“Try the Daily Live Charts Service Free for 2 Weeks”

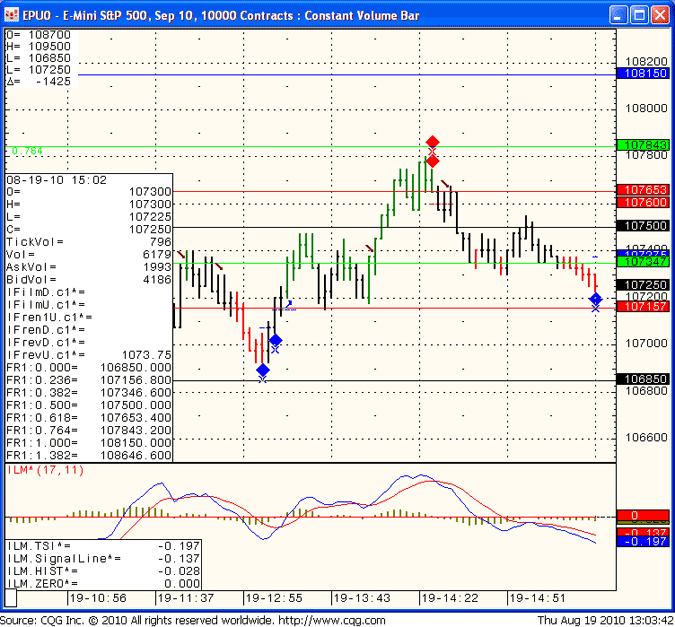

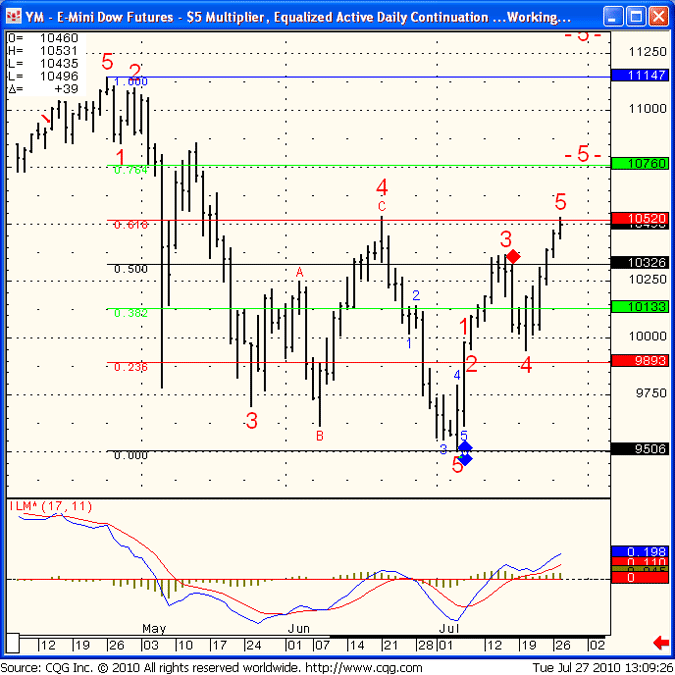

Screen shot from my daily live chart service below. You are more than welcome to try this service for 2 weeks free if you have not had the trial before. Cost of service for cannon trading clients is $119 per month.

During the sharing of live charts (which i provide under LEVEX Capital mgmt. Inc – Commodity Trading Advisor) I share my approach, concept/model for day-trading, my proprietary DIAMOND indicator and general feedback from my experience.

to sign for free trail, visit: https://www.cannontrading.com/tools/intraday-futures-trading-signals