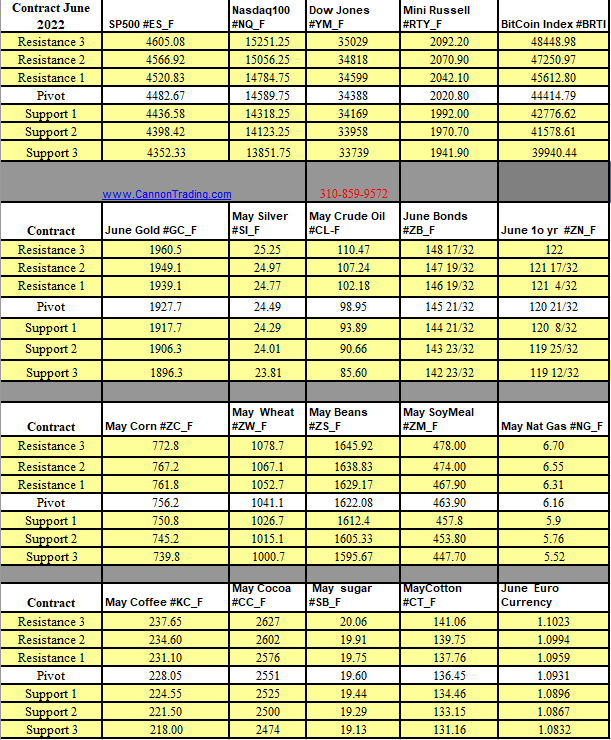

Futures Trading Levels

04-07-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.