Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

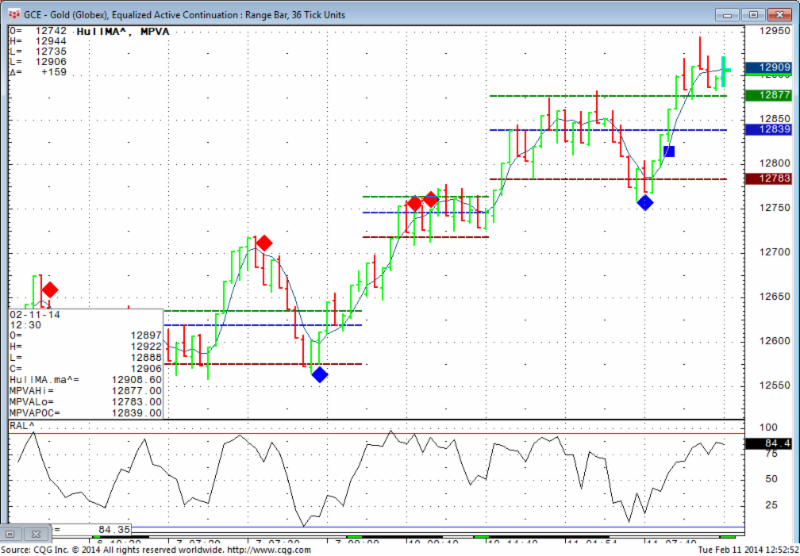

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday June 13, 2014

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

FRONT MONTH for stock index futures and currencies is now SEPTEMBER.

Make sure you are trading the September contract.

I was asked this morning, “what futures markets would you recommend a newcomer to start with?”

While the answer will vary based on perspective trader risk capital, risk tolerance, personality etc. I do think that there are a few markets that might be a better start for first time futures day trader.

I personally would say, leave the mini SP alone. Yes it has the biggest volume but there is quite a bit of size on the bid/ask that may make this frustrating for new traders.

My favorite markets to share with first time traders are:

mini Dow

ten year notes

and

mini crude/ mini gold

The mini Dow moves similar to mini SP but the value per point/tick is smaller, still has good volume but not as hard to get filled on the limits as the mini SP.

The 10 year notes are usually less volatile than the other markets mentioned. Completely different type of trading personality and offer a good diversification option for new traders and experienced traders and they trade in halves, so each tick is $15.625 versus each tick of the 30 years which is worth $31.25.

The mini gold and mini crude are another good option because it is the smaller contract size of two markets that can really move, offer volatility and RISK but the availability of the mini sized contracts make these two a better option for beginners until one has experience / risk capital and appetite for the standard contract sizes of gold and crude oil.

If you like the information we share? We would appreciate your positive reviews on our new yelp!! Continue reading “Rollover for Futures Mini Indices & Economic Reports 6.13.2014”