Wishing all of you a great weekend and a successful trading week ahead.

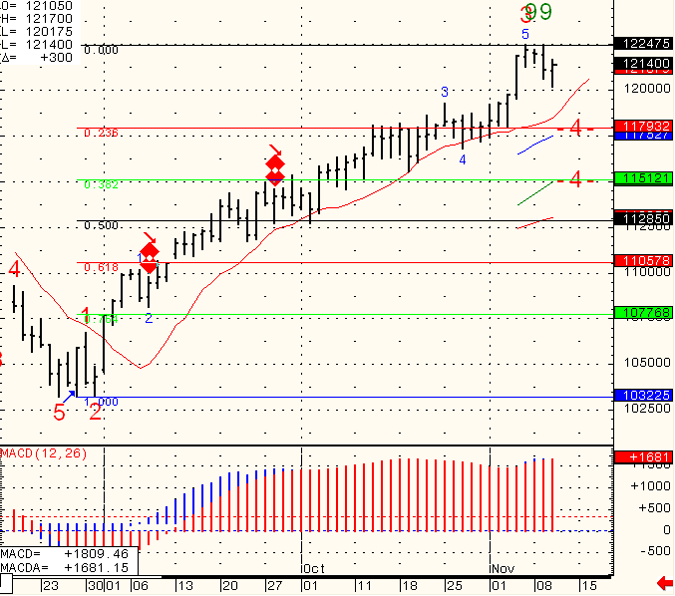

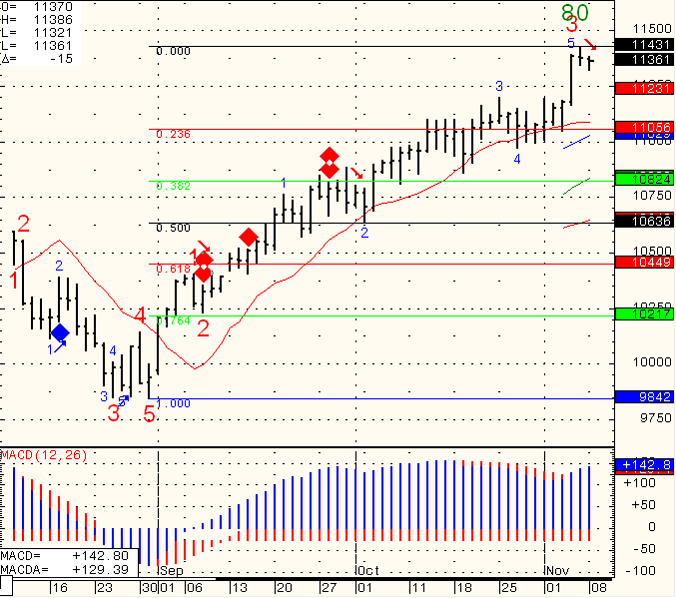

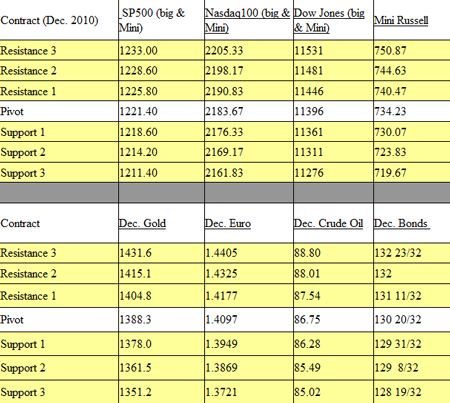

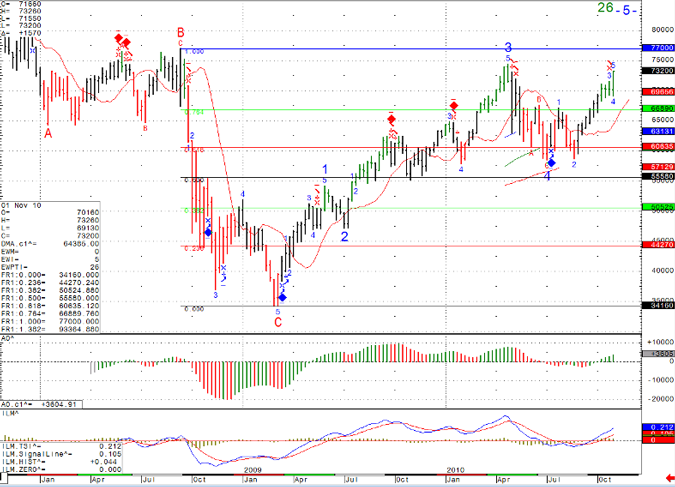

Last two trading days we witnessed increased volatility, which usually provides for better day-trading ranges.

Understanding ahead of time what is the risk you are willing to take, accepting this risk when you enter a trade can help you manage your trades in a calmer way. Continue reading “Continued Increased Volatility in Futures Trading Market for November 15th 2010”