____________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Some thoughts I wrote down the last few days….Random but may help some traders….

1. Why do so many traders ONLY trade the mini SP? There are other markets out here to trade …

2. Do some new traders understand that certain markets have LIMIT UP and LIMIT DOWN moves??

3. Wow…the way many of the markets are trading today is quite different than how they traded 7 years ago….

4. I wonder how many of my clients know about the weekly options ( the mini SP actually has Monday, Wednesday and Friday expiration…) – some traders who complain about getting stopped, should pick up the phone and learn more about these options.5. Slippage is part of the game. Commissions, exchange fees are the cost of doing business, i.e trading.

6. You get what you pay for…whether it is the software you use, the broker you choose….

7. The markets evolve and change and so should you as a trader. Continue learning and exploring different methods, trading vehicles etc.

8. Wow…I was reviewing our site and doing some analysis comparing our site to some competitors and I must say, we offer so MUCH more information and education than most….

9. The iSystems platform is an amazing technology in the way it allows clients to participate in AUTOMATED, ALGO Trading!

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

7-21-2017

| Contract September 2017 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2487.25 | 5985.00 | 21729 | 1452.93 | 95.85 |

| Resistance 2 | 2481.75 | 5961.75 | 21676 | 1449.17 | 95.41 |

| Resistance 1 | 2476.50 | 5943.50 | 21630 | 1445.83 | 94.76 |

| Pivot | 2471.00 | 5920.25 | 21577 | 1442.07 | 94.32 |

| Support 1 | 2465.75 | 5902.00 | 21531 | 1438.73 | 93.67 |

| Support 2 | 2460.25 | 5878.75 | 21478 | 1434.97 | 93.23 |

| Support 3 | 2455.00 | 5860.50 | 21432 | 1431.63 | 92.58 |

| Contract | August Gold | Sept. Silver | Sept. Crude Oil | Sept. Bonds | Sept. Euro |

| Resistance 3 | 1261.5 | 16.71 | 48.45 | 155 11/32 | 1.1914 |

| Resistance 2 | 1254.3 | 16.55 | 48.10 | 155 1/32 | 1.1804 |

| Resistance 1 | 1248.9 | 16.42 | 47.52 | 154 18/32 | 1.1734 |

| Pivot | 1241.7 | 16.27 | 47.17 | 154 8/32 | 1.1624 |

| Support 1 | 1236.3 | 16.14 | 46.59 | 153 25/32 | 1.1553 |

| Support 2 | 1229.1 | 15.98 | 46.24 | 153 15/32 | 1.1443 |

| Support 3 | 1223.7 | 15.85 | 45.66 | 153 | 1.1373 |

| Contract | Dec. Corn | Sept. Wheat | November Beans | Dec. SoyMeal | Aug. Nat Gas |

| Resistance 3 | 414.8 | 520.9 | 1047.08 | 349.30 | 3.19 |

| Resistance 2 | 410.8 | 514.6 | 1039.17 | 344.70 | 3.15 |

| Resistance 1 | 407.8 | 510.2 | 1033.08 | 341.40 | 3.09 |

| Pivot | 403.8 | 503.8 | 1025.17 | 336.80 | 3.05 |

| Support 1 | 400.8 | 499.4 | 1019.1 | 333.5 | 3.0 |

| Support 2 | 396.8 | 493.1 | 1011.17 | 328.90 | 2.96 |

| Support 3 | 393.8 | 488.7 | 1005.08 | 325.60 | 2.90 |

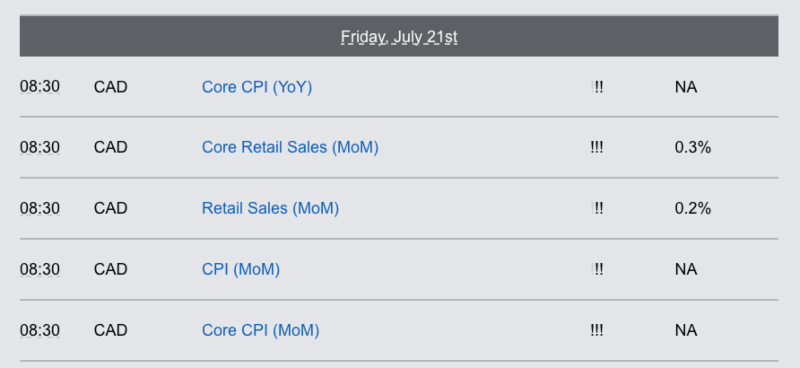

Economic Reports, source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.