Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5. Economic Reports for Monday, December 12, 2011

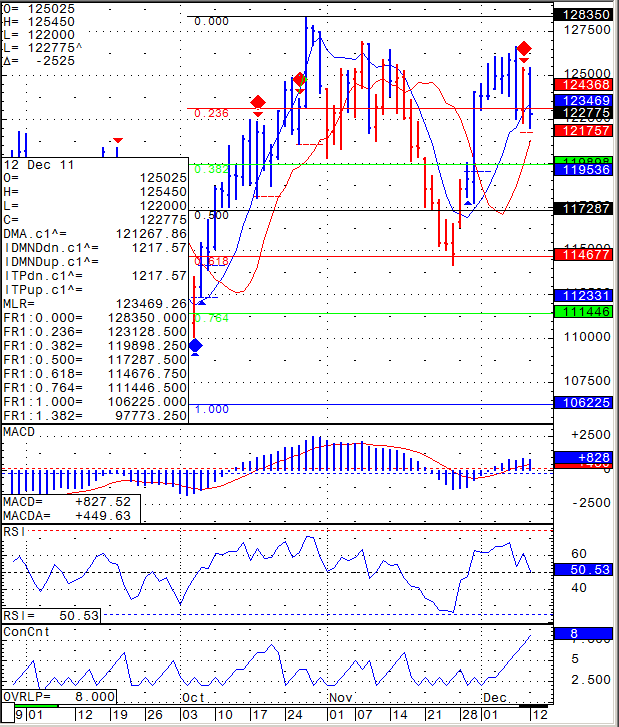

1. Market Commentary and Daily Mini S&P 500 Chart

Front month for equity indices is MARCH 2012

mini SP, mini Nasdaq, mini Russell, Mini Dow and few more are all March 2012

Symbol in most platforms for March mini SP is ESH2. Pay attention please!

AT A GLANCE: FOMC Takes No Action; Still Sees ‘Significant Risks’

12/13/11 13:45

THE STORY

The Federal Open Market Committee, the policy-setting arm of the Federal Reserve Board, left its policy options open for 2012 but took no actions Tuesday and offered an assessment of the economy that was guardedly more upbeat, but still marked by “significant downside risks.”

Nine out of 10 Fed officials voted to keep the central bank’s easy-credit policies unchanged for the second meeting in a row in what was the last Federal Open Market Committee meeting of the year. It took place on Fed Chairman Ben Bernanke’s 58th birthday.

Officials reiterated that short-term interest rates are likely to stay close to zero until mid-2013 at least. In their assessment of the economy, they said indicators pointed to some improvement in the U.S. jobs market.

Data since the FOMC last met at the sta! rt of November suggest the “economy has been expanding moderately, notwithstanding some apparent slowing in global growth,” Fed officials said in a statement.

The U.S. unemployment rate fell to 8.6% in November, the lowest level since March 2009, and the number of people filing for unemployment benefits has fallen recently.

Still, the Fed is concerned the U.S. economy could be hit by higher taxes and continued government layoffs next year, as well as the repercussions from the debt crisis in Europe, which has close financial and trade ties with the U.S.

The Fed is looking at revamping its communication strategy, which could be a step toward easier monetary policy. Officials are considering whether to make their internal interest-rate forecasts public. If they do this, and those forecasts suggest short-term interest rates will stay low for even longer than investors now believe, that could drive long-term rates down and be a boost to growth.

The post-! meeting statement gave no indication of the state of that debate. This suggests the Fed has left it to be resolved next year. Minutes of the meeting, due out in three weeks, might reveal more.

Prior to the meeting, few analysts expected the policymakers to introduce any new stimulus measures since its latest stimulus plan–known as Operation Twist–was disclosed less than three months ago. Under Operation Twist, the Fed will exchange $400 billion of its short-term Treasury securities for longer-dated ones.

In December, the central bank aims to purchase $45 billion worth of U.S. government debt through 13 operations and sell $52 billion via seven sales. An extra auction of about $8 billion was added this month because of a canceled sale on Nov. 30.

Operation Twist will keep the Fed’s balance sheet size steady. By purchasing longer-term Treasurys, the Fed hopes to push long-term borrowing costs lower for consumers and businesses to facilitate the economic recovery. Continue reading “AT A GLANCE: FOMC Takes No Action; Still Sees ‘Significant Risks’ | Support and Resistance Levels”