Important Notices: The Week Ahead

By John Thorpe, Senior Broker

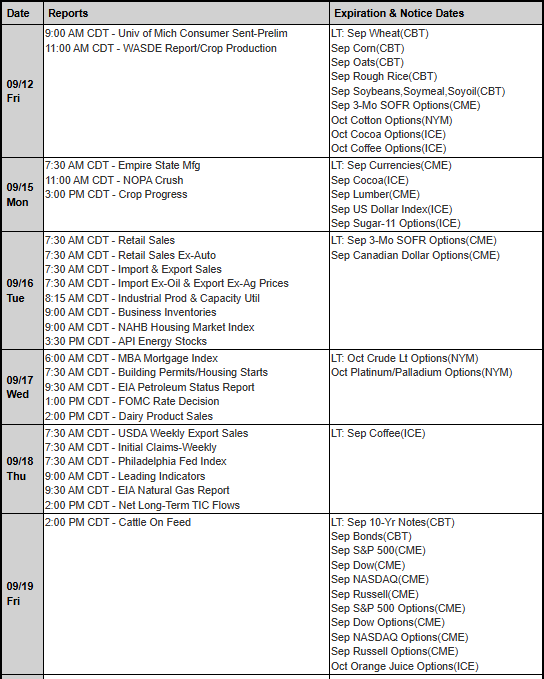

FOMC meeting Interest rate decision, Indices Rollover, the final week of Summer.

You should be rolling over to the December Stock indices Monday, the last trading day will be Friday September 19th. The Next quarterly contract month will be December, the 4th quarter! Where has the year gone?!

The Symbol for Dec is “Z” for zebra. If you need instruction on changing your symbol from Sep. “U” to Dec. “Z”, I have provided a link to our YouTube channel for those using the CannonX, CQG Desktop, StoneX version of the free software. Please click here: Rolling Over Futures Contracts – A Step-By-Step Guide

With the FOMC meeting coming up I am sharing a video I put together a few months back explaining how you can utilize a market based probability predictor that in fact is oft quoted by the Financial talking heads when referencing future FOMC moves.

The describes how to use the CME Fed Watch tool just prior to the June 17th meeting .

Here is the link to the CME FedWatch tool. FedWatch – CME Group

Markets have already priced in the probability of a .25 cut in the Fed Funds rate so it’s important to watch these numbers to see how the markets react after the announcement, I challenge you to look at the tool before and after to see probability changes for the next meeting based on the language and outlook Fed Chair Powell outlines during his presser.

Those trading markets other than the indices understand rates effect nearly all the markets we trade. To name a few: precious metals (inflation), Bonds (long term rates following short term to varying degrees), the energy complex (cheaper capital higher demand), Equities (cheaper capital), Currencies (capital flows out of US dollar denominated assets to higher interest rate debentures) Grains, Lumber.. etc.

As for earnings reports we are truly at the end of Q2 Reporting.

The on again off again nature of Tariff and Russia/Ukraine war talks has created golden opportunities for breakouts in some markets, rangebound trades in others.

Continued volatility to come as next week all markets will be reacting to whatever comes out of U.S. Govt leadership relating to conflicts cessation and trade deals, especially with China, India, Canada and Russia. Also, remember that Mexico’s extension will end October 29.

We’ll see you next week! Please enjoy a safe and memorable weekend.

Earnings Next Week:

- Mon. TrustPilot, Dave and Busters

- Tue. Quiet

- Wed. General Mills

- Thu. FedeX, Darden,

- Fri. Quiet

FED SPEECHES: (all times CDT)

- Mon. Fed Blackout

- Tues. Period

- Wed. 1:00 p.m. Rate announcement. 1:00 p.m. Fed Chair Powell Presser with Q and A

- Thu. Quiet

- Fri. Quiet

Economic Data week:

- Mon. Quiet

- Tue. Retail Sales, Capacity Utilization Redbook, NAHB Housing Mkt Index

- Wed. Bldg Permits, EIA Crude Stocks, 17-week Bill auction, Fed Rate Decision

- Thur. Initial Jobless claims, Philly Fed, EIA NAT GAS Storage, Fed Balance sheet,

- Fri. Baker Hughes Rig Count

|