Today was a “slow trading day” when it came to stock indices, which leads me to a good point I would like to make. Most of our day traders, trade the e-mini stock index futures, mostly the mini SP because of its heavy daily volume and exposure.

However, I think that day-traders should be able to follow at least another market, maybe even two additional markets and look for different set up in these markets as well.

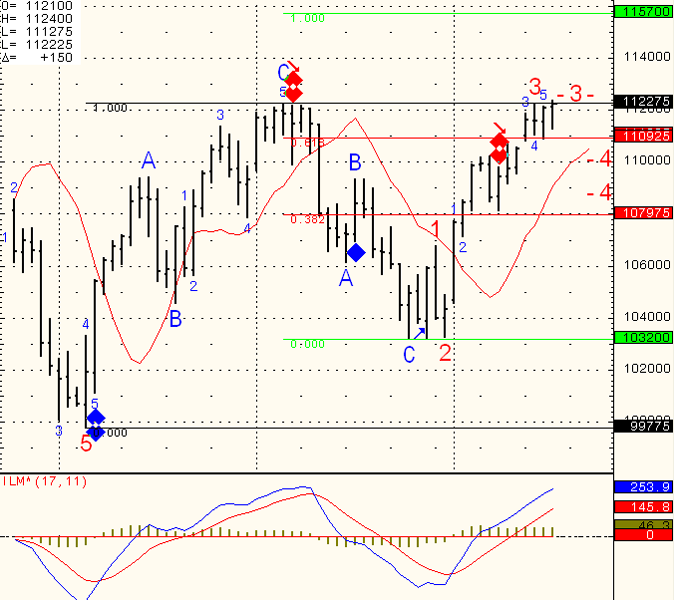

Good example from today is the Euro currency. While the mini SP was pretty dead….the Euro had nice range, good volatility and good volume which presents both risks and opportunities for day-traders.

Obviously, before you start trading a new market you should educate yourself on tick size, trading hours, “personality”, when is there more volume in that specific contract etc.

If you do so, I think you will achieve a couple of things, first is diversification. While some days trades in certain market may not work, trades in a different market may provide balance.

Also, if on certain days, certain markets are “sleepy” ( which most day-traders do NOT like), another market may have more action….

As always, do your homework, practice in simulation mode first and make sure you understand the “new contract” you may be trading along with the risks involved.

Below is a screen shot of the Euro Currency from todays webinar session :

( free trial at – https://www.cannontrading.com/tools/intraday-futures-trading-signals )

Continue reading “Futures Trading Levels and Economic Reports for December 7th 2010”

Continue reading “Futures Trading Levels and Economic Reports for December 7th 2010”