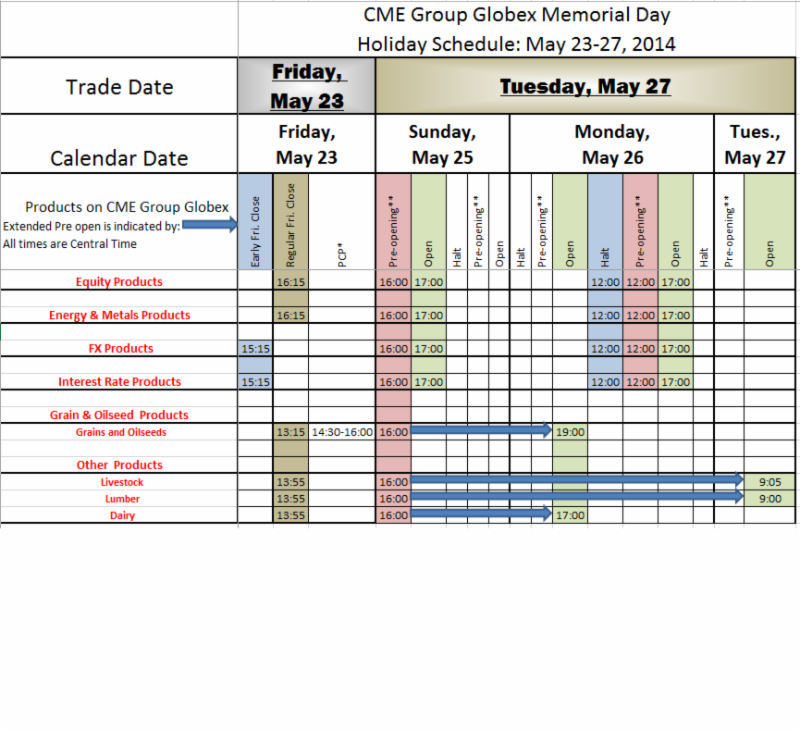

Fri, 30 May 2014 16:13 PM EST- Both equities and bonds gained ground slowly this week: the S&P500 pushed out to record highs above 1,920 and the benchmark US 10-year yield fell as low as 2.433%, its lowest level since last June. In Europe, the DAX was at all-time highs and the FTSE was only 100 points away from all-time highs. Meanwhile, trading volumes were pretty light, due in part to the Memorial Day holiday in the United States and Ascension Day in Europe. But with ever strengthening asset prices comes complacency: the VIX volatility index dropped to 11.46 (last Friday’s bottom was 11.36, the lowest reading since March 2013) and a break below 11.00 would put the index right where it was at the beginning of 2007, which makes many analysts very uncomfortable. For the week, the DJIA rose 0.7%, the S&P500 added 1.2% and the Nasdaq gained 1.4%.- The second reading of US Q1 GDP was revised to -1.0% from +0.1% in the advance reading. The downward revision was due to a larger drag from inventories and less government spending than surmised by the advance reading. This marks only the second time since the recession that GDP declined during a quarter. There is also concern about Q1 gross domestic income, which fell 2.3%, its worst performance since the recession. Note that the personal consumption figure stayed very strong at +3.1%. Fed presidents Williams and Plosser both said they were not too worried about the weak data and said there would be a big snapback in the Q2 GDP figures. In yet another sign inflation is rebounding, the April PCE index rose to its highest annualized rate since late 2012. The personal consumption expenditure index rose 0.2% in April, as did the core rate that strips out food and energy.

– Billionaire oligarch Petro Poroshenko won the Ukrainian presidential elections on May 25, taking 55% of the vote, with Yulia Tymoshenko trailing with 13%. The decisive victory prevented a runoff and leaves Poroshenko in a strong position to continue Kiev’s “anti-terrorist” operations in the eastern part of the country. There was more violence in the east this week, as militants shot down helicopters and launched assaults on military bases, leading to scores of casualties. Note that Poroshenko will be sworn in as Ukraine’s fifth president on June 7, and he has promised to immediately dissolve parliament and call early elections. Ukraine began payments for gas debt owed to Gazprom, and it looks as though negotiations will continue and prevent Russia from demanding pre-payment for future gas deliveries.

– Gold prices took a 2% tumble on Tuesday after China’s gold imports from Hong Kong fell in April amid signs that investment demand is waning. Moreover, the decisive election outcome in Ukraine and Russia’s conciliatory moves helped drive the safe haven lower. Prices fell further in the second half of the week, and spot gold closed out the week around $1,250, at February lows.

– Pfizer let the clock run out on its bid for AstraZeneca, with no higher offer or further interest from AstraZeneca. Under UK takeover rules, Pfizer could resubmit another offer for AstraZeneca in six months, meaning the chances of a deal are not entirely gone. In contrast, Valeant continued its full court press, and in the span of a few days boosted the cash component of its offer for Allergan twice, first by $10 to $58.30/share and then again by $13.70 to $72/share (the firm maintained the equity component at 0.83 of a Valeant share). Pilgrim’s Pride offered to buy Hillshire Brands for $45/share in cash, in a deal worth $6.4 billion. Recall that back on May 12th, Hillshire cut its own deal to buy Pinnacle Foods for $36/share in cash and stock, in a total deal valued around $4.3 billion.

– Next week, the Obama administration will roll out a set of EPA proposals to regulate emissions from existing power plants, including coal plants. The key structure of the proposals will be a cap-and-trade system designed to give states the flexibility to meet benchmarks, as opposed to placing emissions limits on individual plants. Recall that last week, there were reports suggesting the EPA rules could result in a required 25% cut in greenhouse gas emissions by the utility sector.

– Homebuilder Toll Brothers more than doubled its profits in the first quarter, widely beating both earnings and revenue expectations. The company reaffirmed its FY targets, slightly raising the low end of its average selling price outlook. The backlog and deliveries grew by healthy double-digit percentages, indicating that the housing recovery is on track, at least at the high end of the market. “We are in a leveling period in the early stages of the housing recovery with significant pent-up demand building,” said TOL’s CEO.

– Comments by ECB figures suggest the chances of easing at next Thursday’s ECB Council meeting are looking better and better. President Draghi warned about the potential for a “negative spiral” between low inflation, falling inflation expectations and poor credit availability. Austria’s Nowotny said the ECB cannot allow destabilization of inflation expectations and admitted that a rate cut is under discussion. Luxembourg’s Mersch warned that multiple steps could be taken at next week’s meeting. The consensus view is that the deposit rate will be cut into negative territory for the first time ever, and staff inflation forecasts will be significantly reduced, signaling the ECB’s seriousness about the need for more action to fight deflation. EUR/USD traded in a very tight range, from a high of 1.3670 on Monday to lows around 1.3600 mid-week.

– Three key Japanese economic reports provided a worrying but not wholly unexpected view of the continuing impact of PM Abe’s reforms. April retail sales saw their biggest annual decline in over three years (-13.7% m/m, -4.4% y/y). This is the first report in the series since the VAT tax went up to 8% from 5% on April 1st. Recall the March y/y figure was +11%, boosted by buying ahead of the tax hike. April industrial production was weaker than expected, prompting Tokyo to lower its economic assessment on the sector to “flattening as a trend.” Finally April national CPI (+3.1%) and May Tokyo CPI (+3.4%) rose at their fastest rates in two decades. The CPI data were driven higher by the consumption tax hike being passed on to consumers, and analysts are divided on the extent to which the adjusted version really meets the BoJ’s 2% target. USD/JPY was locked in the top half of the 101 handle.

– Chinese authorities have sworn off massive stimulus programs as a means for bolstering the nation’s slowing economy, and as a result Beijing is looking to more targeted approaches. The housing market is slowing and April industrial profit growth data out this week slowed to single digits y/y. Cutting the reserve requirement ratio is widely understood to be the next weapon in the arsenal. Various commentators said that the chances of a RRR cut in the second half of 2014 is looking increasingly likely, and JPMorgan said there would be at least two RRR reductions. Beijing’s other, less subtle weapon is to weaken the renminbi: this week the PBoC let the yuan mid-point drop to 6.1705, its weakest setting since last September.

– There were renewed tensions between China and Vietnam after a Chinese ship rammed and sunk a Vietnamese fishing vessel. A spokesperson for the Vietnamese Foreign Ministry said that the fishing boat was initially surrounded by 40 Chinese ships approximately 17 nautical miles from the China Haiyang Shiyou-981 oil rig. The oil rig was the cause of violent anti-China protests earlier this month. At the ASEAN conference in Singapore, Japan PM Abe commented that Japan would start to play a more proactive role in maintaining security in Asia and support efforts by the Philippines and Vietnam to resolve conflicts.

![]()

![]()

![]()

![]()

![]()

![]()