Mini S&P Charts & Economic Reports 6.06.2014

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday June 6, 2014

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

I was talking about how volatility comes and goes in cycles yesterday and sure enough after ECB decision to lower rates, we saw some good, two sided trading action in stock indices along with much better volume.

More to come tomorrow in my opinion as market awaits monthly unemployment report before the cash opens ( 5:30 AM pacific time/ 7:30 AM Central time)

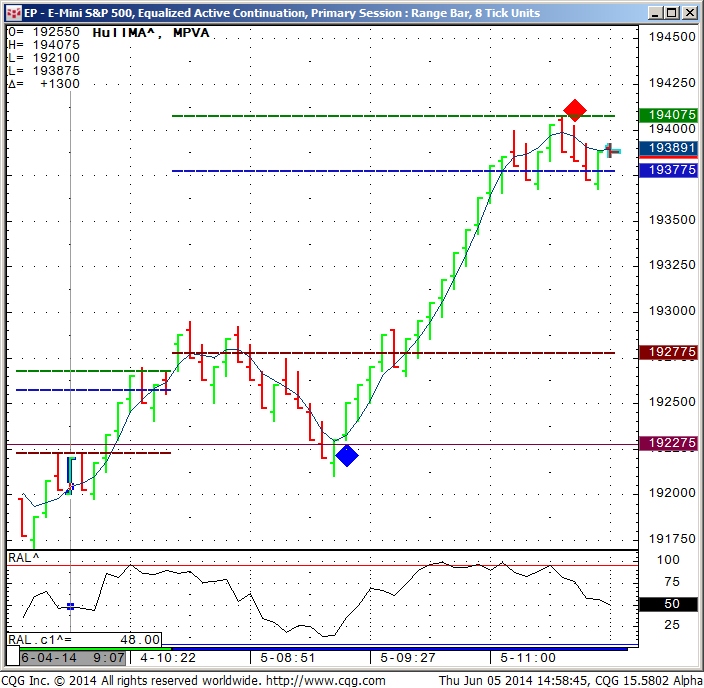

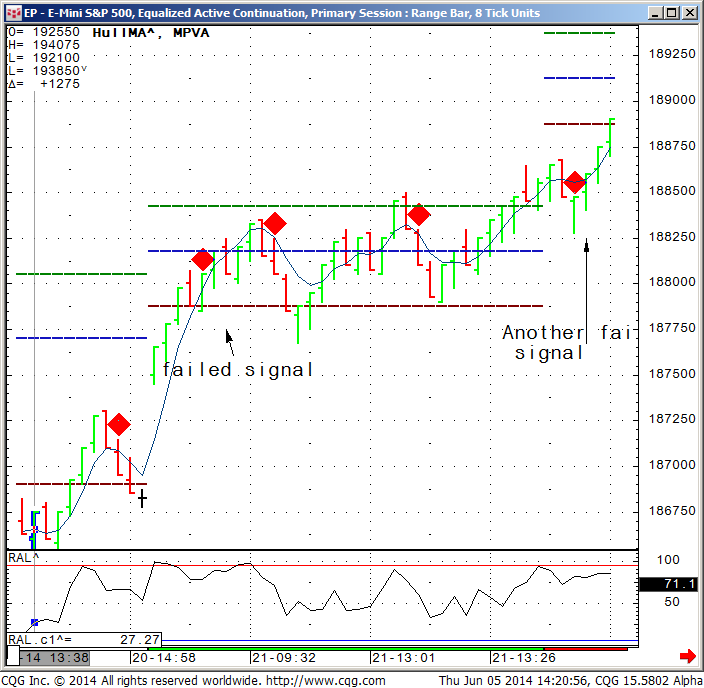

I must share with you my mini SP chart set up as it played out today which shows the only two signals for today -1 buy and 1 sell ( blue diamond buy, red diamond sell). To keep this balanced I am also sharing a screen shot from a few trading days ago where two of the red diamonds generated a “failed” sell signal.

If you like a trial for the ALGO, please read below the charts:

Today’s session:

May 21st 2014 session:

Would you like to have access to my DIAMOND and TOPAZ ALGOs as shown above

and be able to apply for any market and any time frame on your own PC ? You can now have a three weeks free trial where I enable the ALGO along with few studies for your own sierra/ ATcharts and/or CQG .

To start your trial, please visit:

If so, please send me an email with the following information:

1. Are you currently trading futures?

2. Charting software you use?

3. If you use sierra or ATcharts, please let me know the user name so I can enable you

4. Markets you currently trading?

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NO INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS

If you like the information we share? We would appreciate your positive reviews on our new yelp!!

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

| Contract June 2014 | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell | Dollar Index |

| Resistance 3 | 1965.42 | 3841.00 | 17014 | 1191.00 | 81.59 |

| Resistance 2 | 1953.08 | 3811.50 | 16925 | 1172.60 | 81.33 |

| Resistance 1 | 1945.67 | 3793.00 | 16873 | 1162.80 | 80.87 |

| Pivot | 1933.33 | 3763.50 | 16784 | 1144.40 | 80.61 |

| Support 1 | 1925.92 | 3745.00 | 16732 | 1134.60 | 80.15 |

| Support 2 | 1913.58 | 3715.50 | 16643 | 1116.20 | 79.89 |

| Support 3 | 1906.17 | 3697.00 | 16591 | 1106.40 | 79.43 |

| Contract | August Gold | July Silver | July Crude Oil | September Bonds | June Euro |

| Resistance 3 | 1277.1 | 1971.5 | 104.03 | 136 31/32 | 1.3886 |

| Resistance 2 | 1267.5 | 1943.5 | 103.36 | 136 10/32 | 1.3779 |

| Resistance 1 | 1260.4 | 1923.0 | 102.94 | 135 26/32 | 1.3717 |

| Pivot | 1250.8 | 1895.0 | 102.27 | 135 5/32 | 1.3610 |

| Support 1 | 1243.7 | 1874.5 | 101.85 | 134 21/32 | 1.3548 |

| Support 2 | 1234.1 | 1846.5 | 101.18 | 134 | 1.3441 |

| Support 3 | 1227.0 | 1826.0 | 100.76 | 133 16/32 | 1.3379 |

| Contract | July Corn | July Wheat | July Beans | July SoyMeal | July bean Oil |

| Resistance 3 | 462.7 | 607.8 | 1488.00 | 510.83 | 40.30 |

| Resistance 2 | 459.8 | 607.4 | 1482.50 | 507.57 | 39.79 |

| Resistance 1 | 454.4 | 606.6 | 1471.50 | 502.03 | 39.52 |

| Pivot | 451.6 | 606.2 | 1466.00 | 498.77 | 39.01 |

| Support 1 | 446.2 | 605.3 | 1455.0 | 493.2 | 38.7 |

| Support 2 | 443.3 | 604.9 | 1449.50 | 489.97 | 38.23 |

| Support 3 | 437.9 | 604.1 | 1438.50 | 484.43 | 37.96 |

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 4:14pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| FriJun 6 | 2:00am | EUR | German Trade Balance | 15.1B | 14.8B | ||||

| EUR | German Industrial Production m/m | 0.4% | -0.5% | ||||||

| 2:45am | EUR | French Gov Budget Balance | -28.0B | ||||||

| EUR | French Trade Balance | -5.0B | -4.9B | ||||||

| 8:30am | USD | Non-Farm Employment Change | 214K | 288K | |||||

| USD | Unemployment Rate | 6.4% | 6.3% | ||||||

| USD | Average Hourly Earnings m/m | 0.2% | 0.0% | ||||||

| 3:00pm | USD | Consumer Credit m/m | 15.3B | 17.5B |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.