The Week Ahead: FED Talk

By John Thorpe, Senior Broker

1st of the final 3 Fed meetings this year happens this week.

The 1st upcoming meeting on Wednesday the 20th and the final Fed meeting December 13th will also include as a component “Projection Materials” or “Summary of Economic Projections”. The Summary of economic projections should give us a better view of what the voting Fed members are seeing as well. They represent more data driven insights than merely the commentary that follows the rate decisions.

Again, the language of Wednesday’s commentary will be more heavily based on data dependency as investors look for language alluding to the end of the rate increase cycle.

The Oct31/Nov 1 Fed (this is the 2nd of 3 remaining this Year) meeting will not include this data but will still include Fed Chair Powell’s commentary.

Why focus on fed meetings? There is Clear correlation between expectations of interest rate changes and Equity Market prices. An overly simplistic description: Interest rates go higher, equity prices go lower and the correlative inverse should also follow that when interest rates go lower, equity prices go higher.

Clearly our equity indices are range bound as the market has been discounting any and all further rate increases the Fed has alluded to. What has been supporting the market is the view that rate tightening is nearing an end. The Summary of economic projections should give us a better view of what the voting Fed members are seeing as well.

CME Fedwatch Tool is reflecting a 99% probability of no rate change this meeting, maintaining the 5.25-5.50 current borrowing rate with a 1 % chance of a raise in rates.

Earnings

Fedex (FDX) headlines a relatively light earnings calendar this week, with the logistics giant slated to disclose its fiscal first-quarter results after Wednesday’s close. Analysts, on average, expect the company to report earnings of $3.73 per share, up 8.4% year-over-year (YoY), on revenue of $21.8 billion (-7.6% YoY).

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

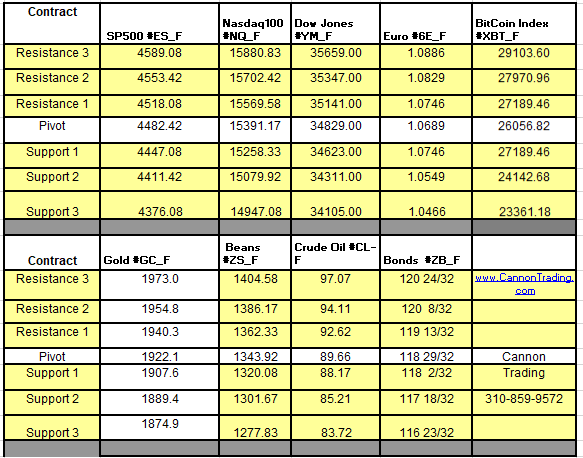

Futures Trading Levels

09-19-2023

Improve Your Trading Skills

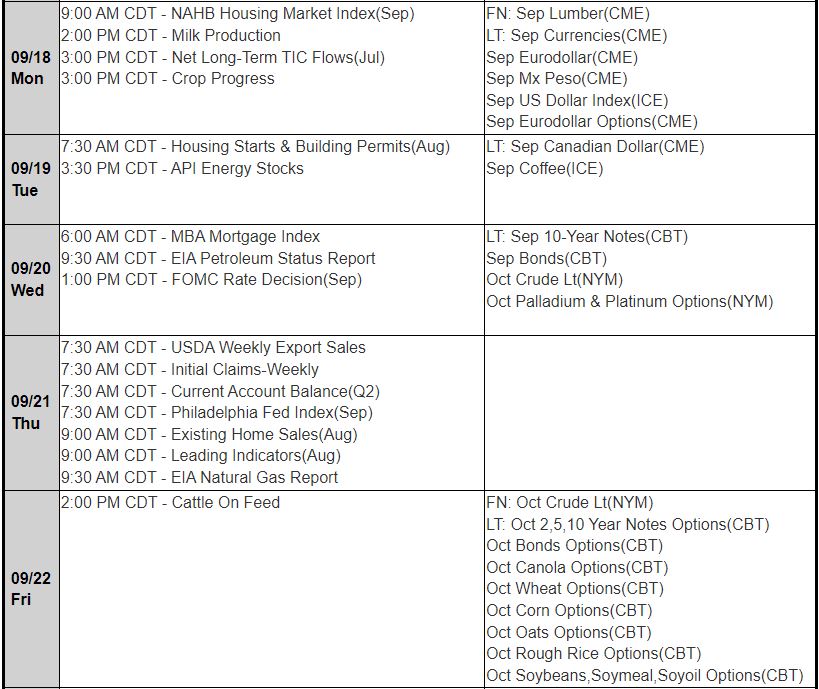

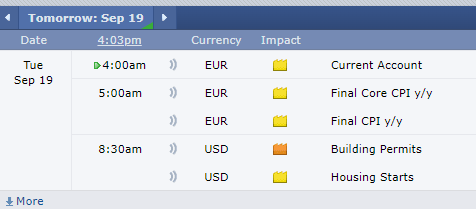

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.