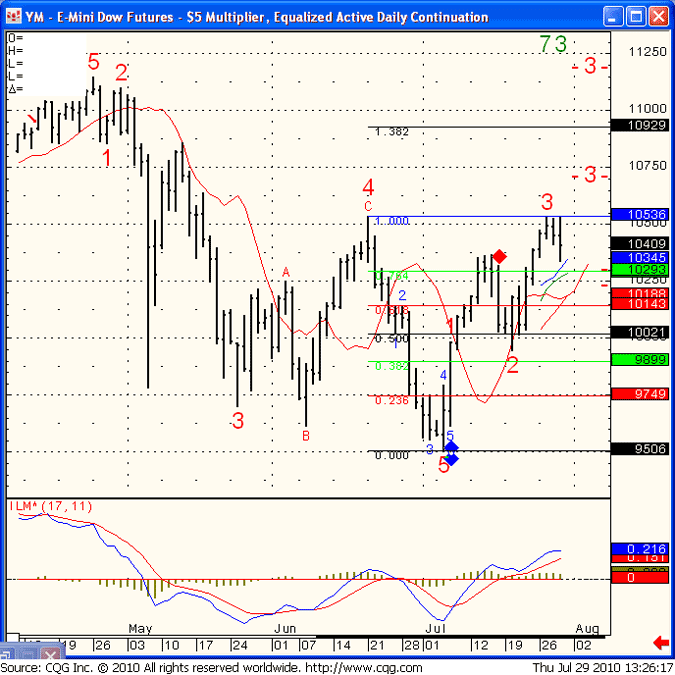

To be honest I don’t have any feel for the medium term outlook of stock indices.

I do like some of the intraday set ups we get in different markets such as Crude, Euro and the Mini SP.

We do have some reports tomorrow and it is the last trading day of the month so we should see some interesting price action.

As far as “mental tip”: keep reminding yourself that the hardest battle for a trader is waiting, patience and fighting ones own demons that normally appear when losing trades happen. Try to be among the tough ones who can control the negative emotions losing trades bring out and your trading will progress. Continue reading “Futures Trading Levels and Mental Tips for October 29th 2010”