Cannon Futures Weekly Newsletter Issue # 1109

Dear Traders,

10 Key Questions on Measuring Your Trading Progress, Success

At some point in nearly everyone’s trading timelines, they wonder how their trading successes (or failures) compare with those of other traders. Wondering just how well you stack up to other traders in the industry is a natural curiosity and a human psychological tendency. However, actually knowing the success or failure rates of others doesn’t do a lot to move you farther down the road of where you want to be regarding trading success.

Most traders also wonder about the success rates of the “professional” traders—the ones who make their living solely by the profits they generate from trading. I will provide you with an answer to this question at the end of this feature.

Below are 10 questions regarding measuring your own trading progress and success. These questions should help you determine where you stand in this challenging field of endeavor.

1. What is trading “success?” This is a most basic question. Most would agree that ultimate trading success is defined as being profitable at trading—making more money than you lose. There are other secondary factors that also define success in trading, such as finding a “balance” between trading and other life activities. But it’s being profitable at trading that is the benchmark of defining success.

2. What is trading “progress?” Beginning traders should not expect to have immediate and ultimate success trading futures, stocks or FOREX markets. What they can expect in the early going is to make steady progress through gaining knowledge and experience. Even veteran successful traders continue to make trading progress. Achieving and maintaining trading success requires continual progress—namely continuing to seek out trading and market knowledge. Traders who truly enjoy the “progress” and process of trading do have a significant trading edge over those who do not enjoy learning and gaining experience.

3. At what point in my trading timeline should I expect trading “success?” Trading success (winning trades) can come right away—even for the beginning traders. What is less likely for the inexperienced traders is sustained trading success. Beginners can even run into a “hot streak” that skews the overall reality of trading. Immediate (and likely fleeting) success for a beginning futures trader can do longer-term psychological harm—if he or she does not fully recognize and understand the hard work and perseverance required on the road to trading success. Many times I get questions from less-experienced traders that go something like this: “I’ve been trading two years and I’ve only been able to about break even.” My reply to them is, “Hey, you should not be too discouraged with those results. Many traders don’t have that kind of success in the early going.”

If so, look no further, Cannon can assist you in getting set up!

|

Would you like to get daily support & resistance levels?

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

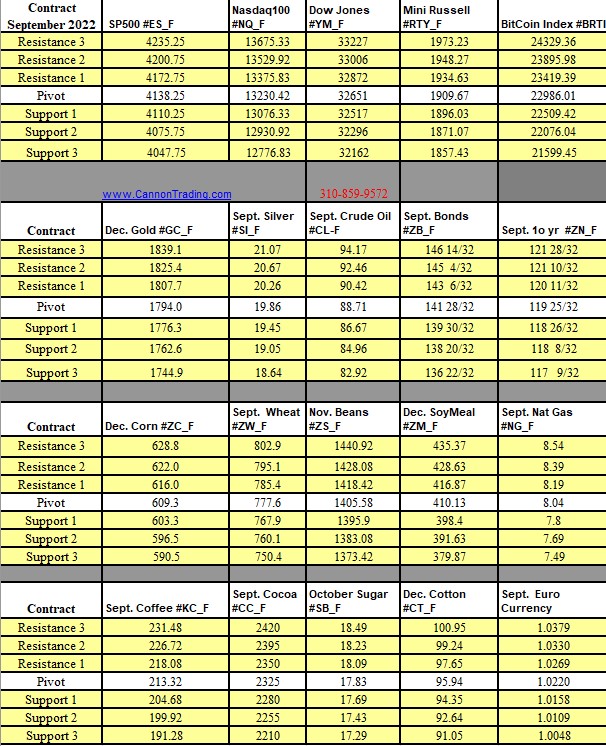

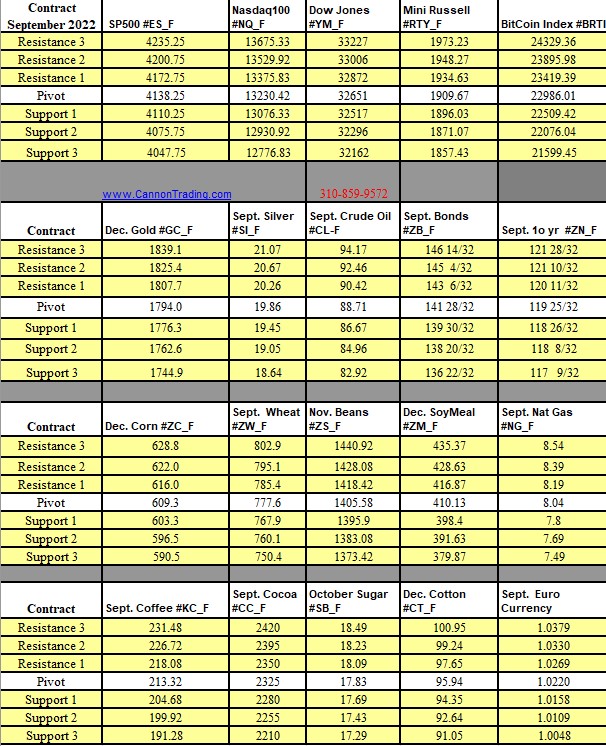

Futures Trading Levels

08-08-2022

Weekly Levels

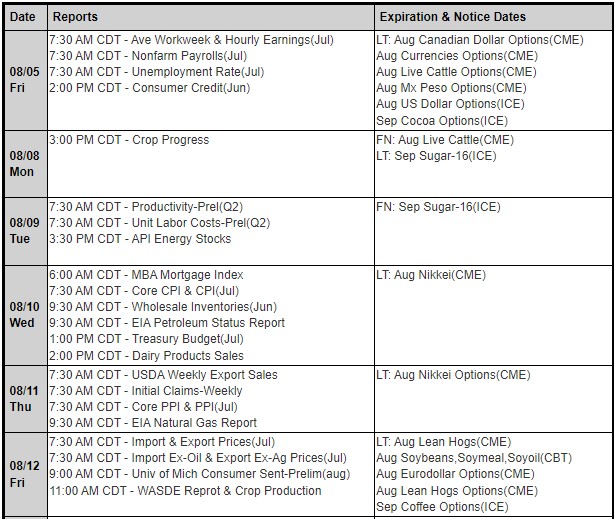

Reports, First Notice (FN), Last trading (LT) Days for the Week:

https://mrci.com

Date Reports/Expiration Notice Dates

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading