_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

Have you heard? There’s a new futures exchange in town and NOW you can trade the 10 years Yield!.

Interest rates have never been lower,* and now trading them has never been easier.

Small Treasury Yield / S10Y gives you access to the lowest interest rate environment in the history of US Treasuries all in a small, standard, and simple future. And the Small Exchange is letting you test it out for zero exchange transaction fees! Put oversized, complicated bond products in your past… trade the future of interest rates.

Don’t miss this limited-time opportunity to trade S10Y for zero exchange transactions fees! The Small Exchange will waive all exchange transaction fees for the Small Treasury Yield futures until January 29th.†

*All-time low in 10-year Treasury rate of 0.52% on August 4, 2020, according to treasury.gov.

†The Small Exchange $0.07 and $0.15 exchange transaction fees will be waived. Commissions and other fees charged by, or passed through from, your broker will still apply. Visit the Small Exchange

fee page for a full list of our fees.

© 2020 Small Exchange, Inc. All rights reserved. Small Exchange, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Trading Commission. The information in this advertisement is current as of the date noted, is for informational purposes only, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. Trading futures involves the risk of loss, including the possibility of loss greater than your initial investment.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

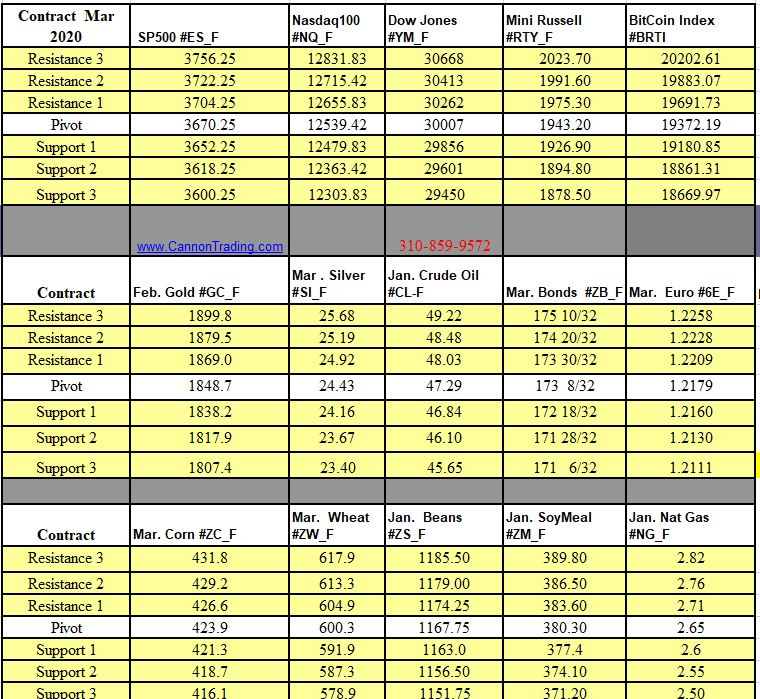

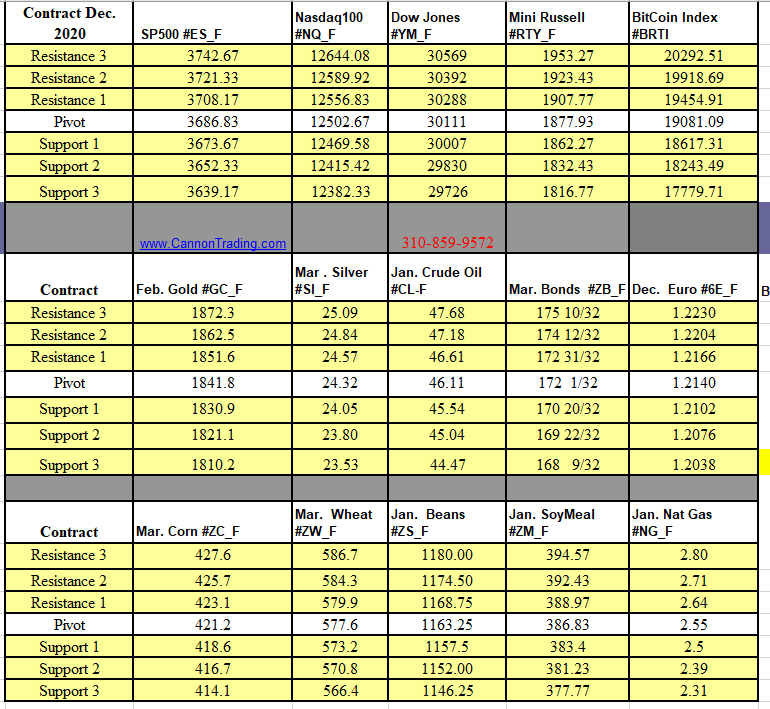

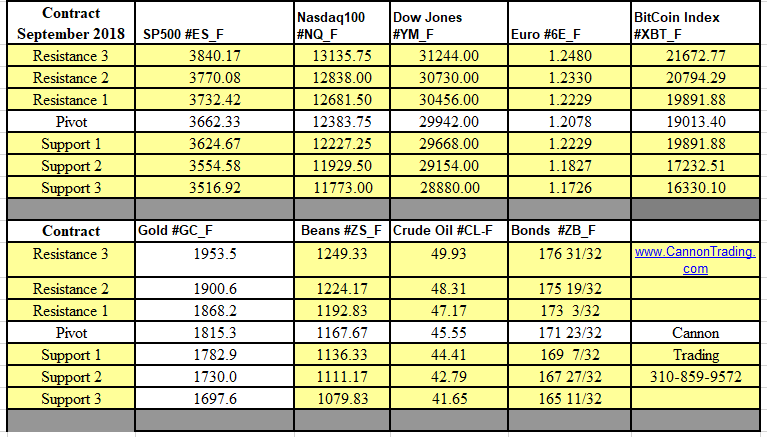

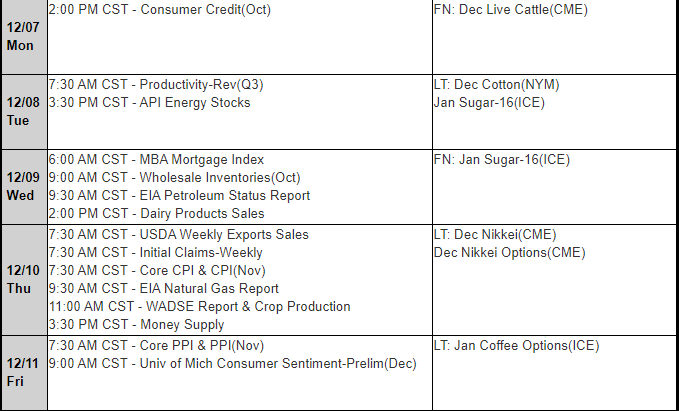

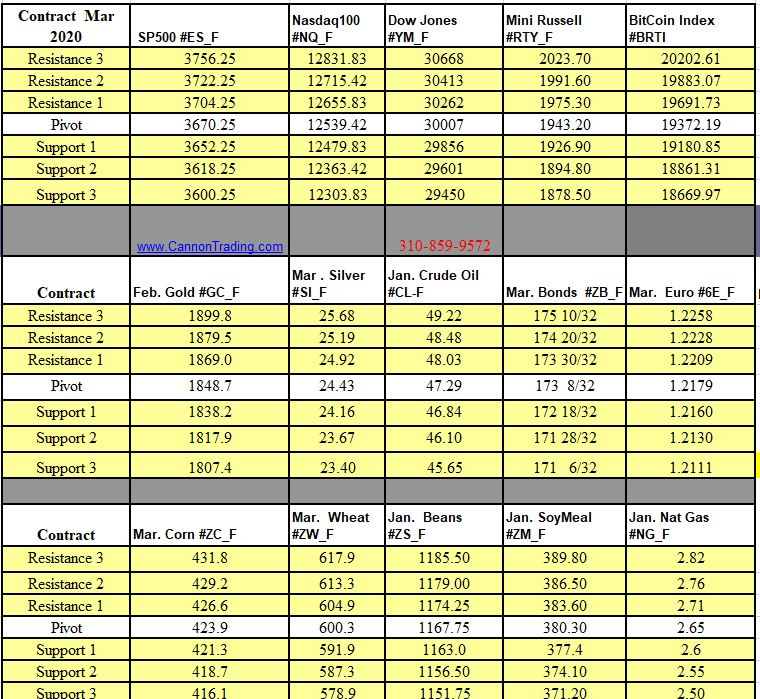

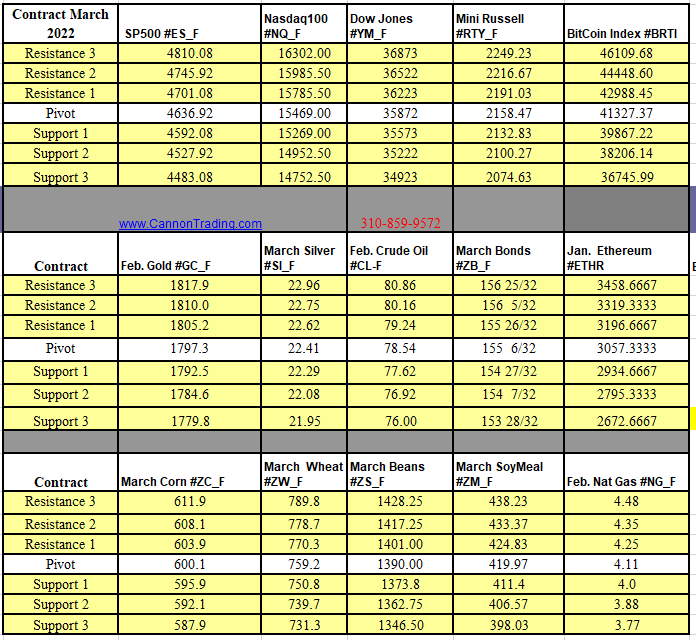

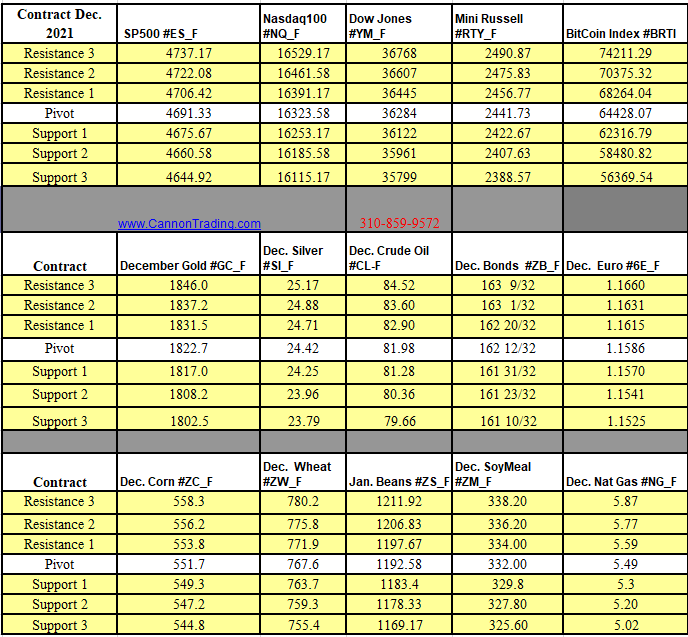

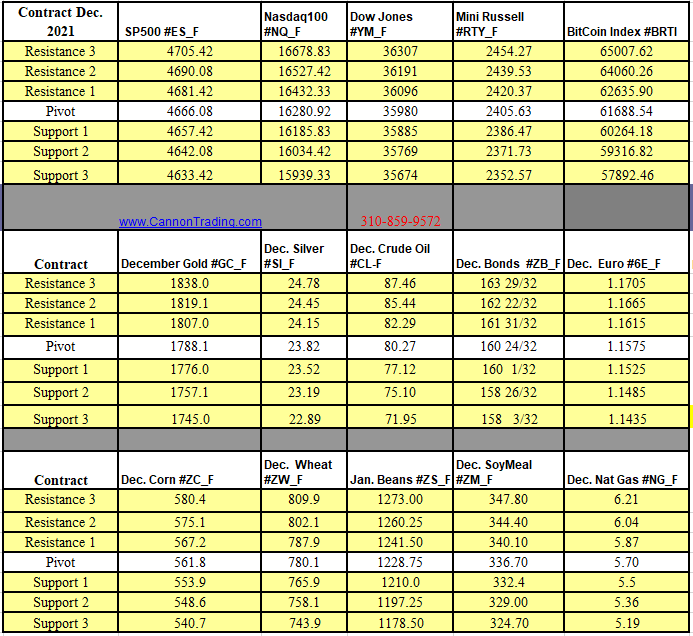

Futures Trading Levels

12-16-2020

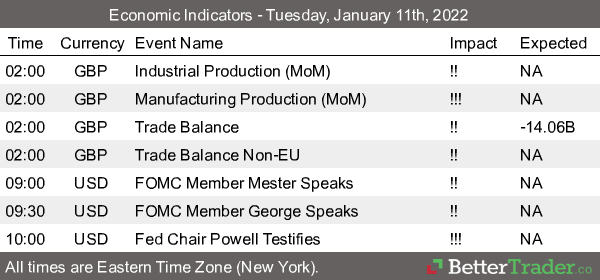

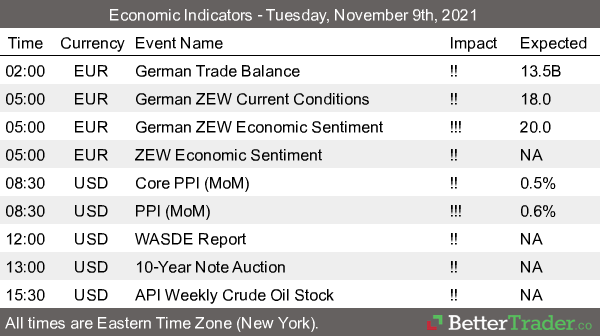

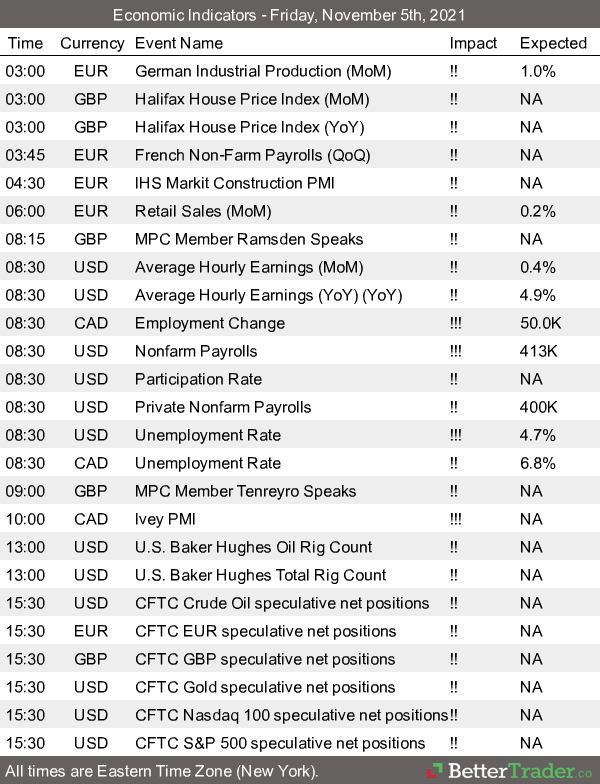

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

_Weekly_Continuation.png)