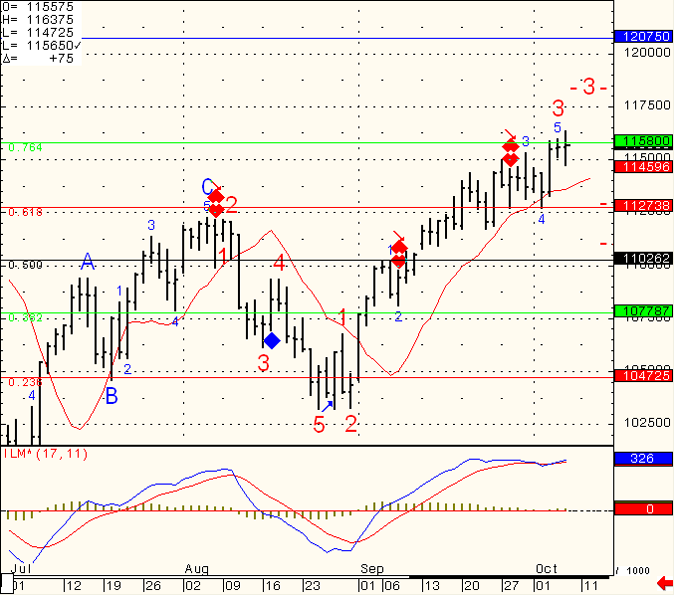

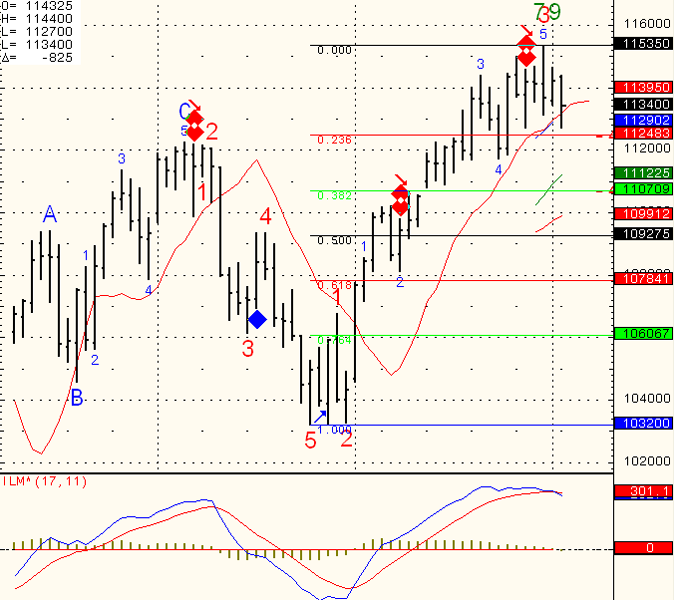

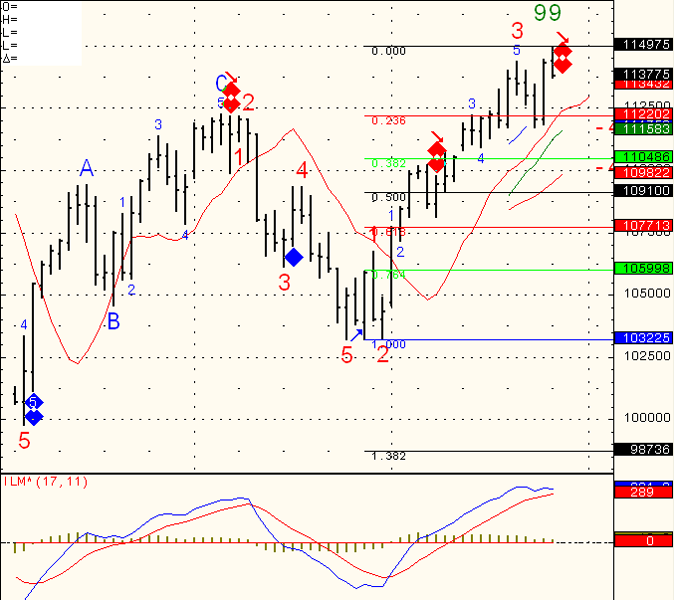

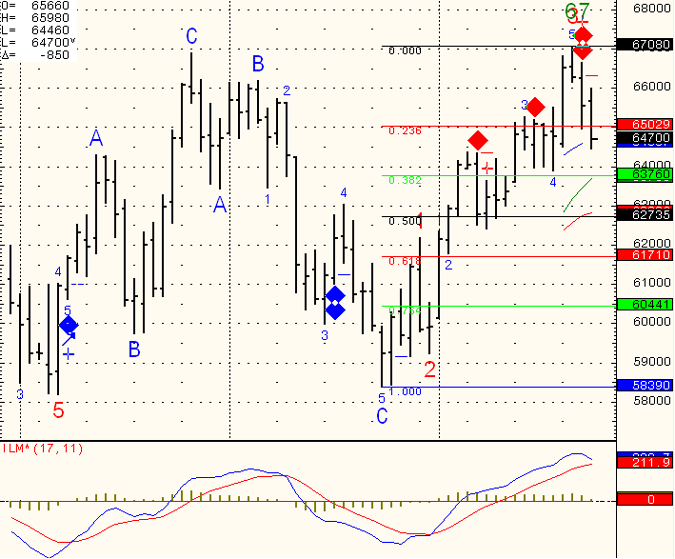

| Daily Support & Résistance Levels | Mini-S&P 500 Futures Dec. 10 |

Mini-Nasdaq 100 Futures Dec. 10 |

Mini-Dow Futures Dec. 10 |

Mini Russell 2000 Futures Dec.10 |

30-year US Bond Futures Dec. 10 |

10-Year US Note Futures Dec. 10 |

|---|---|---|---|---|---|---|

| Support 3 | 1146.00 | 1989.00 | 10770 | 675.90 | 13209 | 12607 |

| Support 2 | 1150.50 | 2006.00 | 10851 | 680.00 | 13300 | 12625 |

| Support 1 | 1155.50 | 2016.50 | 10897 | 684.00 | 13326 | 12703 |

| Resistance 1 | 1165.00 | 2035.00 | 10984 | 696.90 | 13519 | 12722 |

| Resistance 2 | 1171.25 | 2051.00 | 11010 | 701.60 | 13612 | 12727.5 |

| Resistance 3 | 1174.75 | 2063.00 | 11115 | 707.40 | 12627 | 12810.5 |

| Daily Support & Resistance Levels |

Gold Futures Dec.2010 |

Silver Futures Dec. 2010 |

Copper Futures Dec. 2010 |

Crude Oil Futures Nov. 2010 |

Euro Curr. Dec. 2010 |

Dollar Index Dec. 2010 |

| Support 3 | 1308.5 | 22.35 | 3.720 | 80.30 | 1.3667 | .7705 |

| Support 2 | 1326.0 | 22.86 | 3.750 | 80.88 | 1.3740 | .7748 |

| Support 1 | 1341.0 | 22.96 | 3.780 | 81.55 | 1.3767 | .7773 |

| Resistance 1 | 1356.0 | 23.31 | 3.800 | 82.48 | 1.3831 | .7799 |

| Resistance 2 | 1366.0 | 23.40 | 3.822 | 83.50 | 1.3864 | .7817 |

| Resistance 3 | 1375.0 | 23.67 | 3.867 | 84.43 | 1.3924 | .7878 |

Updated: 12-Oct-10 7:59 ET

This Week’s Calendar

Click on a “Release” for Insight

| Date | ET | Release | For | Actual Briefing.com | Consensus | Prior | Revised From |

|---|---|---|---|---|---|---|---|

| Oct 12 | 14:00 | Minutes of FOMC Meeting | 9/21 | ||||

| Oct 13 | 07:00 | MBA Mortgage Applications | 10/08 | NA | NA | -0.2% | |

| Oct 13 | 08:30 | Export Prices ex-ag. | Sep | NA | NA | 0.5% | |

| Oct 13 | 08:30 | Import Prices ex-oil | Sep | NA | NA | 0.3% | |

| Oct 13 | 10:30 | Crude Inventories | 10/09 | NA | NA | 3.09M | |

| Oct 13 | 14:00 | Treasury Budget | Sep | -$32.0B | -$33.5B | -$46.6B | |

| Oct 14 | 08:30 | Initial Claims | 10/09 | 450K | 450K | 445K | |

| Oct 14 | 08:30 | Continuing Claims | 10/02 | 4450K | 4450K | 4462K | |

| Oct 14 | 08:30 | PPI | Sep | 0.1% | 0.2% | 0.4% | |

| Oct 14 | 08:30 | Core PPI | Sep | 0.1% | 0.1% | 0.1% | |

| Oct 14 | 08:30 | Trade Balance | Aug | -$40.0B | -$44.5B | -$42.8B | |

| Oct 15 | 08:30 | CPI | Sep | 0.1% | 0.2% | 0.3% | |

| Oct 15 | 08:30 | Core CPI | Sep | 0.1% | 0.1% | 0.1% | |

| Oct 15 | 08:30 | Retail Sales | Sep | 0.2% | 0.4% | 0.4% | |

| Oct 15 | 08:30 | Retail Sales ex-auto | Sep | 0.1% | 0.4% | 0.6% | |

| Oct 15 | 08:30 | NY Fed – Empire Manufacturing Survey | Oct | 3.0% | 5.75 | 4.10 | |

| Oct 15 | 09:55 | Mich Sentiment | Oct | 67.0 | 68.5 | 68.2 | |

| Oct 15 | 10:00 | Business Inventories | Aug | 0.4% | 0.5% | 1.0% |

- NFIB Small Business Optimism Index

7:30 AM ET - ICSC-Goldman Store Sales

7:45 AM ET - Redbook

8:55 AM ET - 4-Week Bill Announcement

11:00 AM ET - 3-Month Bill Auction

11:30 AM ET - 6-Month Bill Auction

11:30 AM ET - Thomas Hoenig Speaks

11:45 AM ET - 3-Yr Note Auction

1:00 PM ET - FOMC Minutes

2:00 PM ET - SEE FULL LIST HERE

12. OCT. 2010 – Today´s Highlighted Splits

| SYMBOL | COMPANY | EVENT TITLE | EPS ESTIMATE | EPS ACTUAL | PREV. YEAR ACTIVITY | DATE/TIME (ET) |

|---|---|---|---|---|---|---|

| INTC | Intel Corporation | Q3 2010 Intel Corporation Earnings Release | $ 0.50 | n/a | $ 0.33 | 12-Oct |

| CSX | CSX Corporation | Q3 2010 CSX Corporation Earnings Release | $ 1.04 | n/a | $ 0.74 | 12-Oct AMC |

| FAST | Fastenal | Q3 2010 Fastenal Earnings Release & September 2010 Sales Release | $ 0.50 | n/a | $ 0.32 | 12-Oct BMO |

| VOXX | Audiovox Corporation | Q2 2011 Audiovox Corporation Earnings Release | $ 0.00 | n/a | $ 0.04 | 12-Oct AMC |

| DIET | eDiets.com, Inc. | Preliminary Q3 2010 eDiets.com, Inc. Earnings Release | n/a | n/a | n/a | 12-Oct BMO |

| AIP.L | AIR PARTNER | Preliminary 2010 AIR PARTNER Earnings Release | n/a | n/a | n/a | 12-Oct BMO |

Continue reading “Daily Support & Resistance and Economic Data to be Released, October 12th 2010”