Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5. Economic Reports for Monday, December 12, 2011

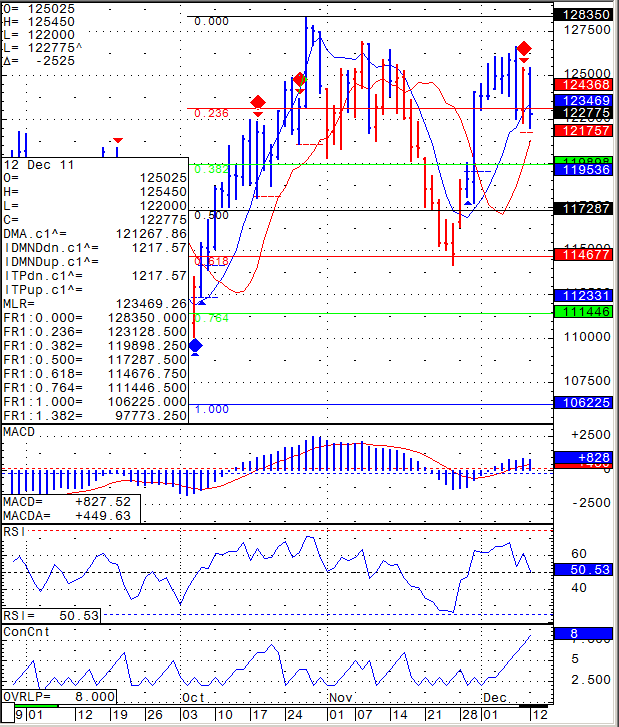

1. Market Commentary and Daily Mini S&P 500 Chart

Front month for equity indices is MARCH 2012

mini SP, mini Nasdaq, mini Russell, Mini Dow and few more are all March 2012

Symbol in most platforms for March mini SP is ESH2. Pay attention please!

One day FOMC meeting tomorrow. Statement will be released around 2:15 PM EST

FOMC days have different characteristics than other trading days. If you have traded for a while, check your trading notes from past FOMC days that may help you prepare for tomorrow.

if you are a newcomer, take a more conservative approach and make sure you understand that the news can really move the market.

My observations suggest choppy, low volume up until announcement, followed by some some sharp volatile moves right during and after the announcement. However, with tomorrow early morning reports and recent volatility, we may see wild action through out.

One advice everyone can benefit from is, reduce your trading size in proportion to the increase in volatility. This should help your comfort level while in the day-trade.

Daily chart of March Mini SP 500 for your review below. Break below 1217 can trigger additional move down, break above 1255 can trigger additional move upside:

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

| Contract (Dec. 2011) | SP500 (big & Mini) |

Nasdaq100 (big & Mini) |

Dow Jones (big & Mini) |

Mini Russell |

| Resistance Level 3 | 1256.77 | 2323.33 | 12133 | 765.17 |

| Resistance Level 2 | 1247.63 | 2308.67 | 12066 | 754.43 |

| Resistance Level 1 | 1239.07 | 2299.33 | 12005 | 741.27 |

| Pivot Point | 1229.93 | 2284.67 | 11938 | 730.53 |

| Support Level 1 | 1221.37 | 2275.33 | 11877 | 717.37 |

| Support Level 2 | 1212.23 | 2260.67 | 11810 | 706.63 |

| Support Level 3 | 1203.67 | 2251.33 | 11749 | 693.47 |

3. Support & Resistance Levels for Gold, Euro, Crude Oil, and U.S. T-Bonds

| Contract | Feb. Gold | Dec. Euro | Jan. Crude Oil | March. Bonds |

| Resistance Level 3 | 1705.1 | 1.3545 | 101.51 | 143 3/32 |

| Resistance Level 2 | 1694.2 | 1.3465 | 100.60 | 142 25/32 |

| Resistance Level 1 | 1682.0 | 1.3336 | 99.37 | 142 8/32 |

| Pivot Point | 1671.1 | 1.3256 | 98.46 | 141 30/32 |

| Support Level 1 | 1658.9 | 1.3127 | 97.23 | 141 13/32 |

| Support Level 2 | 1648.0 | 1.3047 | 96.32 | 141 3/32 |

| Support Level 3 | 1635.8 | 1.2918 | 95.09 | 140 18/32 |

4. Support & Resistance Levels for Corn, Wheat, Beans and Silver

| Contract | March Corn | March Wheat | Jan. Beans | March. Silver |

| Resistance Level 3 | 611.4 | 617.9 | 1137.33 | 3349.3 |

| Resistance Level 2 | 604.3 | 609.8 | 1126.17 | 3289.7 |

| Resistance Level 1 | 599.2 | 603.4 | 1117.33 | 3211.3 |

| Pivot Point | 592.1 | 595.3 | 1106.17 | 3151.7 |

| Support Level 1 | 586.9 | 588.9 | 1097.3 | 3073.3 |

| Support Level 2 | 579.8 | 580.8 | 1086.17 | 3013.7 |

| Support Level 3 | 574.7 | 574.4 | 1077.33 | 2935.3 |

5. Economic Reports

French CPI

1:30am

German ZEW Economic Sentiment

5:00am

ZEW Economic Sentiment

5:00am

Core Retail Sales

8:30am

Retail Sales

8:30am

Business Inventories

10:00am

IBD/TIPP Economic Optimism

Tentative

FOMC Statement

2:15pm

Federal Funds Rate

2:15pm