____________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Hope everyone had a nice weekend and will enjoy a successful trading week!

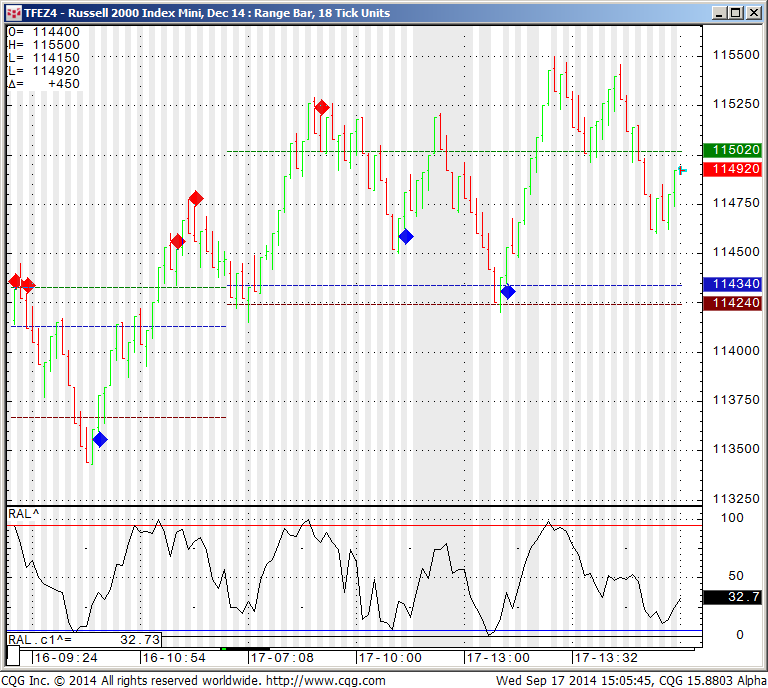

A bit more on the mini Russell:

For the next few months, the mini Russell 2000 will trade side by side on both the CME and ICE exchanges.