Dear Traders,

Get Real Time updates and more on our private FB group!

*Heads up: Start trading January

beans – November beans entering first notice day.

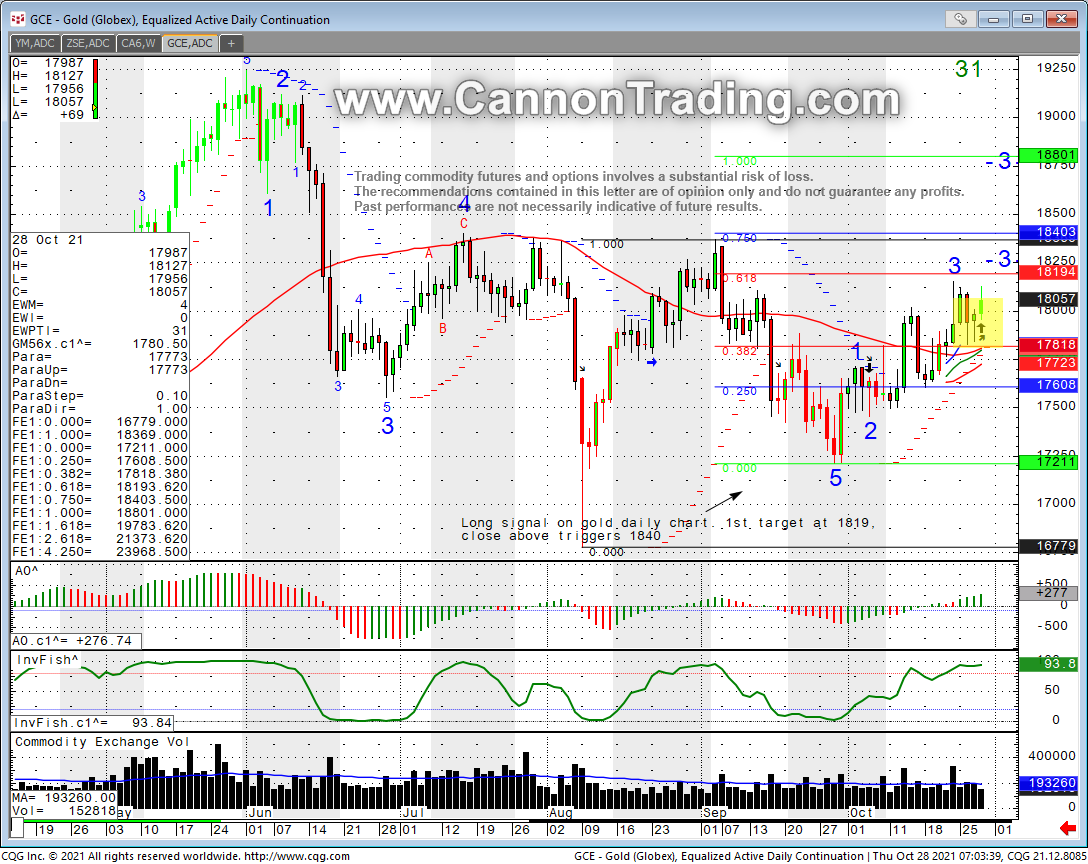

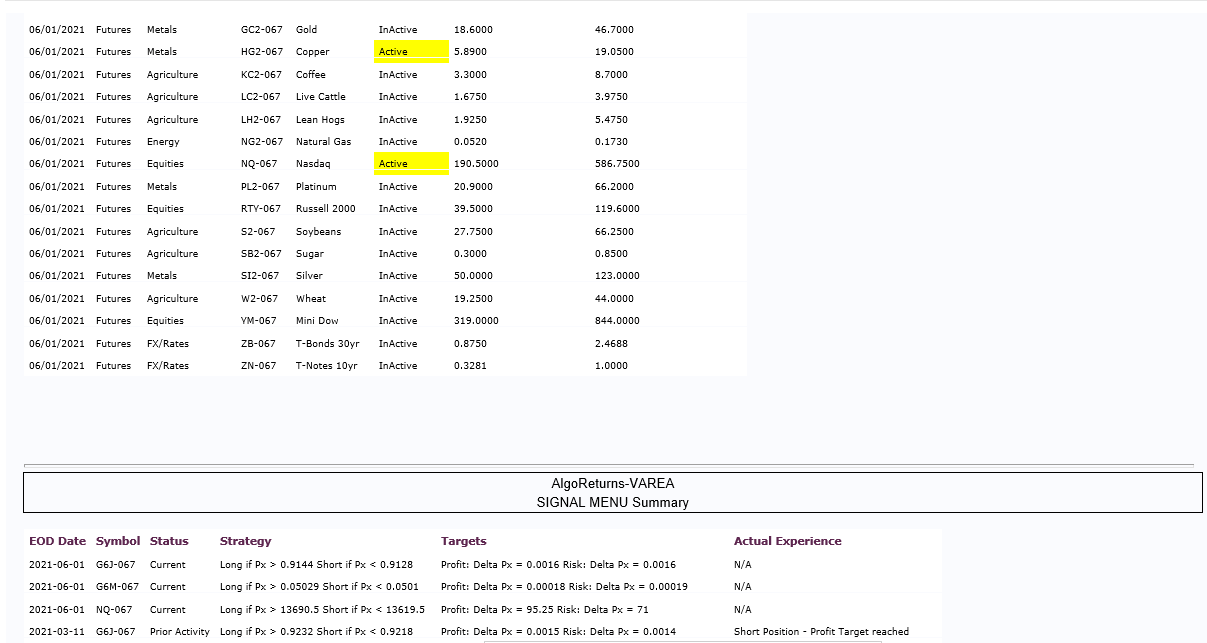

Gold Daily Chart below…..

Potential long signal was generated today( based on personal technical factors I use) – Looking at the quote below, my biggest battle in this hypothetical example would be:

- Entry level ( market? wait for lower price? enter if price breaks above?)

- Exit in case of loss

- Exit in case of profit

- Trade size?

- If at a loss will I exit all? or in parts?

- If profit achieved will I exit part of the trade? ( assuming I am trading more than 1 contract or perhaps MICROS)

- Do I need to bring stop to breakeven at any point ( if certain profit achieved?)

Obviously the answer to all of the above will change from trader to trader but bringing these points up can hopefully help you approach trading from a different angle.

“Every battle is won or lost before it is ever fought.”

Sun Tzu

The Art of War

This passage – dating back the 6th century B.C. – can aptly be applied to trading futures. Prepare for each trade. Set your risk. If the initial outcome is favorable, use your enemy’s resources (move your stop) to sustain your trading.

Don’t engage in extended battles (over trade) and consume your resources (money, time, mental energy).

Your “enemy,” (the market) only has the power to destroy your account if you let it.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

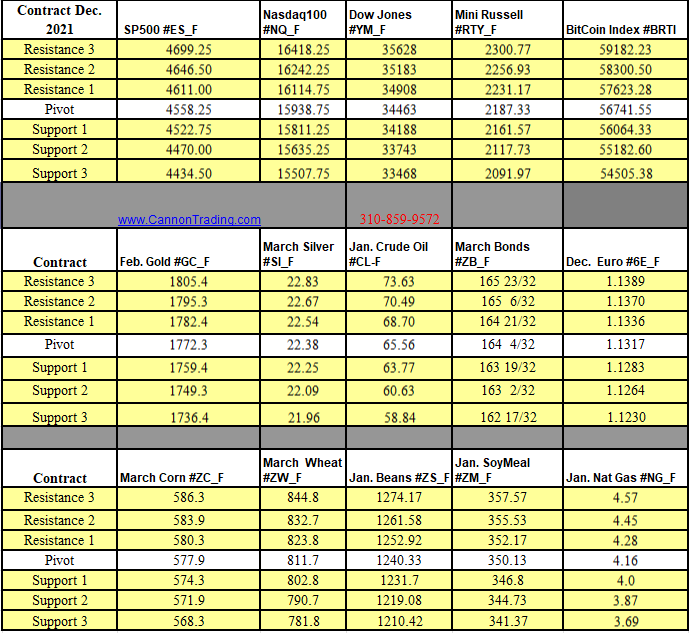

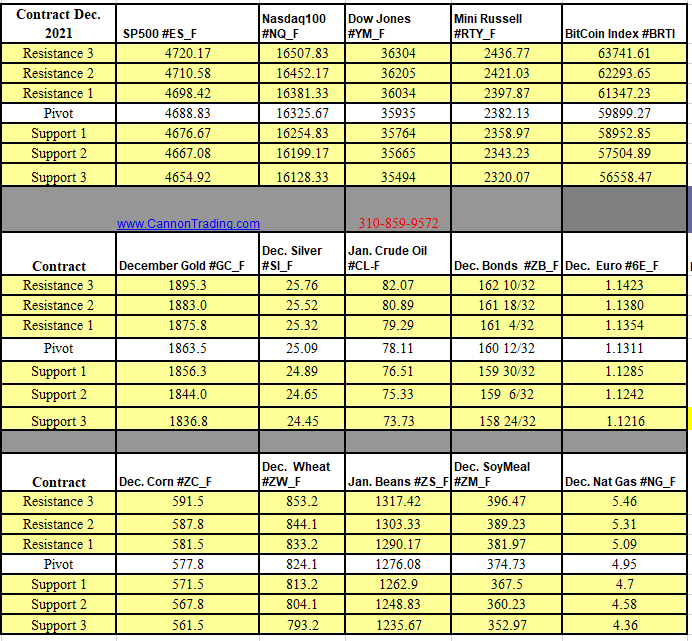

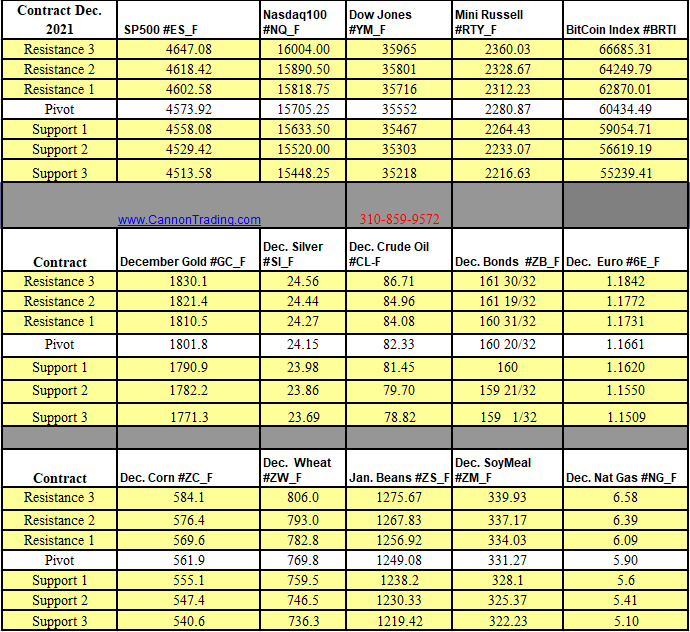

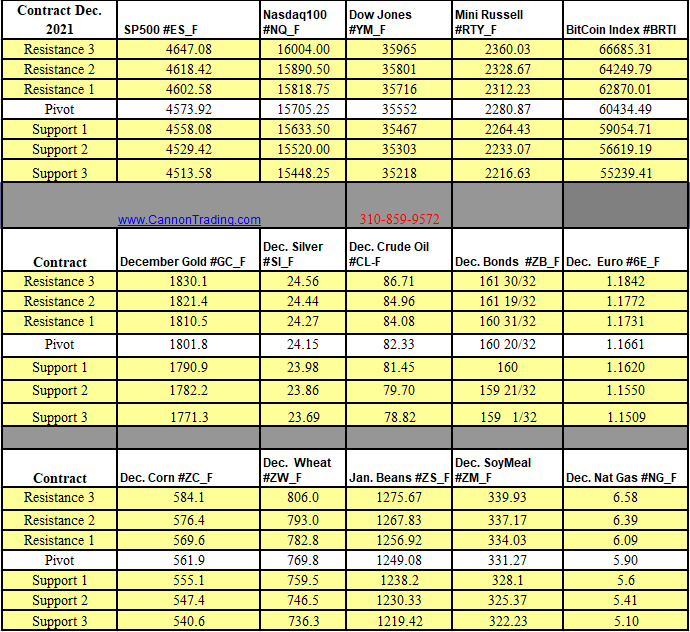

Futures Trading Levels

10-29-2020

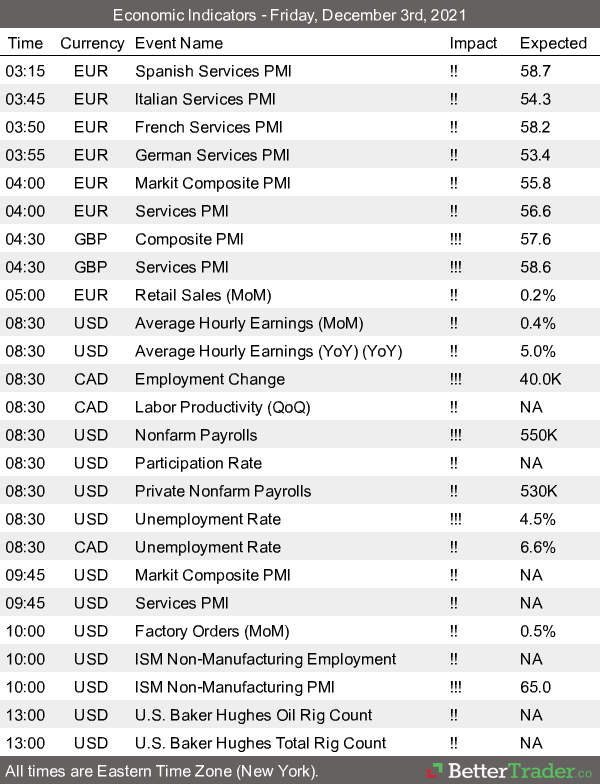

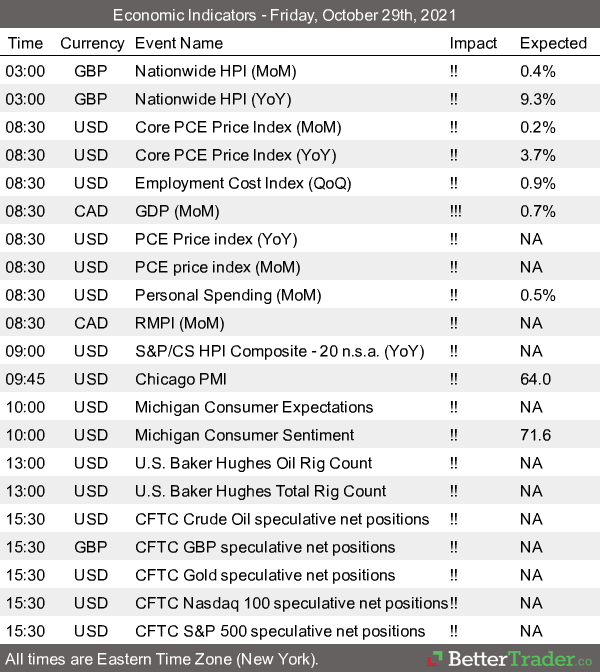

Economic Reports, source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.