Day Trading Commodities with Crude Oil Futures

Crude Oil Futures volatility offers a "different market personality" than stock index futures. Here is some of the things you need to know about day trading crude oil futures:

This is an update to the article below, which was written a few years back but it is TIMELESS in m y opinion when it comes to crude oil futures.

The update I am posting on December 2023 is to add a couple of pointers that may assist those who are trading crude oil futures, looking to trade or day-trade crude oil futures and MICRO crude oil futures etc. The first point is to share that volume on both crude oil futures (symbol on most platforms will be CL or MCL) and mini crude oil futures ( most common symbol is QM, so QMQ19 will be the August 2019 mini Crude Oil Futures. The Crude Oil futures have been averaging close to million contracts per day and are now one of the most popular and most traded futures contracts out there. Many days surpassing the ES/ mini SP 500 contract which used to be the "king" of markets for futures day traders.

If you are VERY short term trader, you need to also pay attention to order flow! Order flow is a term that refers to the analysis of the volume and direction of orders that are executed in a market, such as crude oil futures trading. Order flow can help traders understand the supply and demand dynamics of the market, as well as the sentiment and behavior of other market participants. Order flow can also help traders identify potential price movements, trends, reversals, and trading opportunities

The second point I would like to make is that breakout strategies are an interesting concept to use with this market, especially when volatility is higher than the average. One should explore the breakouts on different time frames along with possible filters such as volume and determine if the strategy will be a good fit for him or her as a trader.

Below is an example of what a breakout chart looks like from recent trading sessions.

Crude Oil is one of MY favorite futures market for day trading. Before I dive in and share with you how the volatility in crude oil fits my risk tolerance for day trading and provide a couple of chart examples, we should review some of the specifications of Crude Oil Futures.

Crude Oil Futures have monthly expiration. So each month we trade a different contract month, so one needs to know when is the first notice day and last trading day for crude oil futures in order to always make sure we are trading the proper month with the most liquidity and avoid any chance of getting into delivery situation.

Next is the contract size. Crude Oil futures are based on 1,000 barrels. To be honest from a day trading perspective all I care is that each tick or 1 cent fluctuation is $10 against me or in my favor per contract. That means that a move from 92.94 to 92.74 = $200.

Another factor is trading hours. At the time I am sharing my thoughts with you, April 8th 2013, crude oil futures trade on the CME Globex platform and trade from 5 PM CDT until the next day at 4 PM CDT. That is 23 of straight trading hours. I definitely don't recommend day trading this market 23 hours...but it is good to know the trading hours.

Volume in crude oil futures is pretty good to trade in my opinion. Averaging about 700,000 contracts per day.

One last pointer to touch on is the Energy Information Administration (EIA) report that normally comes out Wednesday at 9:30 CDT (on short weeks, holidays etc., this report will be pushed to Thursday at 10 AM CDT). I tell my clients that this report is way too volatile and I like to be out 5 minutes before and not resume trading 5 minutes until after the report comes out. This report by itself deserves a writing but on short, the report provides information on how our stock pile is doing ( = supply/demand) and the market will move based on the numbers versus what was expected. Again as a day trader, your main job is to know about this report, when it comes out and in my opinion stay out of the market during this time. for economic reports and trading levels

What makes Crude Oil futures attractive for me in terms of day trading is the fact that fear and greed are intensified in this market. That creates a ground for spikes, sell offs and many times a volatile, two sided type of trading range. I have also seen big moves happen in crude oil futures VERY FAST. Compare that to markets like mini SP 500 futures or T Bonds futures and you will see higher volatility on average. Maybe its the lack of patience I have noticed about myself at times that attracts me to this market but I like the fact that my day trades in crude oil don't last long...I either get stopped out or hit my profit target, normally within 2-8 minutes. Sometimes faster than that. This may not be a fit for everyone and there are so many ways to day trade futures (subject for a whole book...), so one does need to first understand themselves in regards to trading, their time schedule, their risk capital, level of discipline etc. before trying to choose which markets to trade.

Being on the west coast, I like the times of 6 Am to 10 AM (Pacific Time) for day-trading this market. I think it usually provides for enough moves, these are the times with the most active volume. If you are an overseas trader, perhaps European time zone, you may want to look at the North Sea Crude Oil which trades on ICE with nice volume and MUCH action during the European session.

What I personally look for when day trading crude oil futures is exhaustion in buying/ selling and extreme overbought / oversold conditions. I then look for what we call the counter trend move. I must warn you in advance, that if you are not disciplined enough to place stops on each trade you can get hurt pretty bad as sometimes the counter move I look for does not happen and the market may make another big leg against me.

So what do I do? I set up my crude oil futures chart with Crude oil Support and Resistance levels

I like to use an indicator similar to RSI and normally I will use either volume charts or range bar charts.

I like volume charts better for the short term day-trading because I feel that when the market moves fast you will get a better visual picture using volume charts that waiting for a 3 minutes chart to complete for example. Also if the market is "dead", low volume and not much movement, you may get false signals on the time charts just because time has passed and the bars complete.

All the topics above and below deserve further review but in this initial article I just like to provide you with basics/ overview and perhaps open your mind to this market as one that you can possibly day-trade.

I like to set up my future trading platform with automated target and profit to be sent to the market as soon I enter my trade. We have more than a few FREE trading platforms that will accomplish that.

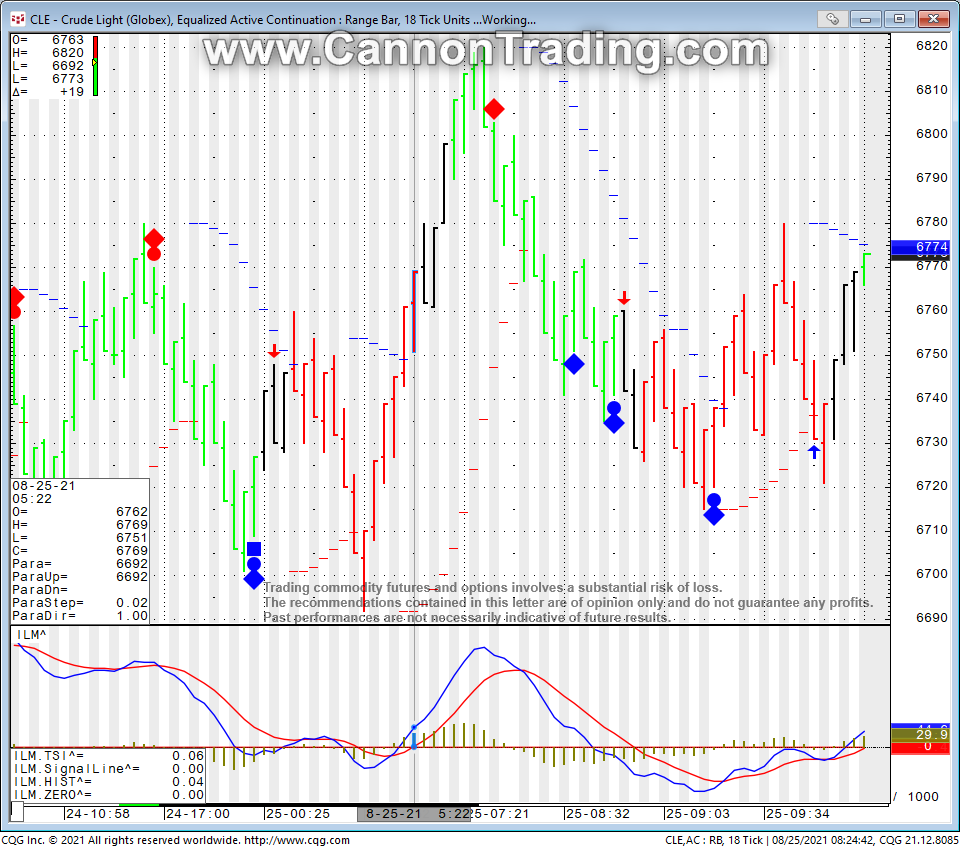

Below is an example of day trading set ups from August 25th 2021. I used 18 ticks range bar chart:

What I was looking for is reversal points. You can see the reversal points marked in the form of red diamonds ( possible sell) and blue diamonds ( possible buy). I like to have study called parabolics as well to help with possible trailing stop if market comes my way. If you like a free trial of the signals shown in this chart, visit:Simple Approach to Day Trading Futures.

If you like this Newsletter, Please share!

RISK DISCLOSURE: Past results are not necessarily indicative of future results. The risk of loss in futures trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Below is an example of a failed day trading set up from April 8th 2013

Very similar set up to the one above, except this time the counter move did not happen and I got stopped out pretty close to the low of the day )-:

RISK DISCLOSURE: Past results are not necessarily indicative of future results. The risk of loss in futures trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

If you like a free trial of the charting software and the studies used in the examples I shared, please visit: https://www.cannontrading.com/tools/intraday-futures-trading-signals

To summarize I hope I was able to share with you:

1. Crude Oil as another possible market to look at for day-trading.

2. Describe briefly some of the contracts specs/behavior as related to day trading.

3. Briefly touch on the use of counter trend moves in day trading crude oil futures.

Disclaimers:

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

****Day trading can be extremely risky

Day trading generally is not appropriate for someone of limited resources and limited investments or trading experience and low risk tolerance. You should be prepared to lose all of the funds that you use for day trading. And more importantly, you should not fund day trading activities with funds required to meet your living expenses or change your standard of living.

You should be wary of advertisements or other statements that emphasize the potential for large profits in day trading. Day trading can also lead to large and immediate financial losses.

Day trading will generate substantial commissions, even if the per trade cost is low.

Day trading involves aggressive trading, and you will pay commission on each trade. The total daily commissions that you pay on your trades will add to your losses or significantly reduce your earnings.

Day trading on margin may result in losses beyond your initial investment.

Trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the markets. The past performance of any trading system or methodology is not necessarily indicative of future results.

Note about stops: THE PLACEMENT OF CONTINGENT ORDERS BY YOU OR YOUR TRADING ADVISOR, SUCH AS A ‘‘STOP-LOSS’’ OR ‘‘STOP-LIMIT’’ ORDER, WILL NOT NECESSARILY LIMIT YOUR LOSSES TO THE INTENDED AMOUNTS, SINCE MARKET CONDITIONS MAY MAKE IT IMPOSSIBLE TO EXECUTE SUCH ORDERS.