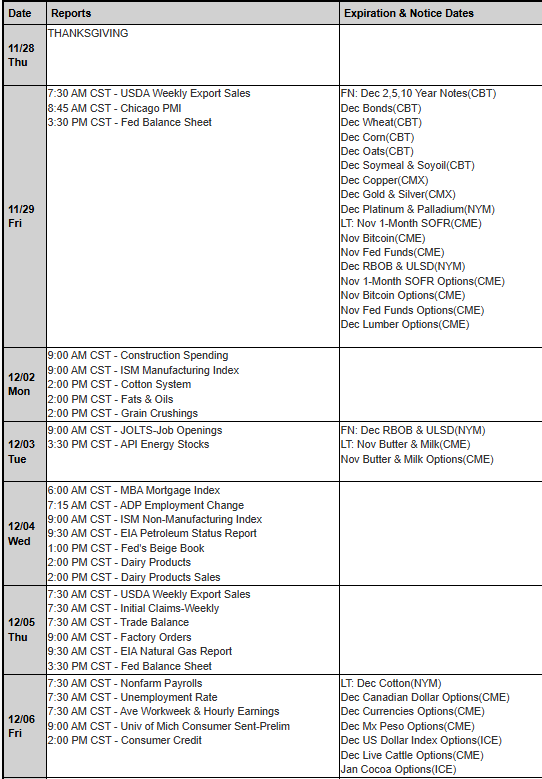

| Hot Market of the Week

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

FREE TRIAL AVAILABLE

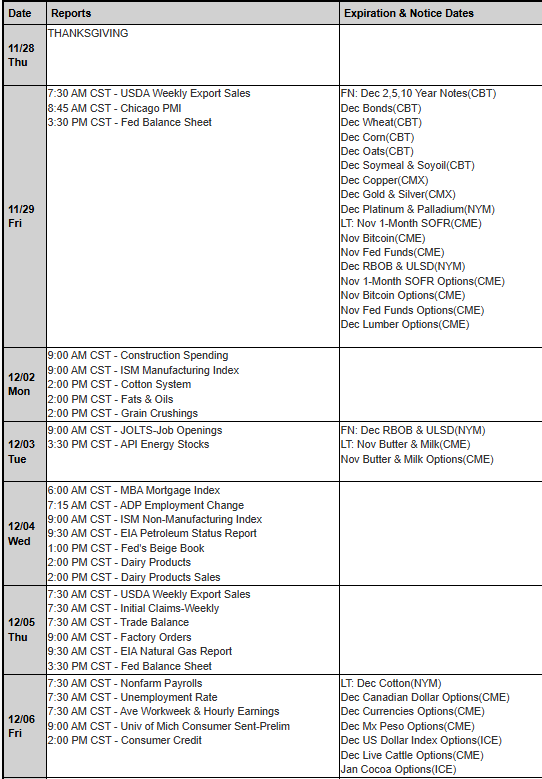

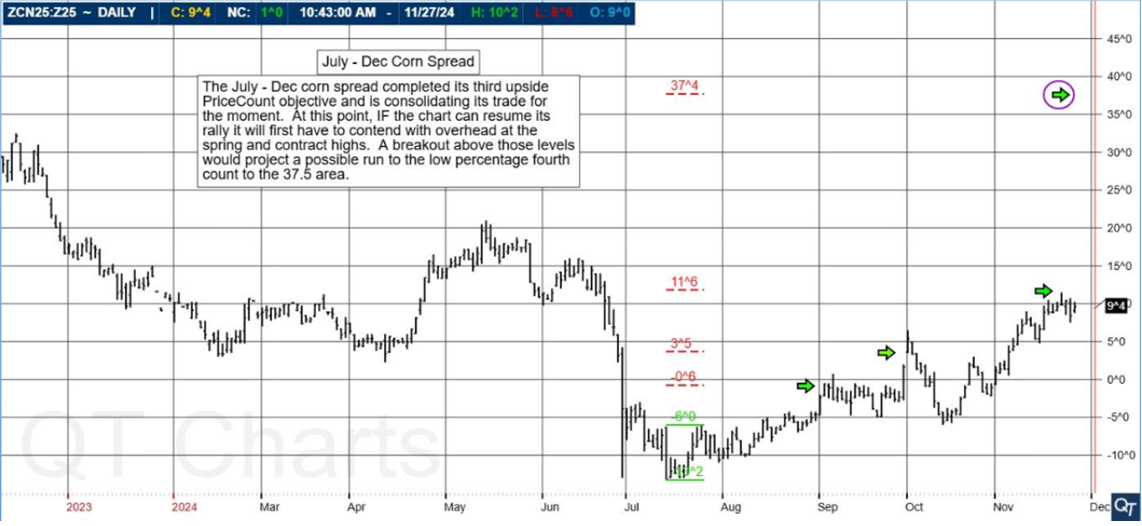

July – Dec Corn Spread

The July – Dec corn spread completed its third upside PriceCount objective and is consolidating its trade for the moment. At this point, IF the chart can resume its rally it will first have to contend with overhead at the spring and contract highs. A breakout above those levels would project a possible run to the low percentage fourth count to the 37.5 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

|