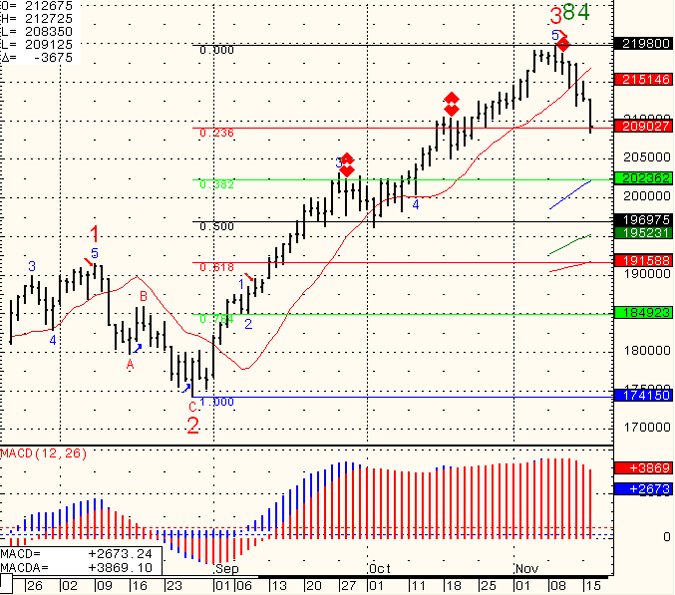

Mini Nasdaq 100 daily chart for your review, we “stopped” right on the first support level, next level if we can break lower is 2023:

Continue reading “Mini Nasdaq 100 for Your Review for November 17th 2010”

Continue reading “Mini Nasdaq 100 for Your Review for November 17th 2010”

Mini Nasdaq 100 daily chart for your review, we “stopped” right on the first support level, next level if we can break lower is 2023:

Continue reading “Mini Nasdaq 100 for Your Review for November 17th 2010”

Continue reading “Mini Nasdaq 100 for Your Review for November 17th 2010”

The market feels to me as if it is either ready to pick up some more momentum to the downside or that this small correction ran its course and the trend up will resume….

I am looking at the following levels and price behavior around these levels to give me more clues as to which way the next move will be.

1206 on the way up (Dec. Mini SP 500) and 1189 on the way down.

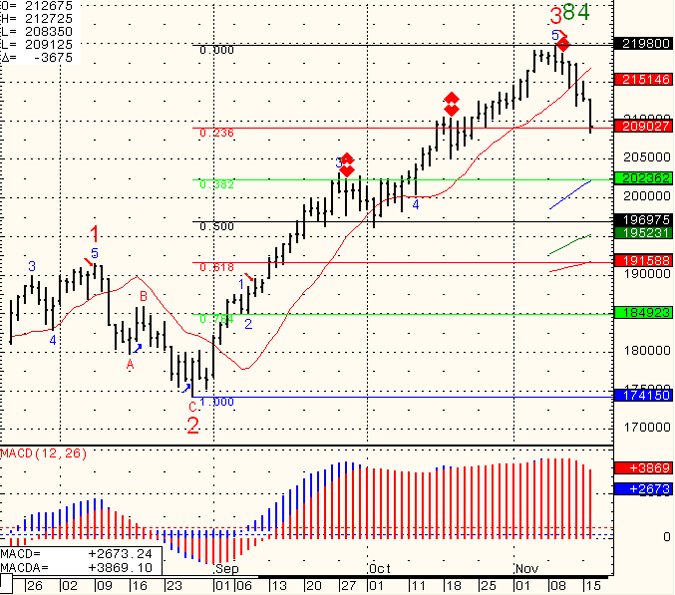

Hourly chart FYI below:

Continue reading “Futures Trading Levels and Economic Reports for November 16th, 2010”

Continue reading “Futures Trading Levels and Economic Reports for November 16th, 2010”

Wishing all of you a great weekend and a successful trading week ahead.

Last two trading days we witnessed increased volatility, which usually provides for better day-trading ranges.

Understanding ahead of time what is the risk you are willing to take, accepting this risk when you enter a trade can help you manage your trades in a calmer way. Continue reading “Continued Increased Volatility in Futures Trading Market for November 15th 2010”

We started out the week with slow trading day and narrow range on stock index futures.

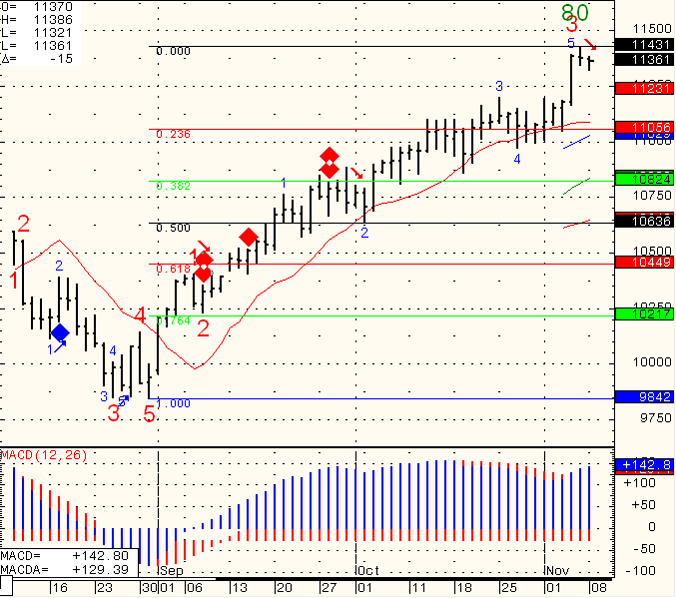

I got a “small sell signal” on mini Dow, which I would like to see a bit more down move before acting on it, simply because volume was not sufficient enough to confirm a good probability of a correction. However, while the probability for down move is not big, the risk reward with a stop above the previous high is not bad….

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. Continue reading “Futures Trading Levels and Economic Reports for Novemeber 9th 2010”

Have a great weekend!

GOOD TRADING!

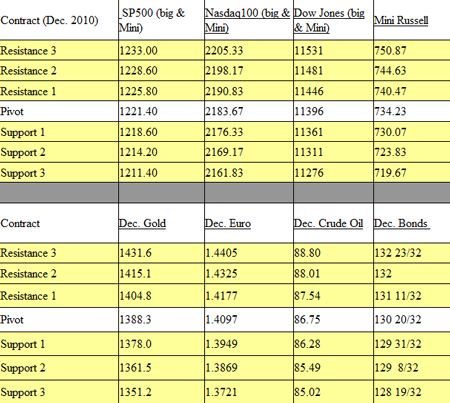

TRADING LEVELS

Continue reading “Futures Trading Levels for November 8th, 2010”

Continue reading “Futures Trading Levels for November 8th, 2010”

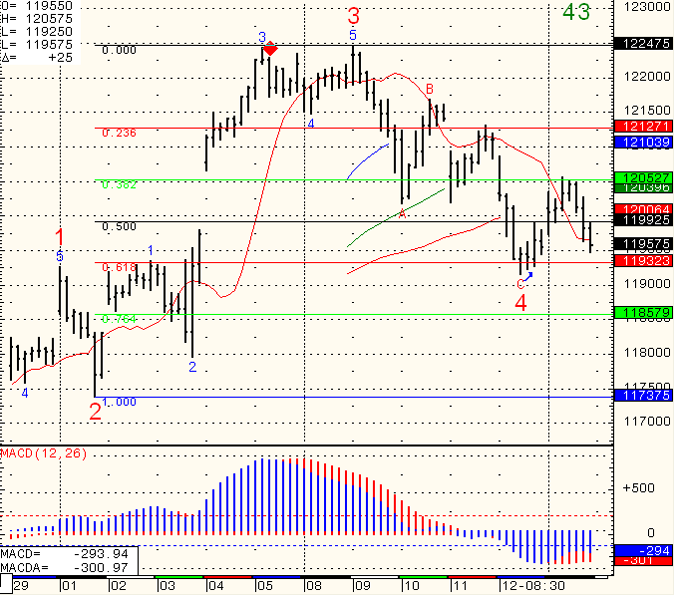

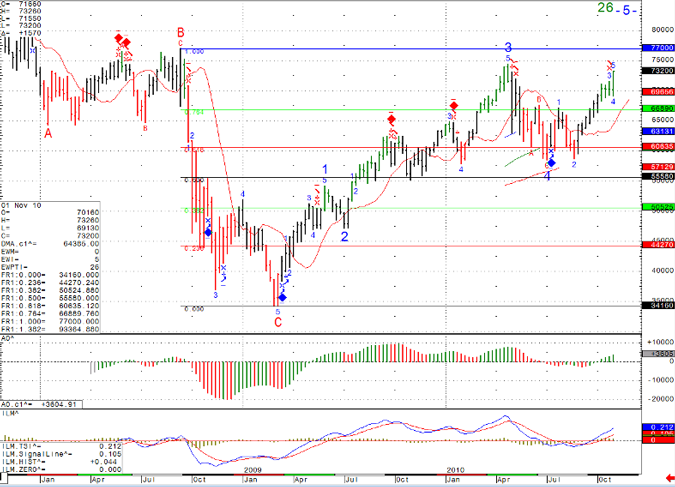

Some potential levels to watch on the way up and/or on pullbacks in the mini Russell WEEKLY chart below:

Continue reading “Futures Trading Levels and Economic Reports for November 5th 2010”

FOMC came and gone. market had its normal volatile two sided action but finished on the highs.

I have said this before, many times you can see the “true market reaction” the day after FOMC.

Tomorrow and Friday (monthly un-employment figures) should be interesting and perhaps volatile trading days. Continue reading “FOMC Sparks True Futures Market Reaction, November 4th 2010”

A BIG 24 hours lay ahead….I suspect some volatility to hit the night markets as election results come out and then we jump right into FOMC tomorrow.

FOMC tomrrow around 2:15 Eastern time.

FOMC days have different characteristics than other trading days. If you have traded for a while, check your trading notes from past FOMC days that may help you prepare for tomorrow.

if you’re a newcomer, take a more conservative approach and make sure you understand that the news can really move the market.

My observations suggest choppy, low volume up until announcement, followed by some sharp volatile moves right during and after the announcement.

I am including a five-minutes chart from Sept. 21st of this year, which was the last FOMC we had for your reference.

Two day FOMC starts tomorrow along with preliminary election news. Should provide for some interesting action in the second part of the trading week.

In between I still don’t see a longer term or a medium term swing trading set up I like, hence I currently focus on intraday set ups which I share in my daily “live charts/ webinar” service.

Daily Futures Day Trading Webinar:

**************************************************

https://www.cannontrading.com/tools/intraday-futures-trading-signals

**************************************************

To be honest I don’t have any feel for the medium term outlook of stock indices.

I do like some of the intraday set ups we get in different markets such as Crude, Euro and the Mini SP.

We do have some reports tomorrow and it is the last trading day of the month so we should see some interesting price action.

As far as “mental tip”: keep reminding yourself that the hardest battle for a trader is waiting, patience and fighting ones own demons that normally appear when losing trades happen. Try to be among the tough ones who can control the negative emotions losing trades bring out and your trading will progress. Continue reading “Futures Trading Levels and Mental Tips for October 29th 2010”