Metals Off Highs, Stocks Fall 1.6%

By Mark O’Brien, Senior Broker

General / Indexes:

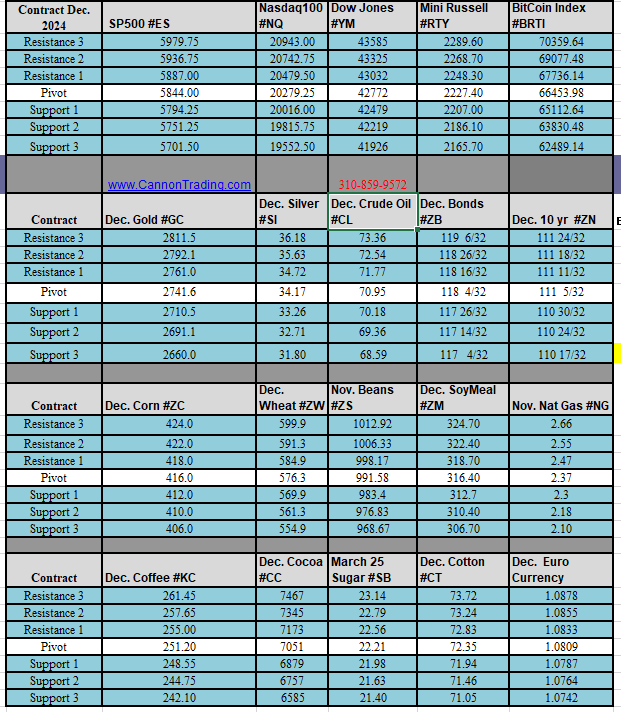

Stock index futures slumped today with the Dec. E-mini Dow Jones futures contract losing over 650 points (a ±$3,250 per contract move) at its intraday low around 1:00 Central Time. The E-mini S&P 500 shed over 90 points (a ±$4,500 per contract move) at its lows and the E-mini Nasdaq lost over 450 points (a $9,000 move) intraday. The latter erased two weeks of higher closing prices.

The rally in stocks has stalled as investors debate how quickly the Federal Reserve will cut interest rates over the next year and sowed worry of rates staying higher for longer.

Metals:

Gold futures are getting shinier by the day. The price of the front month December contract touched another all-time record high overnight, trading briefly at $2,772.60 per ounce before heading on a ±$50 pull-back into its old 10:30 A.M., Central Time pit session close this morning.

Since the start of this year, gold prices have risen by a third, hovering over the $2,700 per ounce mark in the last few trading sessions. Much of the credit for the increased demand can be tied to simmering tensions in the Middle East and the uncertainty over the upcoming presidential elections in the U.S.

The 2024 gains have unfolded after uninspiring price movement over the last ten years. The price of gold reached the vicinity of $1,900 per ounce in 2011, swooned for nearly eight years trading not far from $1,000 per ounce much of the time, then started advancing back to ±$1,900 around mid-2020 where it vacillated little into 2022. After being subdued for so long, gold prices shot up, delivering a 70% jump in the past two years. Looking at the institutional interest in gold several large commercial banks have forecast the current upward price move continuing into next year.

Analysts at Citi raised their three-month forecast for gold prices to $2,800 per ounce. They look for a move to $3,000 over the next 6–12 months. J.P. Morgan has also proposed that gold’s fundamentals point to further upside. |