Online Futures and Commodities Market Reports for July 28th 2010

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

“The Dow Jones Average is leading the way”

Market made recent highs overnight, backed down and managed to close unchanged.

I think with this recent move, it is the Dow Jones average which is leading the way.

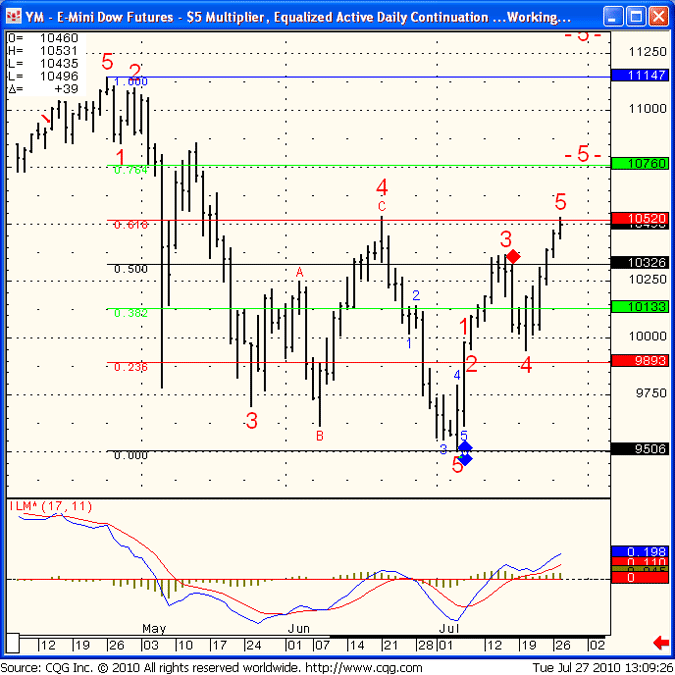

Below is a daily chart of the mini Dow Jones futures along with some Fibonacci levels.

My speculation is that an hourly close during the day session tomorrow above 10520 can trigger 10760,

on the flip side, an hourly close below 10435 can bring 10320 much closer.

YM – E-Mini Dow Futures – $5 Multiplier, Equalized Active Daily Continuation

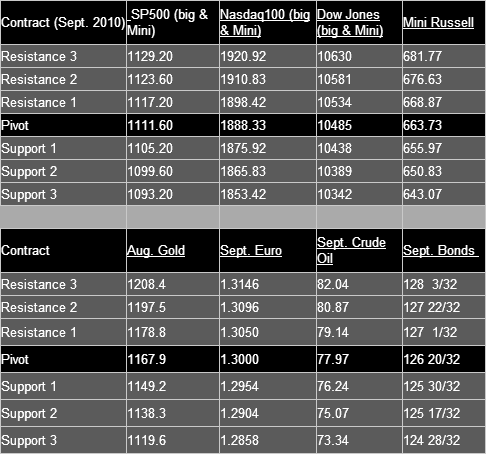

Trading Levels:

This Week’s Calendar from Econoday.Com

Futures Trading Levels for July 28th 2010

All reports are EST time

Wednesday July 28th – http://mam.econoday.com/byweek.asp?cust=mam

- MBA Purchase Applications – 7:00 AM ET

- Durable Goods Orders – 8:30 AM ET

- EIA Petroleum Status Report – 10:30 AM ET

- 5-Yr Note Auction – 1:00 PM ET

- Beige Book – 2:00 PM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!