Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

1. Market Commentary

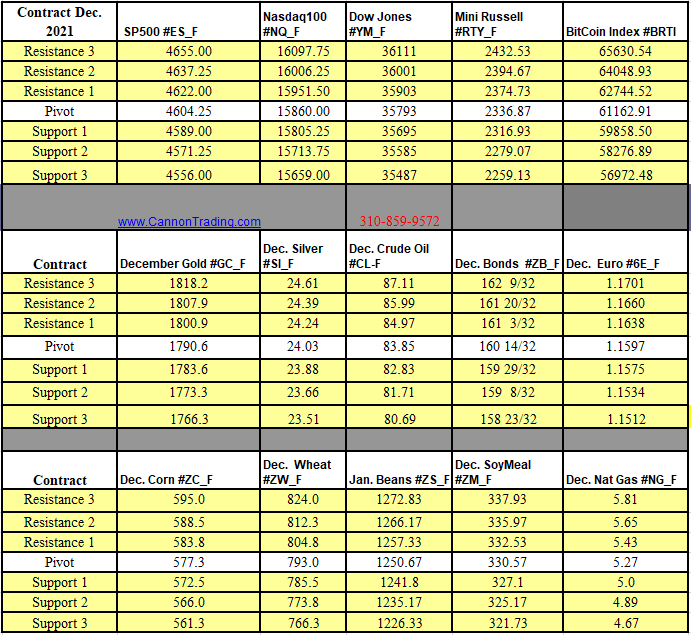

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

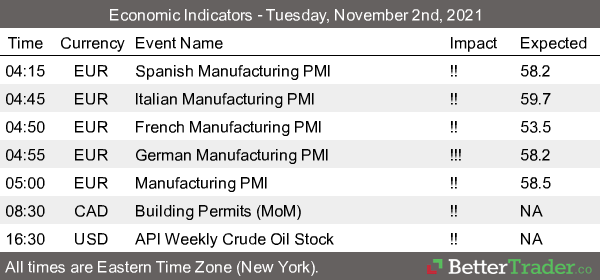

5. Futures Economic Reports for Tuesday August 23, 2016

Hello Traders,

Greetings!

Trading 201: Day Trading Using fear and greed ( using Crude Oil futures as an example)

Crude Oil Futures volatility offers a “different market personality” than stock index futures. Here is some of the things you need to know about day trading crude oil futures:

By: Ilan Levy-Mayer, Cannon Trading Commodities Broker & VP

Crude Oil is one of MY favorite futures markets for day trading. Before I dive in and share with you how the volatility in crude oil fits my risk tolerance for day trading and provide a couple of chart examples, we should review some of the specifications ofCrude Oil Futures.

Crude Oil Futures have monthly expirations. So each month we trade a different contract month, so one needs to know when the first notice day and last trading day for crude oil futures are, in order to always make sure we are trading the proper month with the most liquidity and avoid any chance of getting into a delivery situation.

Next is the contract size. Crude Oil futures are based on 1000 barrels. To be honest from a day trading perspective all I care is that each tick or 1 cent fluctuation is $10 against me or in my favor per contract. That means that a move from 92.94 to 92.74 = $200.

Another factor is trading hours. At the time I am sharing my thoughts with you, April 8th 2013 ( I wrote this one a while back but the examples and logic are still very current!) , crude oil futures trade on the CME Globex platform and trade from 5 PM CDT until the next day at 4 PM CDT. That is 23 of straight trading hours. I definitely don’t recommend day trading this market 23 hours…but it is good to know the trading hours.

Continue reading “Trading Futures Using Fear and Greed 8.23.2016”