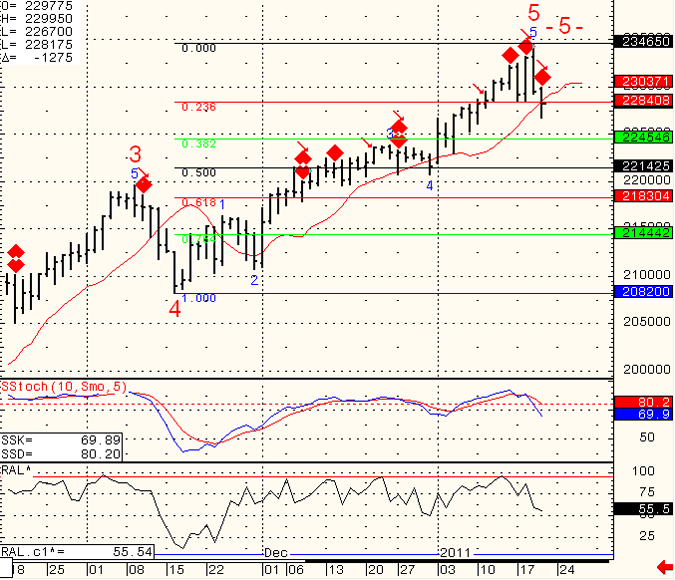

Sometimes a pictures speaks more than a thousand words…..

Continue reading “Futures Trading Levels and Economic Reports for February 4, 2011”

Continue reading “Futures Trading Levels and Economic Reports for February 4, 2011”

Sometimes a pictures speaks more than a thousand words…..

Continue reading “Futures Trading Levels and Economic Reports for February 4, 2011”

Continue reading “Futures Trading Levels and Economic Reports for February 4, 2011”

Next two days are full of economic numbers, plus lets not forget Egypt and Middle East….

I expect higher volatility than we witnessed today but then again, sometimes the market does what it wants, including the un- expected…..

Good quick article at:

https://www.cannontrading.com/community/newsletter/ Continue reading “Futures Trading Levels and Weekly Newsletter February 3, 2011”

My name is Ilan Levy-Mayer and I am the Vice President and Senior Futures Broker at Cannon Trading. I came up with the following personal observations after servingone must keep in mind that futures trading is risky and can involve significant losses.

Hopefully if you are already trading you have completed your initial education: contract specs, trading hours, futures brokers, platforms, the opportunities as well as the risk and need to use risk capital in futures, and so on. Understanding this information is essential to futures trading. The second type of education is ongoing: learning about trading techniques, the evolution of futures markets, different trading tools, and more.

I am definitely not advising you to go on the web and subscribe to a “black box” system (using buy/sell triggers if don’t know why they are being generated). What I am advising is developing a trading technique: a general set of rules and a trading concept. As you progress, you may want to put the different rules and indicators into a computerized system, but the most important factor is to have a focus and a plan. Don’t just wake up in the morning and trade “blank.”

This is the key! Do what you need to do in order to survive this brutal business and give yourself the chance of being here down the road with more experience and a better chance of success. Survival is probably the biggest key for beginning traders. There is a saying in this business: “live to trade another day.” It is so true!

READ THE REST AT:

https://www.cannontrading.com/tools/education-8-steps Continue reading “8 Steps to Successful Futures Day Trading February 2, 2011”

A new month starting and below you will see my WEEKLY chart for the mini SP. I have sell set up in this market as well and if the short side pick speed, I would look for around 1230 and 1186 within the next few weeks. If i am wrong and the market breaks above 1300, I would play defense and wait for the next set up.

I wish you all a great trading month in February.

Continue reading “Futures Trading Levels and Economic Report for February 1, 2011”

Continue reading “Futures Trading Levels and Economic Report for February 1, 2011”

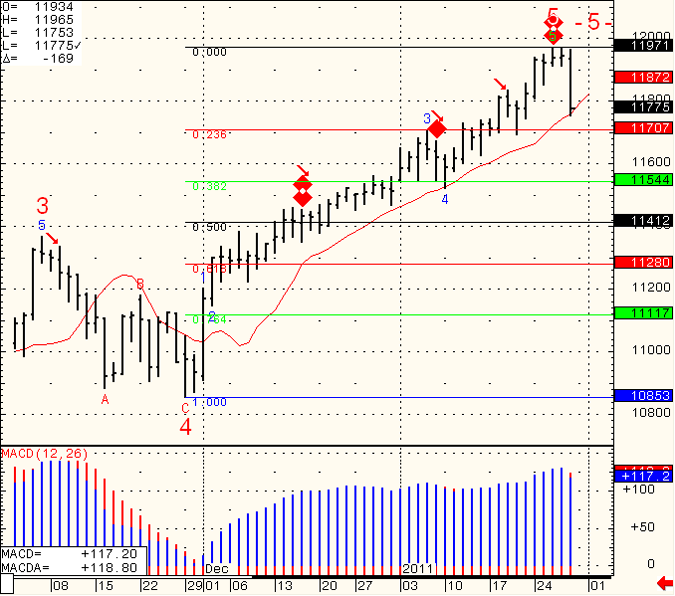

I have been talking and sharing potential short based on the Dow Jones CASH for a few days. Well this short got triggered this morning and signaled a wide sell off in stock indices. I have included a chart of mini Dow Jones futures with different levels to watch for. Pay attention to the red moving avg. that has held this recent rally for few good weeks now.

We closed right against it.

With recent global geo political unrest, I suspect volatility will increase quite a bit.

Understand that the DAYTRADING environment you may facing ahead is much different than what you have seen last few weeks. Adjust your mental approach, money management, stops and everything that has to do with money management and trade management accordingly!!

Continue reading “Futures Trading Levels and Economic Reports for January 31, 2011”

Continue reading “Futures Trading Levels and Economic Reports for January 31, 2011”

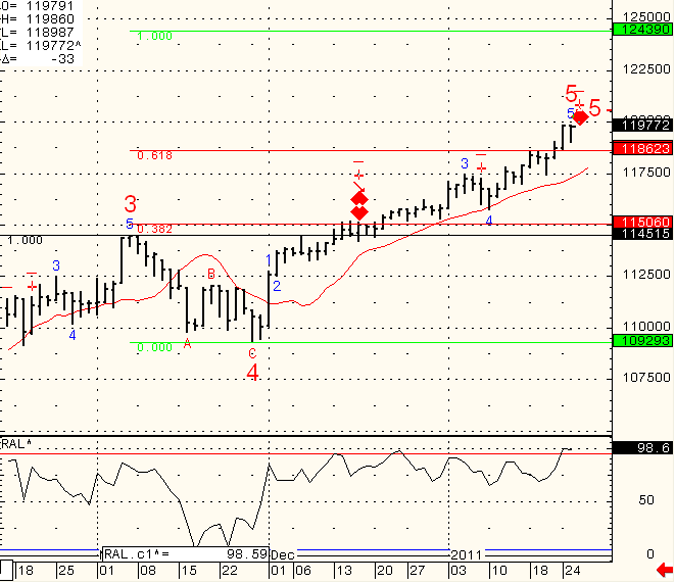

The short POTENTIAL trading signal on the Dow Cash is still in play but as I mentioned a few days ago:

Just because I have a signal does NOT mean it is a crystal balll…hence I like to see follow through of price action or what I call price confirmation.

That level for me is now 11898 on the cash. My opinion is that a break below, will increase chances for meanigful correction, until then I would NOT fight the trend or try to predict tops.

Updated CASH DOW JONES chart below:

Continue reading “Futures Trading Levels and Economic Reports for January 28, 2010”

Some excellent reading material about trading psychology which I personally think is BIG part of trading on our weekly newsletter:

******************************************************************

https://www.cannontrading.com/community/newsletter/

****************************************************************** Continue reading “Futures Trading Levels and Weekly Futures Trading Newsletter January 27, 2011”

We should see volatile next 24 hours.

State of the Union tonight and tomorrow we have FOMC statement.

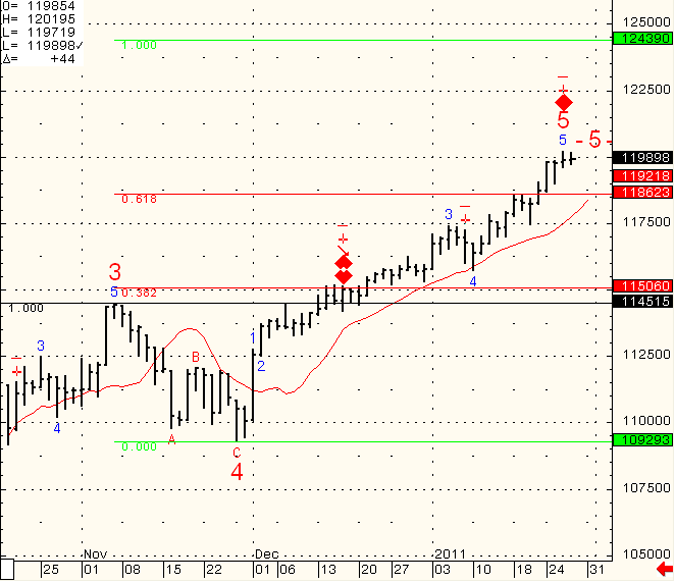

I shared the Dow Jones Cash index yesterday so i am providing an updated chart from today in which I actually got a potential sell signal.

As you can see we have a RED diamond appearing ahead of tomorrows open, the way I like to trade this signal is by entering on a stop, so in this case I will wait to see if Dow Jones Cash trades below today’s low at 11898 and only then I would have higher confidence to be short.

Below the chart, please review some notes i wrote for FOMC days:

Continue reading “Futures Trading Levels and Economic Reports for January 26, 2011”

Continue reading “Futures Trading Levels and Economic Reports for January 26, 2011”

I wrote the following last Thursday as SP, NASDAQ and Russell 2000 were selling off a bit:”Last two days we saw the first meaningful price decline in more than a few good weeks.

Still we are not getting a confirmation from the Dow Jones index that this potential

I would like to see for a larger scale sell off. ”

So while I still think stock indices are over valued and due for a correction, I definitely don’t think it is wise to try and “predict tops and bottoms” and in this case it is trying to pick tops.

I rather wait for a good signal along with good risk/ reward set up.

The chart below if of the Dow Jones CASH INDEX (not the futures contract). I would take a shot at a short position if the cash can break below 11,862, otherwise it looks like the Dow may want to work its way towards the 12439. I use this technique of entering certain positions if prices break above or below certain levels as it gives me more confidence in market direction. I call it “Price Confirmation”

Past results are not necessarily indicative of future results.

The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition. Continue reading “Futures Trading Levels and Economic Reports for January 25, 2011”

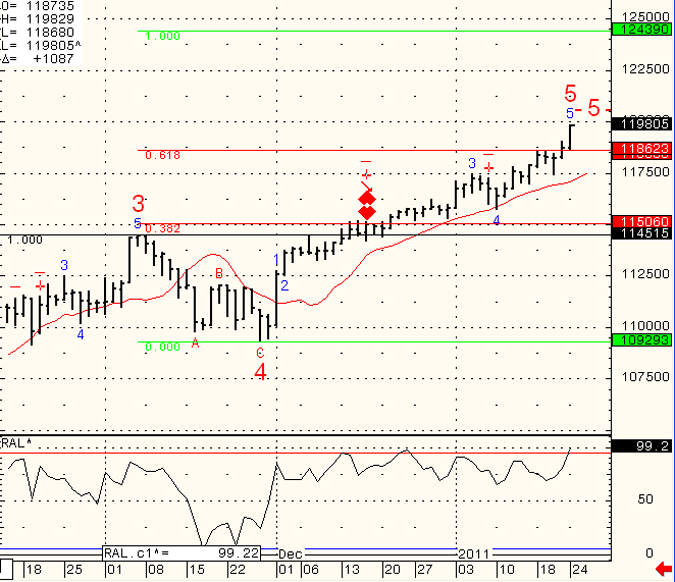

Last two days we saw the first meaningful price decline in more than a few good weeks.

Still we are not getting a confirmation from the Dow Jones index that this potential

I would like to see for a larger scale sell off.

Below you will see a daily chart of the mini NASDAQ 100 contract along with some potential levels.

Continue reading “Futures Trading Levels and Economic Reports for January 21, 2011”

Continue reading “Futures Trading Levels and Economic Reports for January 21, 2011”