Get Real Time updates and more on our private FB group!

CME Group Pro Workshop Series

Advanced options workshop

We look forward to having you join us tomorrow for our Options Strategies Advanced Level workshop.

View last week’s session here to see what kind of discussions you can expect.

Please read the below information for the session on November 1 and add the event to your calendar below.

Joining Instructions:

To join the online event, please use the following link:

Options Strategies – Advanced Level Webinar

Webinar number: 248 671 10401

Webinar password: p5F3V6Jcnu2 (75338652 from phones and video systems)

Helpful Tips:

- Please plan to join 10 minutes in advance to ensure no technical difficulties.

- For optimal audio/video quality, disconnect from your company’s VPN.

- We recommend using Google Chrome as your browser.

- Please test audio prior to the start of the online event. Ensure that you are using headphones for optimal sound quality and that audio is not muted.

- If your internet audio and/or video experience does not work, use the dial-in numbers to join by phone

Recording Disclaimer:

This online event will be recorded for the purposes of archived viewing for attendees unable to attend the live session. By participating in this online event, you are considered to have consented to the recording. All video and audio communications must remain professional and relevant to the topic and purpose of the online event. Personal views or opinions expressed during the online event are those of the participants and may not necessarily reflect the official policy or position of CME Group.

Add to Calendar

DATE:

November 1, 2023

TIME:

11:00 a.m. CT

16:00 p.m. GMT

DIAL-IN ONLY:

US & Canada Toll Free:

877-309-3457

UK Toll Free:

08005280101

Access code:

248 671 10401

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

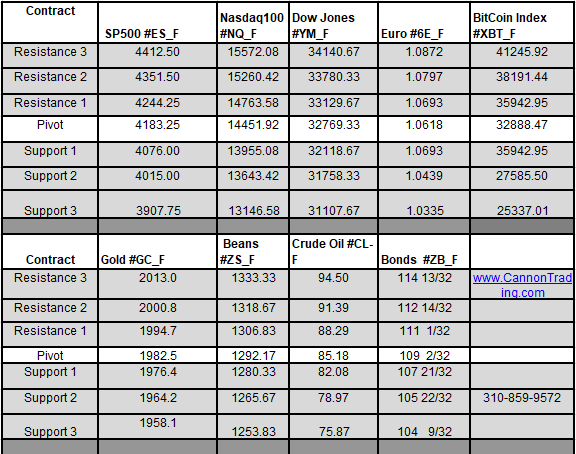

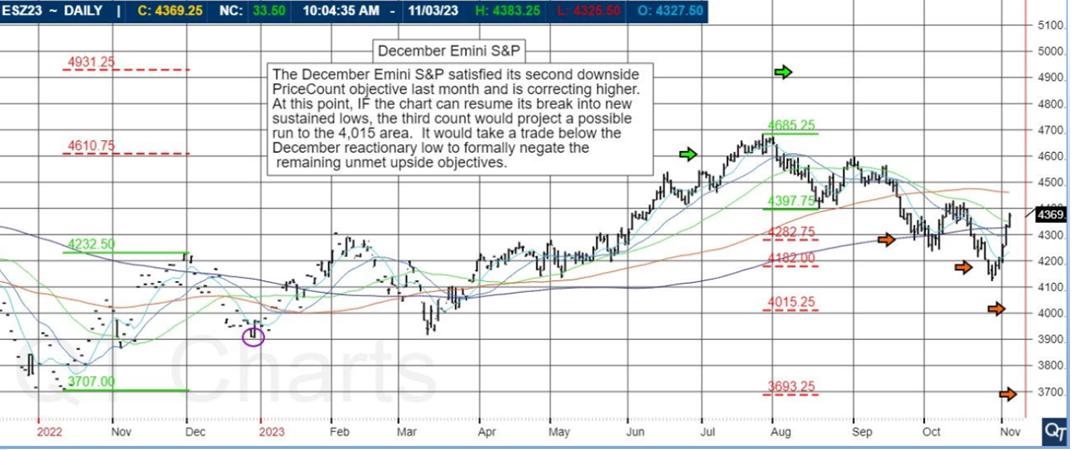

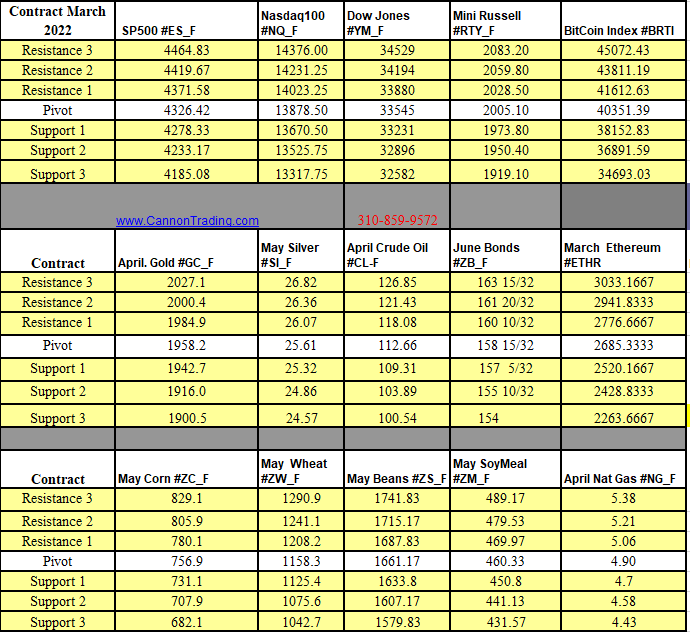

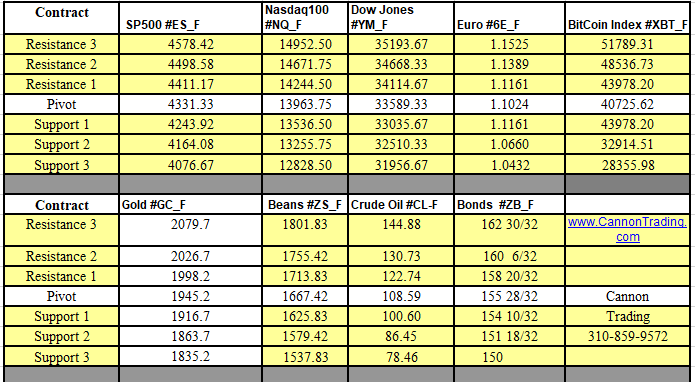

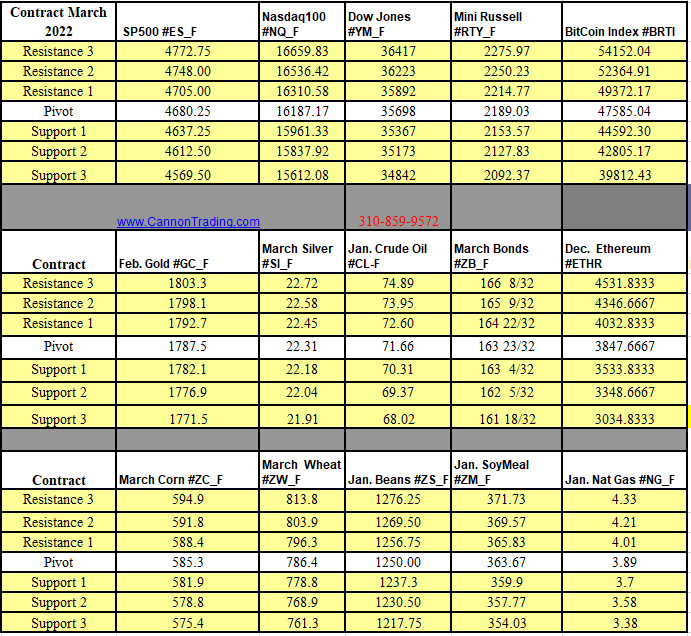

Futures Trading Levels

11-01-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Improve Your Trading Skills

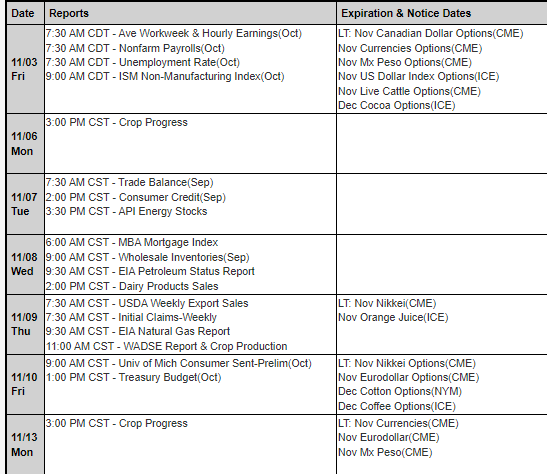

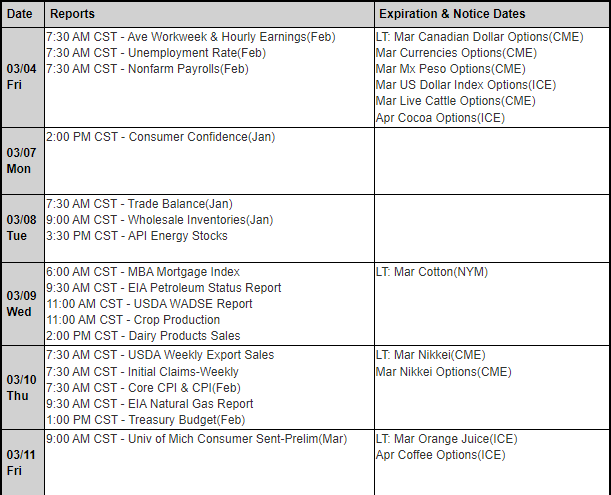

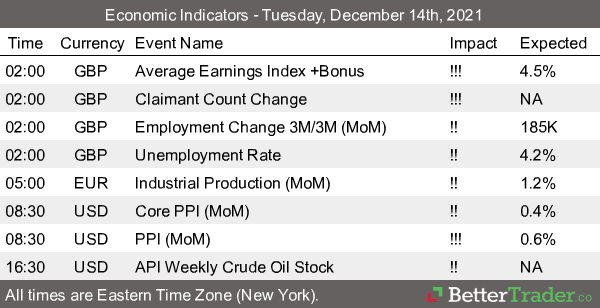

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.