Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5. Economic Reports for Friday, January 6, 2012

1. Market Commentary

Volume slowly trickling back, I expect that by Monday volume will return to “normal”.

Unemployment report tomorrow should move the markets.

Understanding the type of trading environment you are in is crucial.

Past two weeks markets were in “Holiday Mode” = lighter volume, narrower ranges etc.

Before that we had periods of higher volatility, wider ranges, higher volume.

Different types of market environments require adjusting your approach.

Here is a small write up I share with my webinar subscribers:

My opinion is that there are 3 main types of trading days.

1. Most common is two sided trading action with swings up and down – this type of trading day is most suitable for the main aspect of this model, which is taking trades based on the arrows.

2. Strong trending day, mostly one directional – this type of trading day is the least common, many times will happen on Mondays and maybe 3-5 times a month at most – this type of trading day is most suitable for using the color scheme I have on the charts. Green bars mean strong up trend, red bars mean strong down trend. If you determined that this is a trend day, then use pull backs to enter with the direction of trend and use the parabolic (little dashes) as you trailing stop.

3. Slow and/ or choppy trading day – this type of trading day is best suited for taking small profits from the market by either using the main model or taking the diamonds as entry signal, going for quick profits and tight stops.

Good question is how can one asses what type of trading day we will have while the market is still trading….I am doing some work about it and will be happy to hear feedback via email but here are some initial observations:

Was the overnight session a wide, two sided trading range? If the answer is yes, good chances for similar trading day during the primary session ( primary session is when the cash/ stock market is open)

Mondays have the highest chance for trending days

The behavior of the first hour of trading can also suggests the type of action for the rest of the day.

If the first 30 minutes have good volume, better chances for type 1 or type 2 trading days.

low volume during first 30 minutes can suggest a choppy (type 3 trading day)

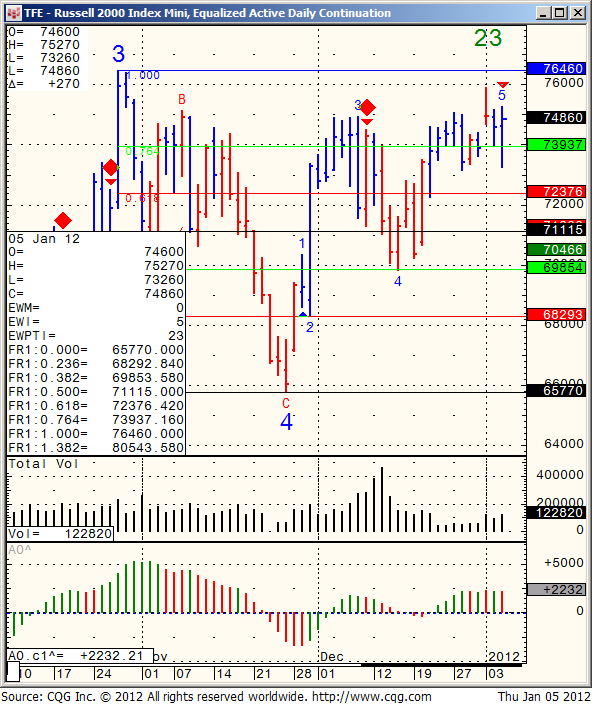

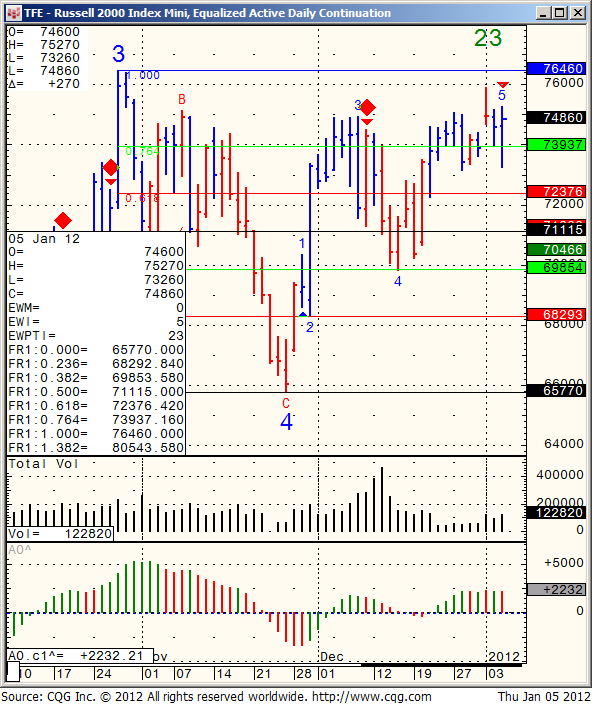

Mini Russell daily chart for your review below: