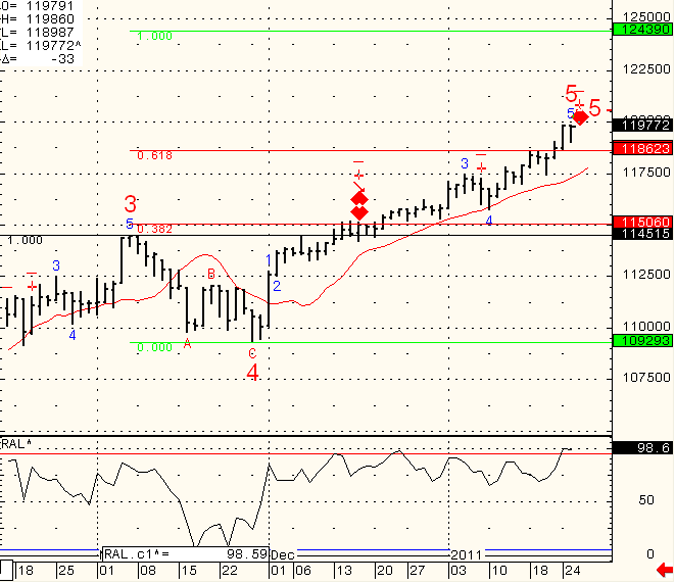

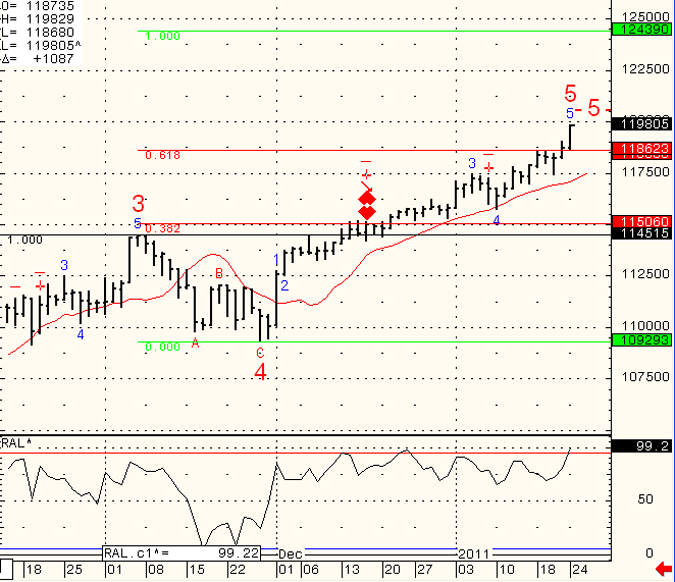

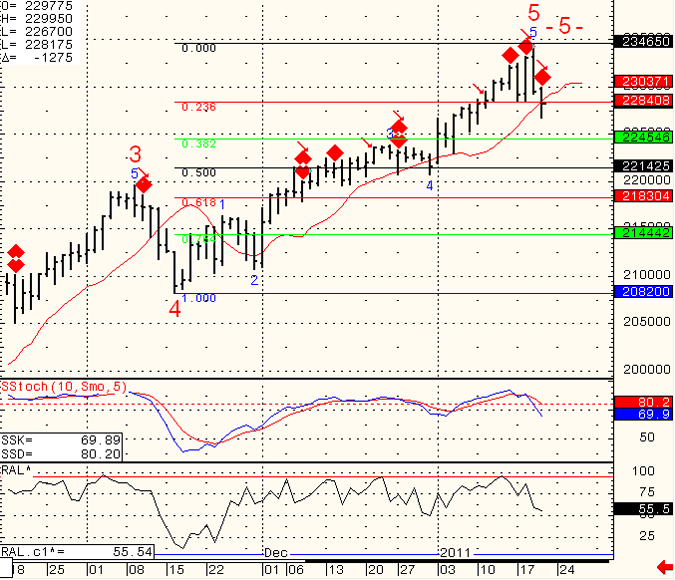

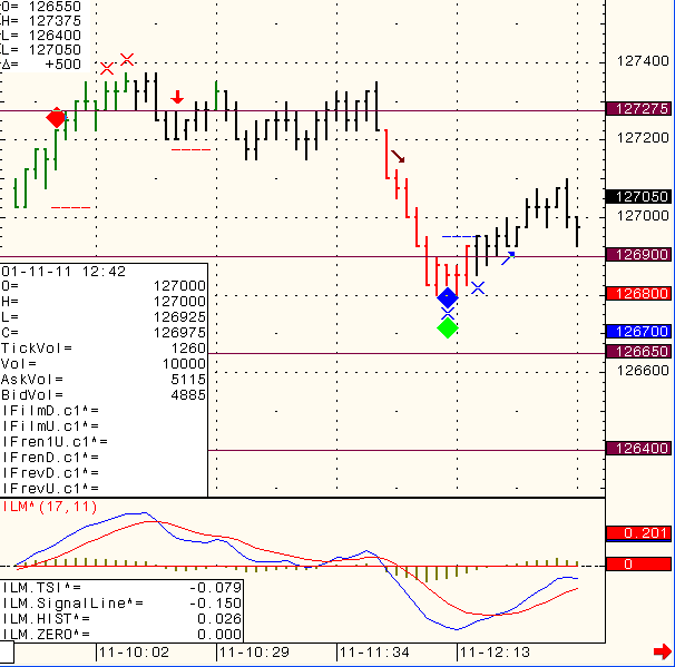

Below is a screen shot from the daily service I hold, called NAZLAN live charts or as some know it, daily webinar.

I think the term live charts is a better description for the service being offered, which you can have a free trial to until Jan. 28th, EVEN if you have had one before.

Sign up at: https://www.cannontrading.com/tools/intraday-futures-trading-signals

Every day around 8:30 AM central, I send an invite code where one can log in and view my live screen that includes 3 charts. Mini SP500, euro currency futures and crude oil futures. The charts include a few set ups that I like to use for intra-day trading along with some notes and general observations of the market for that day.

The corner stone of the charts is the “DIAMOND algorithm” I developed over the last couple of years, which I explain in details during the sessions and that I personally found as one leading indicator that gives me confidence to take certain day-trading set ups. The screen shot from todays webinar may provide a visual for what I just wrote above….

Upper left corner is small image of Euro currency chart, lower left is of the Crude oil and large right is of the mini SP 500. Actual size during the live service is much larger…..

After the free trail, if you decide to subscribe, the cost of the service for CANNON trading clients is $119 per month and for non CANNON trading clients, the cost is $299 per month.

*** Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

In no event should the content of this newsletter be construed as an express or implied promise, guarantee or implication by or from, Cannon Trading or it’s affiliates, that you will profit or that losses can or will be limited in any manner whatsoever. Continue reading “Futures Trading Levels and Economic Reports for January 19, 2011”