Cannon Futures Weekly Letter

In Today’s Issue #1229

- 1099’s Are Available

- The Week Ahead –

- Futures 102 – Hedging With grains, Options on Futures

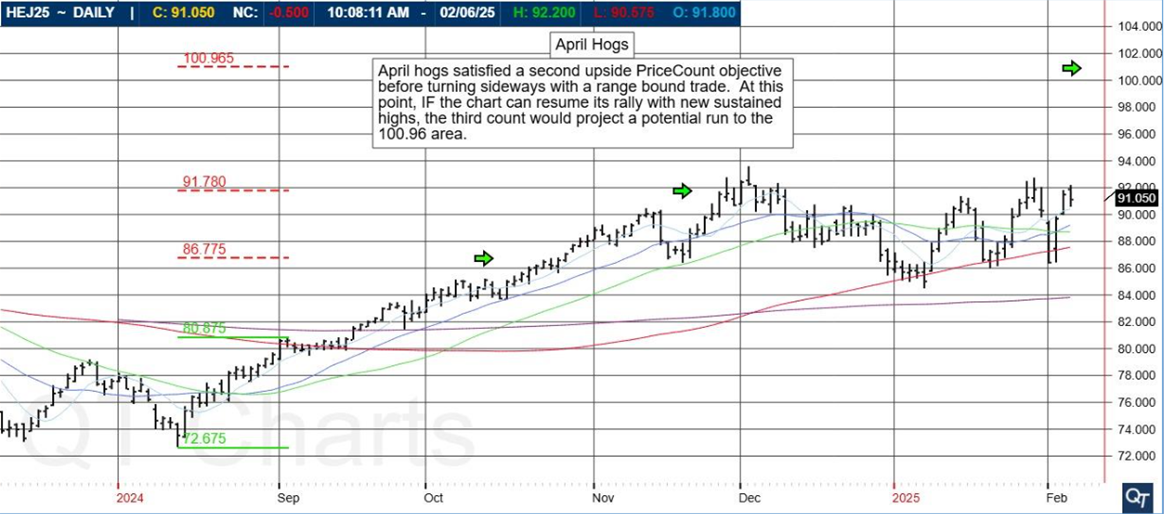

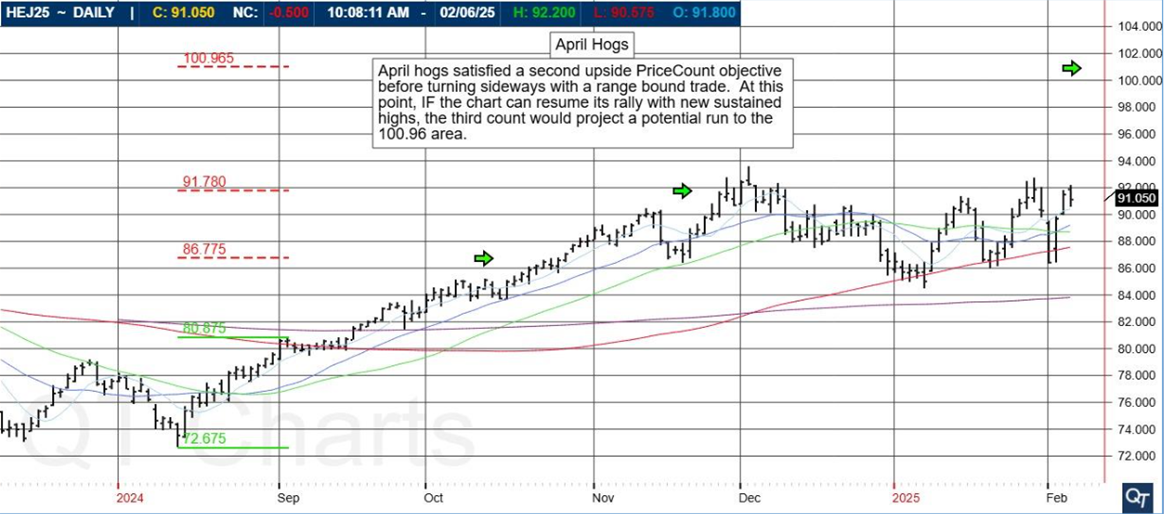

- Hot Market of the Week – April Hogs

- Broker’s Trading System of the Week – ES intraday System

- Trading Levels for Next Week

- Trading Reports for Next Week

|

|

1099’s:

1099 forms will be generated for all futures trading accounts held by US clients that placed any trades during the 2024 calendar year. Traders should expect to receive their 1099 forms via mail, email or through their portal in early February.

· 1099 forms will be provided directly from the FCM to the client.

· To login and retrieve your 1099 for your Cannon account via StoneX click here

· To login and retrieve your 1099 for your Cannon account via Ironbeam click here

· To login and retrieve your 1099 for your Cannon account via Dorman click here

For any other FCM’s please contact your broker directly. |

|

Important Notices: The Week Ahead

By John Thorpe, Senior Broker

Humphrey Hawkins Testimony week, Fed Chair Powell gives testimony to the Senate Banking Committee beginning @ 9:00 am CST Tuesday the 11th, Wednesday he walks over to the House Financial Committee and answers questions for the congressional body. CPI,PPI! WASDE week! + 5Fed Speakers, 1000’s of midcaps reporting past earnings and future guidance.

Economic releases are relatively light this week with one exception: Consumer Price Index (CPI) pre-market Friday. The Fed Speakers will be at the podium for the foreseeable future as we don’t have another Fed rate decision until late March.

Earnings Next Week:

- Mon. McDonalds

- Tue. Coca-Cola, Softbank

- Wed. Cisco

- Thu. Applied materials

- Fri. Quiet

FED SPEECHES:

- Mon Quiet

- Tues. Hammock 7:50 CST, Chair Powell Testimony 9amCST, Bowman and Williams 2:30pmCST

- Wed. Chair Powell Testimony 9am CST, Bostic 11:00 am CST, Waller 4:05PM,

- Thu. Quiet

- Fri. Quiet

Economic Data week:

- Mon. Consumer inflation expectations

- Tue. WASDE Ag Numbers 9amCST, NIFB Optimism index

- Wed. CPI

- Thur. Initial Jobless Claims, PPI

- Fri. Retail Sales, Capacity Utilization, Business Inventories

|

|

Futures 102: Hedging Grains with Options on Futures

Course Overview

Gain an understanding of how buyers and sellers of grains and oilseeds utilize futures and options to hedge their position to manage price risk. This course will enhance the hedger’s understanding of the different strategies available as well as how the basis affects prices.

Start Now |

|

Hot Market of the Week

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading and options on futures needs.

Free Trial Available

December 25 Corn

April Hogs satisfied a second upside PriceCount objective before turning sideways with a range bound trade. At this point, IF the chart can resume its rally with new sustained highs, the third count would project a potential run to the 100.96 area.

PriceCounts – Not about where we’ve been, but where we might be going next!

|

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|

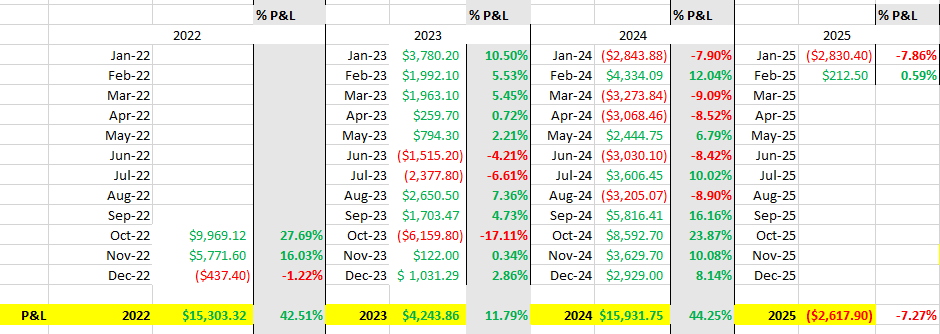

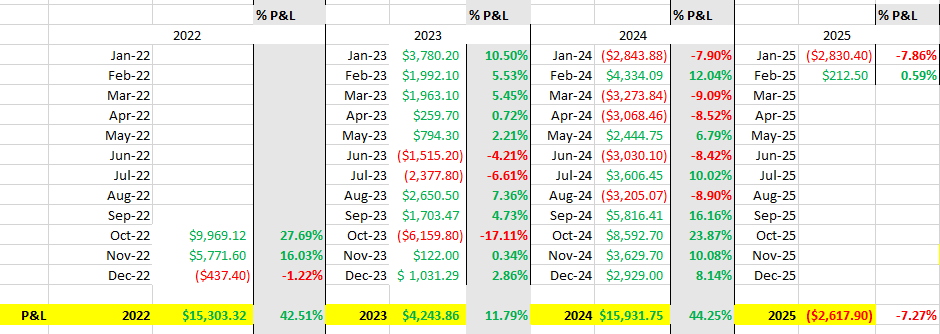

Brokers Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

ES NZL

PRODUCT

Mini SP500

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$36,000

COST

USD 199 / monthly

Get Started

Learn More

|

|

| Would you like to get weekly updates on real-time, results of systems mentioned above? |

|

|

|

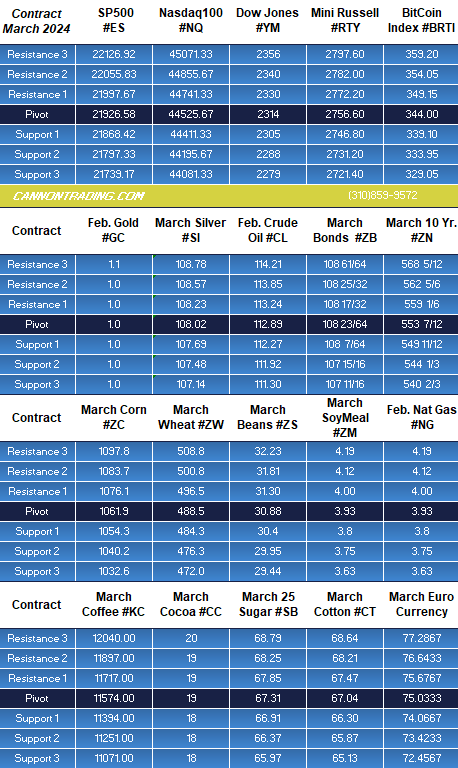

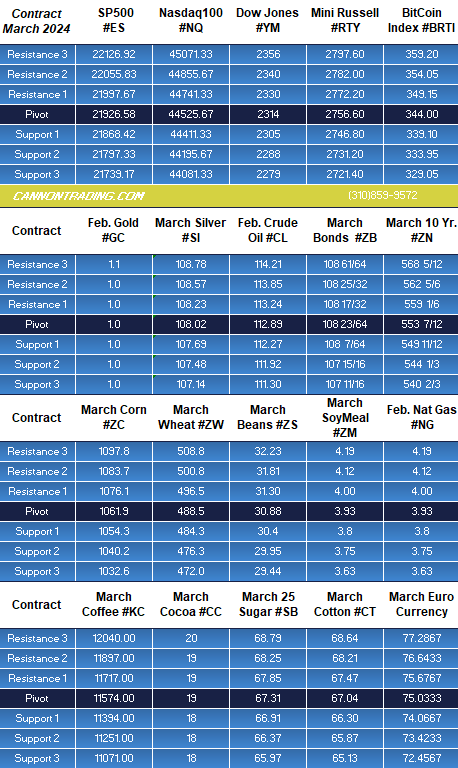

Trading Levels for Next Week

Daily Levels for February 10, 2025

|

|

| Would you like to receive daily support & resistance levels? |

|

|

|

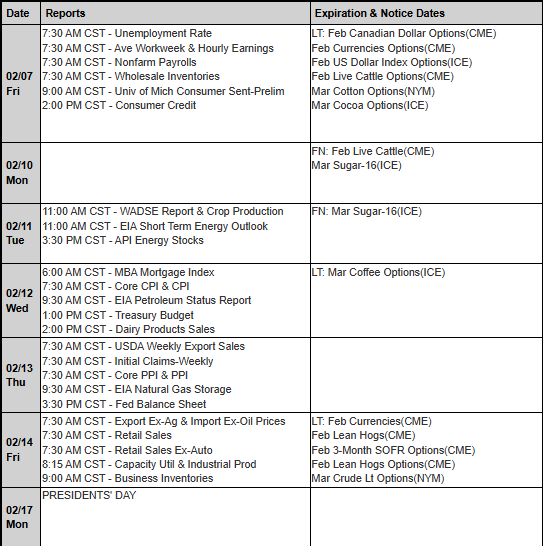

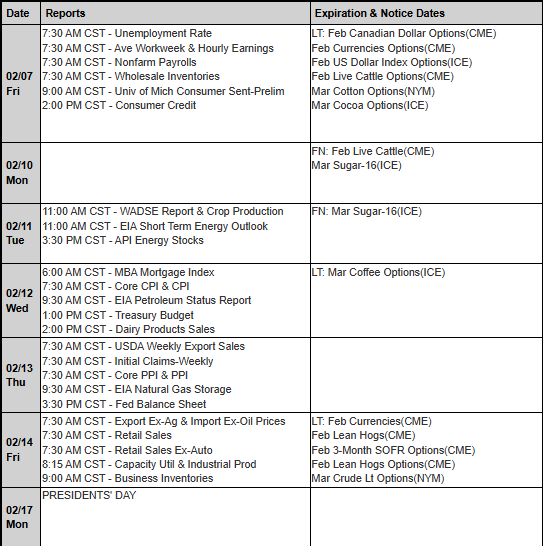

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week:

www.mrci.com

|

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|

|

|

|