Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

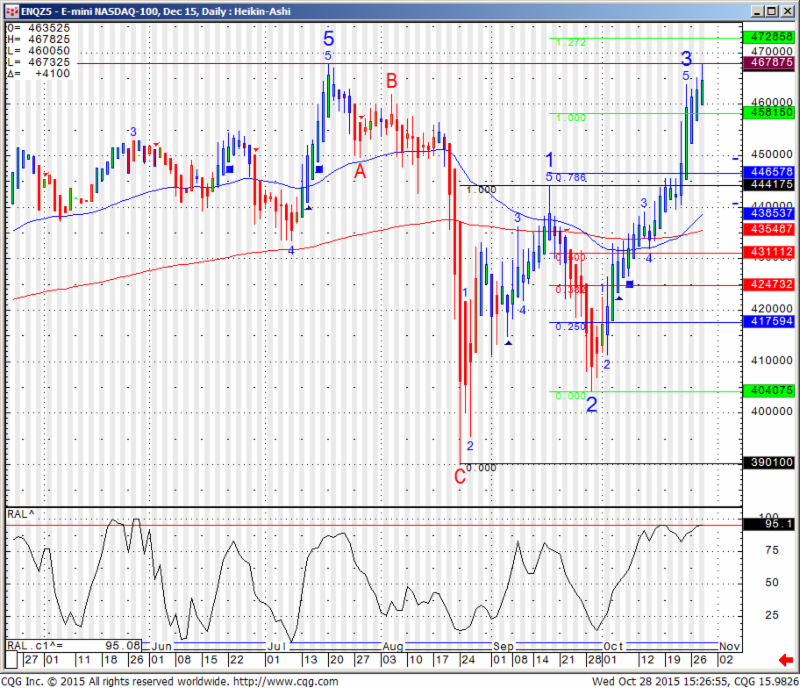

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

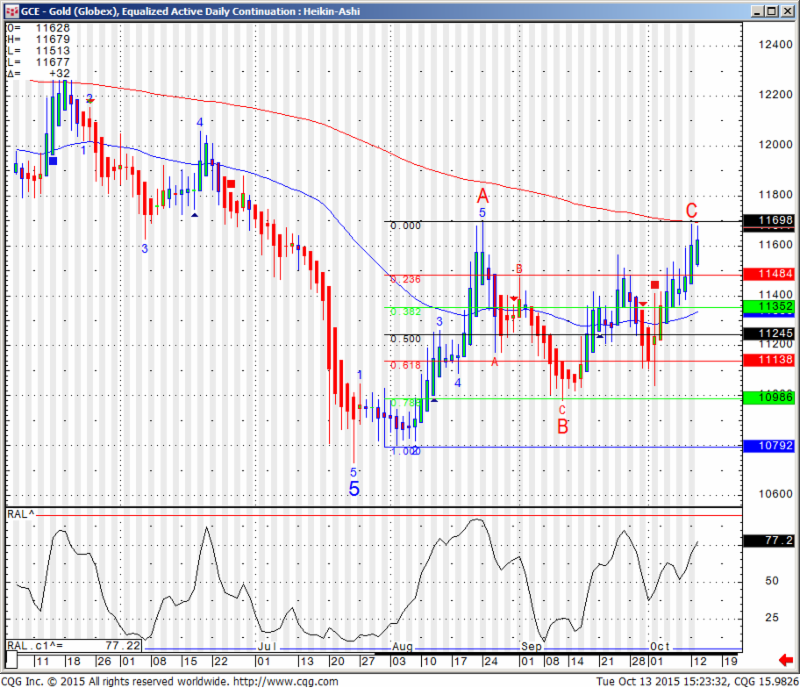

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday October 30, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Fed funds futures are now predicting a 50% chance of rate hikes at the December FOMC meeting, up sharply from below 40% yesterday. As of writing, the DJIA has given up 0.41%, the S&P500 is off 0.26% and the Nasdaq is down 0.37%.In its decision yesterday afternoon, the FOMC dropped a reference to global risks restraining growth and referred to its “next meeting” on Dec. 15-16 as “live” as it discussed the timing of rate liftoff. Fed’s Lacker dissented for a second time, remaining in favor of an immediate 0.25% rate increase. With job growth remaining pretty solid (the four-week MA in the continuing claims data out today sank to its lowest level since 1973), inflation continues to be the main source of uncertainty. Just this morning, the third quarter GDP price index and core PCE measures undershot expectations.The advance reading of annualized third quarter GDP slightly undershot expectations, and dramatically slowed from the second quarter rate, dropping to +1.5% from +3.9%. Analysts widely interpreted the slowdown as a direct result of businesses cutting back on restocking to work off an inventory glut. Businesses accumulated $56.8 billion worth of inventory in the third quarter, the smallest since the first quarter of 2014 and down sharply from $113.5 billion in the April-June period. Meanwhile, third quarter consumer spending expanded at a +3.2% annualized rate in the quarter after expanding at a +3.6% annualized rate in the second quarter, suggesting that the consumer sector remains quite healthy.

Shares of Allergan are up 8.6% this morning after disclosing it it had been approached and was in “preliminary friendly discussions” with Pfizer regarding a potential merger, but also warned no deal has been finalized. In a separate statement, Pfizer confirmed the talks, saying it would not speculate on terms of a potential agreement. Recall that in Spring of 2014, Pfizer tried and failed to acquire AstraZeneca. Reports out yesterday indicated that both companies were in discussions to create what would be the world’s largest healthcare company with a combined market cap of around $330 billion.