Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Volatility has picked up again! Make sure you adapt as markets are always changing and what may work for range bound/ low volatility days will not work for wide range/ higher volatility days.

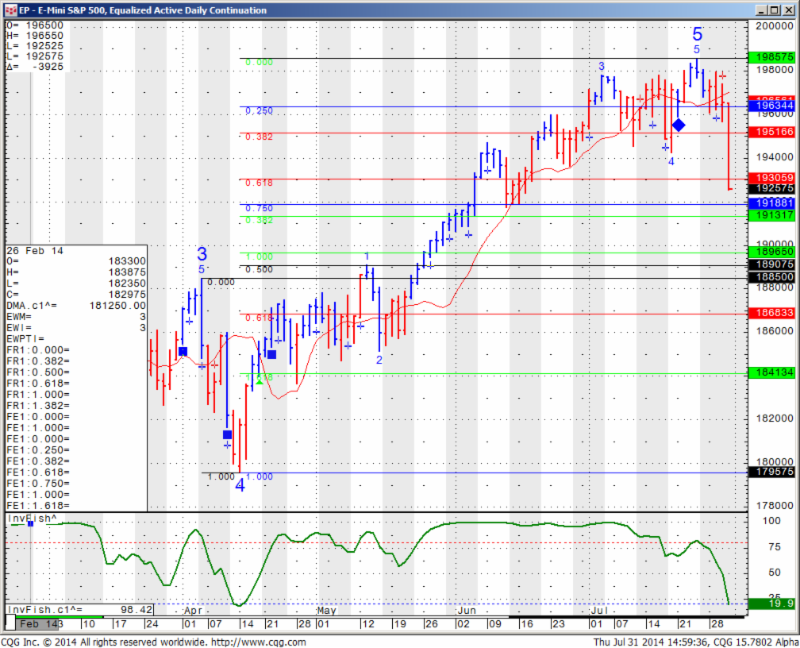

I see major support for SP500 at 1795 and it will be interesting to see price reaction if we test this level in the next few days.

On a different note, I wrote a quick analysis along with chart for Crude Oil futures at:

http://experts.forexmagnates.com/crude-oil-attempting-break-lower/