Get Real Time updates and more on our private FB group!

What You Need to Know for Trading June 23rd

by Mark O’Brien, Sr. Broker:

Energy:

Crude oil prices slumped to their lowest prices in over a month. August West Texas Intermediate (WTI) traded to an intraday low of $101.83 a barrel, prices not seen since May 19 and nearly $20 off its $120.88 intraday high of last Tuesday (6/14).

More energy: You didn’t miss it. Due to the Monday Junteenth holiday, the weekly Energy Information Agency (EIA) Petroleum Status Report (Energy Stocks) will be released tomorrow, as opposed to its regular Wednesday release. The weekly

Natural Gas Storage Report typically released on Thursday will do so at its regular time: 9:30, Central Time. Then, at 10:00 the Energy Stocks report will be released.

Crypto: Last Trading Day for June

Bitcoin futures is this Friday, June 17. These are financially settled (no physical delivery), but if you’re holding longer-term positions in the June contract, you need to roll your position over/forward to the new front month contract – July – by no later than tomorrow, Thursday, June 23.

Financials: Today Federal Reserve Bank Chairman Jerome Powell addressed the Senate Banking Committee, as his schedule happened to play out, just one week after the Fed ordered the largest interest rate increase since 1994. The central bank is under growing pressure to combat inflation, which hit a four-decade high of 8.6% in May. Tomorrow, Chairman Powell addresses the House Financial Services Committee where members will also question the Chairman on the nation’s economy.

Grains: After rallying more than 30 cents during early trading,

July wheat gave back all of its gains and then some to close down 2 cents and traded intraday to its lowest price ($9.60) since March 2nd.

July Soybeans hit a 1-month low $16.54 ¼ a bushel. This as the latest 1-5-day weather forecast less heat and scattered chances of rain over the next two weeks, with even some below normal temperatures, helping to spark aggressive long liquidation selling from speculators.

More grains: First Notice Day for grains is next Thursday, June 30. Avoid delivery and roll your positions!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

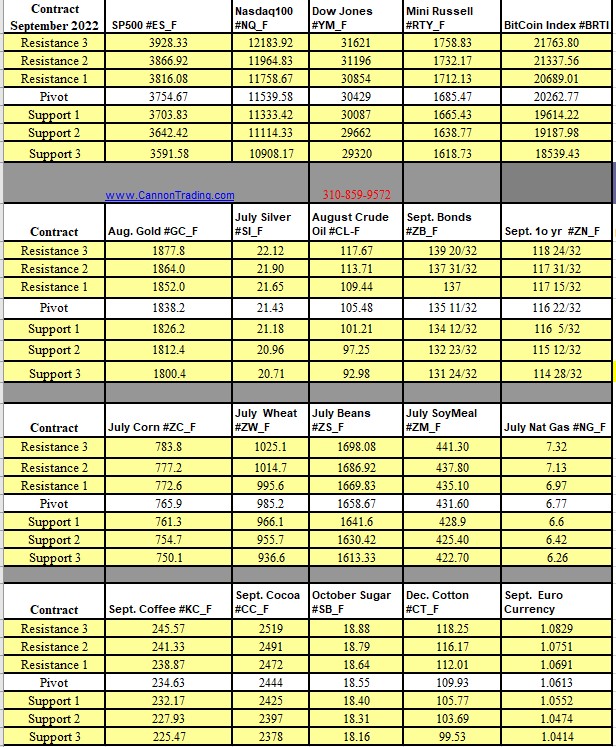

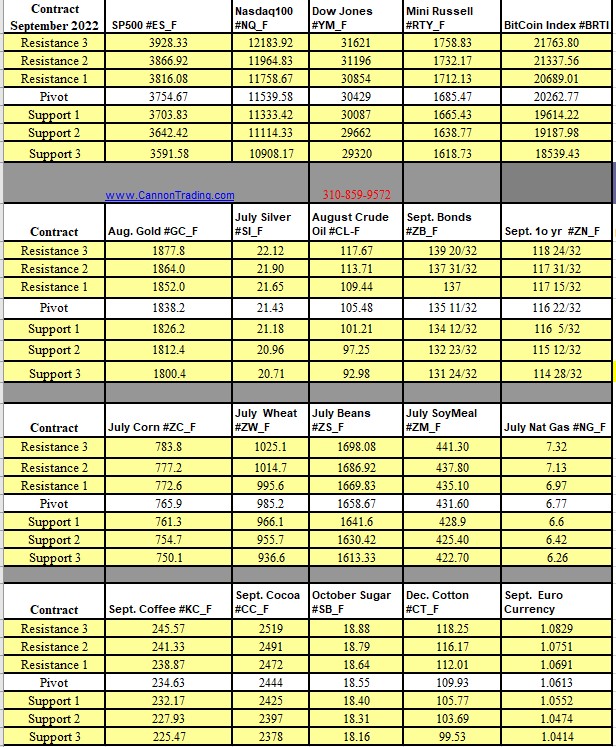

Futures Trading Levels

06-23-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.