Life After CPI …..

by Mark O’Brien, Senior Broker

General:

It’s been ten months since the central bank paused its rate hike cycle. It seems as though Jay Powell’s motto throughout his entire tenure as chairman of the Fed has been, “The data will guide our decisions,” and today the Bureau of Labor Statistics released another chunk of data: its March Consumer Price Index (CPI) report, which measures the prices paid by consumers for a basket of consumer goods and services. The consumer-price index rose 0.4% in March and 3.5% on an annual basis. Economists had expected 0.3% and 3.4%. Core CPI, which removes the volatile food and energy categories, was up 0.4% from February, topping an expected 0.3%. Now, after strong prints in January and February, are these new readings stronger evidence of a “sticky” inflation situation?

At their March meeting, according to its minutes released later this morning, Federal Reserve officials expressed concern that inflation wasn’t moving lower quickly enough. The CPI report likely didn’t moderate those concerns and the timing for the first long-anticipated rate cut has presumably drifted further out on the calendar.

Energies:

Speaking of inflation, the first three months of 2024 saw crude oil jump ±$17 per barrel – a ±$17,000 move for the main 1,000-barrel futures contract – with the front-month May contract trading to the year’s high of $87.63 intraday just last Friday.

Softs:

After a one-day 321-point/$3,210 move up on March 12 to close above $7,000/ton – its latest all-time high – May cocoa continued its “no top in sight,” rally, closing today at $10,476/ton, a staggering ±$34,700 per contract move in twenty trading sessions.

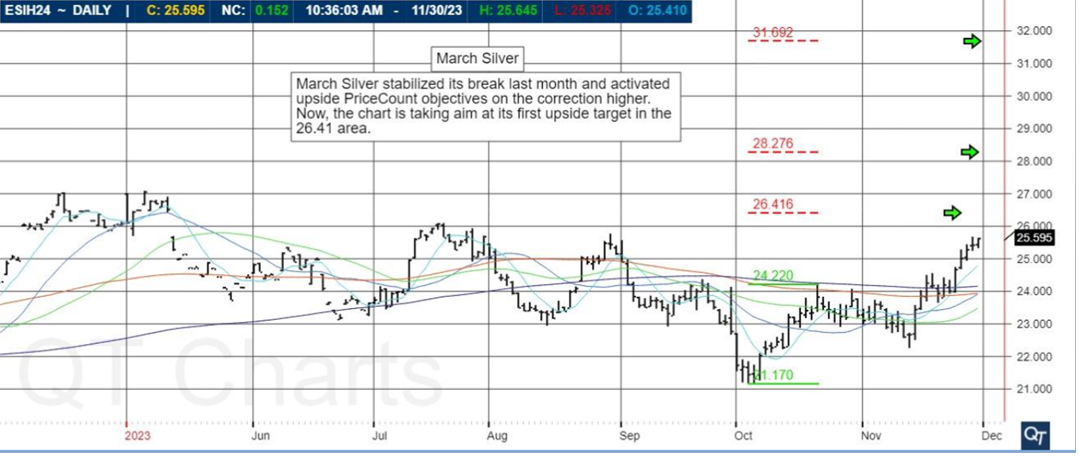

Metals:

While cocoa retained its “king of the all-time highs” crown for the month, gold did not disappoint bulls in this market, setting its own new all-time high yesterday, trading up to $2,384.50/oz. intraday (basis the June futures contract). This is a $199.00/oz. move ($19,900 per contract for the standard 100-oz. futures contract) over the same 20-sesson span as the move in cocoa referenced above.

Grains:

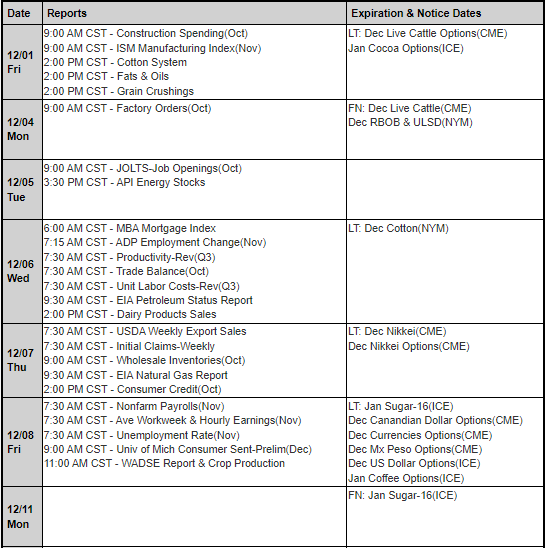

Keep an eye out for tomorrow’s U.S. Department of Agriculture’s two main reports: its monthly Crop Production and World Agricultural Supply and Demand Estimates (WASDE). These serve as the primary informers of the fundamentals underlying domestic and global agricultural futures markets.

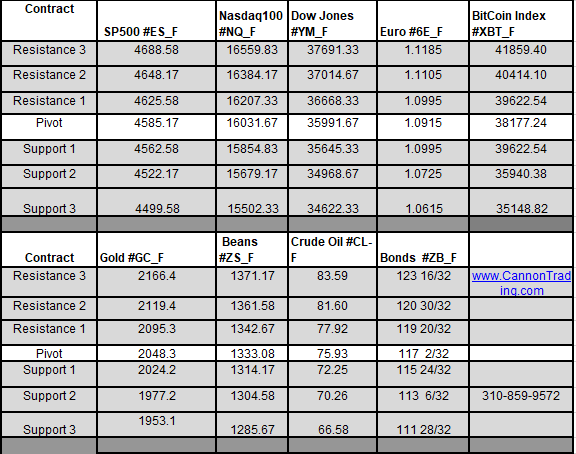

Daily Levels for April 11th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.