Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

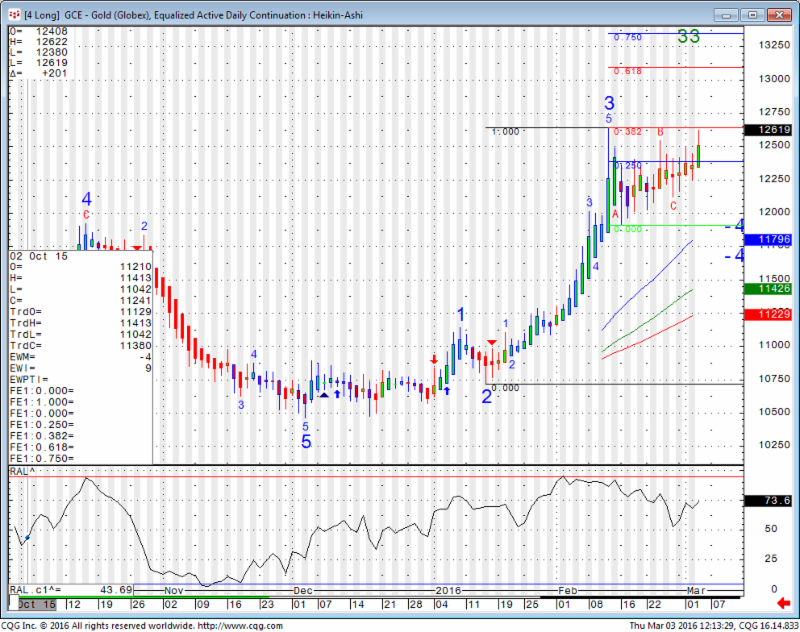

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday March 15, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

FRONT MONTH for STOCK INDEX is JUNE!!

A note on managing trade size by my colleague, John Thorpe who has over 25 years of experience starting on the floor of the CBOT.

Managing your trading/position size is crucial to long term success regardless of style.

Daytrading, Swing or long term position trading.

In order to select the size you will employ make a mental note of three things before you trade. The Foundation of Trading your plan is first determining the size you will be employing, the number of contracts.

We must assume your risk capital is fixed.

1) How liquid is the contract I will be trading?

Are there frequent price gaps, lack of continuity with bid/ask spreads.

What is the Open Interest and Volume relative to other contracts in the same industry, index , futures contract type.

Continue reading “Managing Your Futures Trading/Position 3.15.2016”