As we asked many times before….is this bounce just a correction from the short term sell off we had over the last few days OR was the sell off of the last few days just a correction from the recent rally of last few weeks???

I wish I could tell you, but what I can share is that in situation like this one, it is wise to wait for market reaction, price behavior around key areas of support and resistance and perhaps look at a few time frames, i.e. look at 15 minute chart, an hourly chart and a daily chart…

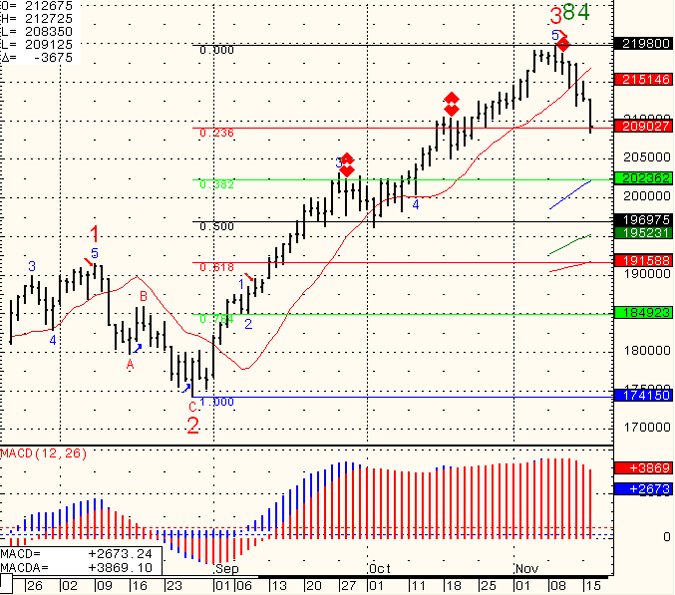

Below you will see the hourly Mini SP chart and below that the mini SP Daily chart for your review along with key levels.

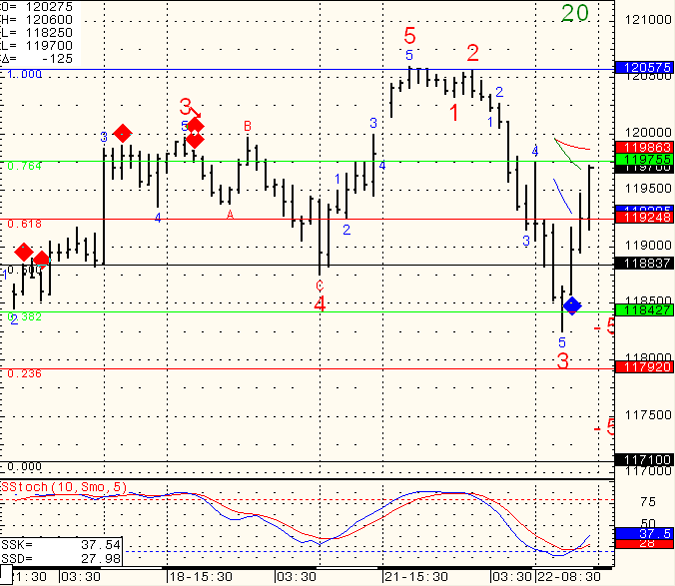

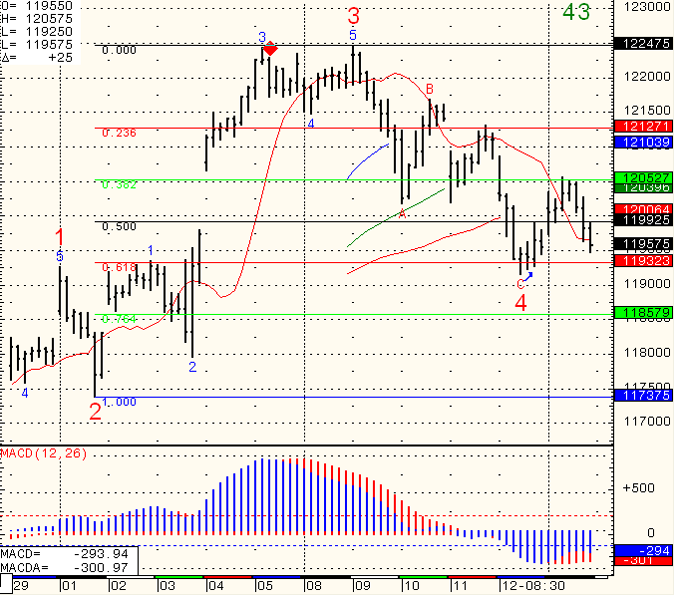

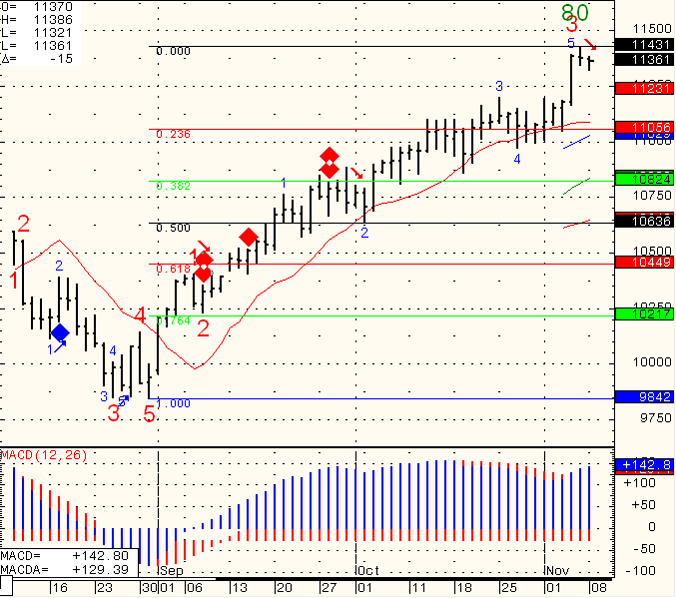

Mini SP 500 hourly chart:

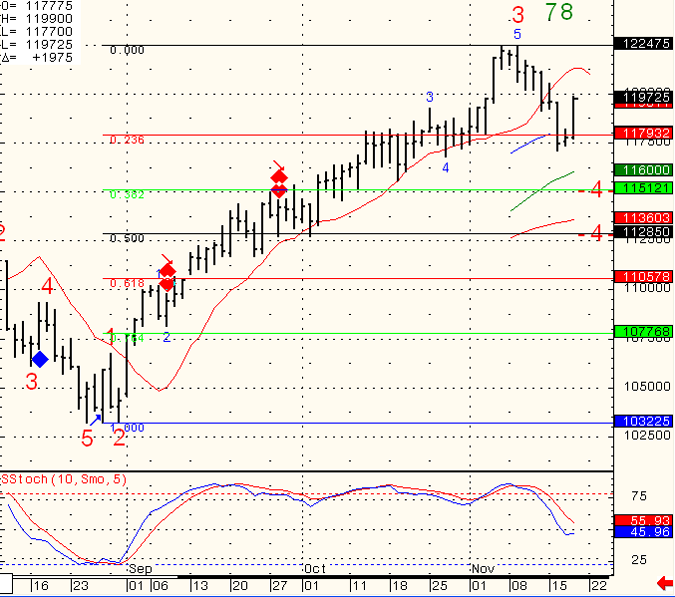

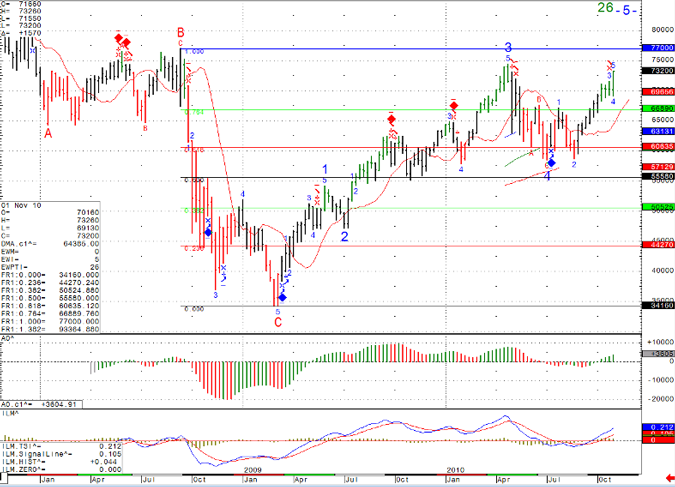

Mini SP 500 Daily chart:

Continue reading “Recent Rally of Futures Trading Causes Short Term Sell Off, November 19th, 2010”

Continue reading “Recent Rally of Futures Trading Causes Short Term Sell Off, November 19th, 2010”