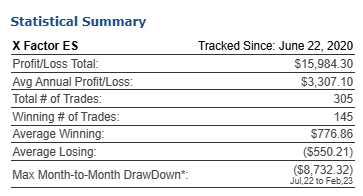

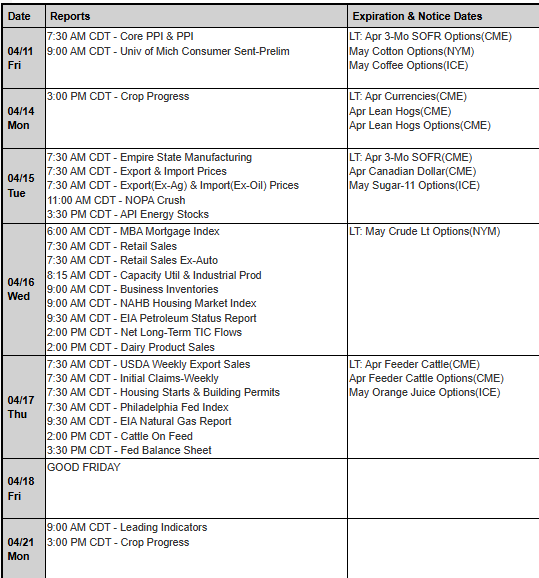

Brokers Futures Trading System of the Week

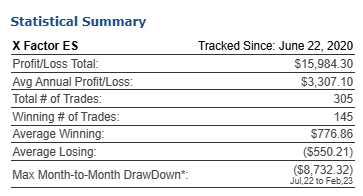

X Factor ES Trading System

Market Sector: Stock Index Futures

Markets Traded: ES

System Type: Day Trading

Risk per Trade: varies

Trading Rules: Partially Disclosed

Suggested Capital: $10,000

Developer Fee per contract: $125.00 Monthly Subscription

System Description:

Trade ES futures. Started June 2020 and proud of it’s return. There are 4 independent optimized systems coded to seek long or short entries, and the system only uses the higher probability signal. System contains a money management component.

Disclaimer: The risk of trading can be substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not necessarily indicative of future results.

Futures Trading Disclaimer:

Transactions in securities futures, commodity and index futures and options on futures carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”.

A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position.

If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit.

Please read full disclaimer HERE.

|