In this issue:

- StoneX/E-Futures Platform Updates

- The Week Ahead – NFP, GOOG and AMZN, Fed Speeches, Full Week!

- Futures 102 – FREE Trading Course – Option Greeks

- Hot Market of the Week – May Wheat

- Broker’s Trading System of the Week – ES intraday System

- Trading Levels for Next Week

- Trading Reports for Next Week

|

|

To our clients whose accounts are with StoneX and currently using the E-Futures Platform:

- The new StoneX Futures platform is up and running.

- Your existing LIVE user name and password will be accepted.

- Your existing exchange data subscriptions will migrate to the new platform.

- To login to the new trading interface please login here:

https://m.cqg.com/stonexfutures

- If you are a current client with funds in your account, you can login to the live platform and have access to simulated account so you can practice. Simply login, click on the account number ( top right corner) and select the Demo/Sim account in yellow!

- If you are not a client and like a demo ( and did not have a demo of StoneX Futures yet) CLICK HERE

- Please note that the E-Futures platform will be set to READ-ONLY and will no longer support trade execution after January 31st.

|

| Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

A full trading week ahead Non-Farm Payrolls Friday, the most impactful of the data reports the FED considers, 12 Fed Speakers, 2 more Trillion dollar market cap babies report earnings, 518 corporate earnings reports total as the meat of the season continues with GOOG, AMZN, and a cast of others listed below including other High Market cap companies reporting past earnings and futures guidance.

Economic releases are relatively light this week with one exception: Non-Farm Payrolls pre-market Friday. The Fed Speakers will return to the podium for the foreseeable future as we don’t have another Fed rate decision until late March.

Earnings Next Week:

- Mon. lite earnings

- Tue. GOOGLE, Merck, Pepsi, Advanced Micro Devices, Pfizer

- Wed. Disney, Qualcomm, ARM, Boston Scientific

- Thu. AMAZON, Eil Lilly, Phillip Morris, Honeywell

- Fri. CBOE Global Markets

FED SPEECHES:

- Mon. Bostic 11:30 AM CST, Musalem 5:30 PM CST

- Tues. Bostic 10am CST, Daly 1 PM CST

- Wed. Barkin 8 am CST, Goolsbee 12:00 PM CST, Bowman 2:00 PM, Jefferson 6:30 PM CST

- Thu. Waller 11:30 CST, Daly 2:30 CST

- Fri. Bowman, 7:25 am CST, Kugler 11:00 am CST

Economic Data week:

- Mon. ISM Manufacturing, Construction Spending

- Tues. Redbook, JOLTS,

- Wed. ISM Svcs

- Thur. Initial Jobless Claims,

- Fri. Non-Farm Payrolls, Michigan Consumer Sentiment

|

|

Futures 102: Option Greeks

Course Overview

Option prices are driven by multiple variables including changes in the underlying price, interest rates, passage of time, and changes in the expected volatility in the market. Collectively, these are called “the Greeks” because the symbols used to represent the sensitivities of these complex derivatives come from calculus and use the Greek Alphabet. Gain a basic understanding of how “the Greeks” are integral to managing a portfolio of options.

Start Course. |

|

-

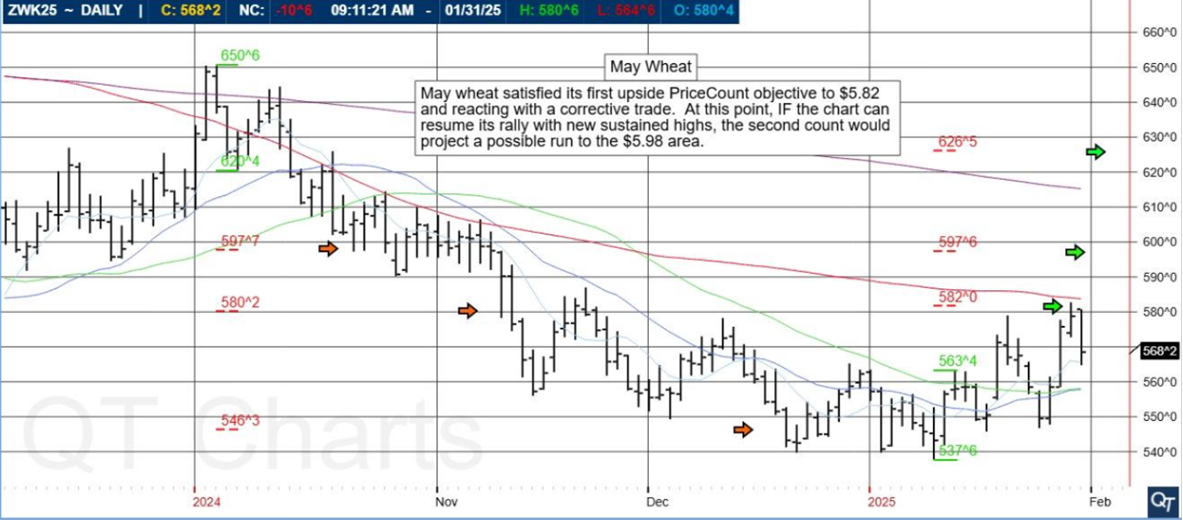

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

FREE TRIAL AVAILABLE

May Wheat

May wheat futures satisfied its first upside PriceCount objective to $5.82 and reacting with a corrective trade. At this point, IF the chart can resume its rally with new sustained highs, the second count would project a possible run to the $5.98 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

|

|

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.comTrading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|

|

|

|

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

ES NZL

PRODUCT

Mini SP500

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$36,000

COST

USD 199 / monthly

Get Started

Learn More

NET, LIVE results below! |

|

The performance shown above is hypothetical in that the chart represents returns in a model account. The model account rises or falls by the average single contract profit and loss achieved by clients trading actual money pursuant to the listed system’s trading signals on the appropriate dates (client fills), or if no actual client profit or loss available – by the hypothetical single contract profit and loss of trades generated by the system’s trading signals on that day in real time (real‐time) less slippage, or if no real time profit or loss available – by the hypothetical single contract profit and loss of trades generated by running the system logic backwards on back adjusted data. Please read full disclaimer HERE.

|

|

|

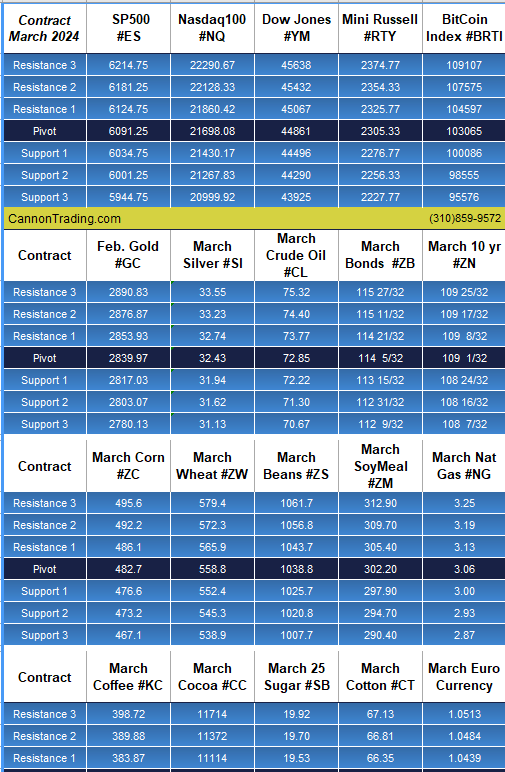

Daily Levels for February 3rd, 2025

-

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week:

Good Trading!

About: Cannon Trading is an independent futures brokerage firm established in 1988 in Los Angeles. Our mission is to provide reliable service along with the latest technological advances and choices while keeping our clients informed and educated in the field of futures and commodities trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|