Cannon Futures Weekly Letter

In Today’s Issue #1259

-

The Week Ahead – Fed Speakers, PCE

-

Futures 101 – Trading Bitcoin and Ether Futures

-

Hot Market of the Week – Dec. Mini SP500

-

Broker’s Trading System of the Week – Natural Gas Swing Trading System

- Trading Levels for Next Week

- Trading Reports for Next Week

|

|

Important Notices: The Week Ahead

By John Thorpe, Senior Broker

Fed Speakers & PCE to Dominate the Week Ahead

Fed Chair Powell to speak in Warwick, RI Wednesday, Heavy week of Fed speakers as well.

The Spice you should be ordering now that Fall is right around the corner should be anything but the pumpkin variety!

The spice building into these markets is what traders look for, Volume is back and so is volatility on many fronts.

With the FOMC meeting behind us, listen for more nuanced language, outside of the 3 cuts prior to years end, Chair Powell shared during after his rate cut speech Wednesday. You will be hearing from a slew of Fed Speakers posting up this week (schedule is below). This unit by themselves, will, no doubt be responsible for bringing additional spice to the marketplace

Those trading markets other than the indices understand rates effect nearly all the markets we trade. To name a few: precious metals (inflation), Bonds (long term rates following short term to varying degrees), the energy complex (cheaper capital higher demand), Equities (cheaper capital), Currencies (capital flows out of US dollar denominated assets to higher interest rate debentures) Grains, Lumber, etc.

As for earnings reports we are truly at the end of Q2 Reporting. We have but a few laggards reporting this week

The on again off again nature of Tariff news has created golden opportunities for breakouts in some markets, rangebound trades in others. The market is just bored with the talk about Russia/Ukraine war cessation, until there is major movement, looks like it’s all up to Putin to move the needle.

Continued volatility to come as next week all markets will be reacting to whatever comes out of U.S. Govt leadership relating to conflicts cessation and trade deals, especially with China great talks with XI and Trump tda, India, Canada and Russia. Also, remember that Mexico’s extension will end October 29.

We’ll see you next week! Please enjoy a safe and memorable weekend.

Earnings Next Week:

- Mon. Quiet

- Tue. Micron

- Wed. Quiet

- Thu. Costco, Accenture

- Fri. Quiet

FED SPEECHES: (all times CDT)

- Mon. Williams 8:45am, Musalem 9:00am, Barkin, Hammack and Miran, (new kid on the block) 11:00am

- Tues. Bowman 8:00am, Bostic 9:00am, Fed Chair Powell from Warwick, RI 11:35 am

- Wed. Daly 3:10 pm

- Thu. Goolsbee 7:20 am, Williams 8:00am, Bowman 9:00am, Barr 12:00 pm, Daly 2:30 pm

- Fri. Hammack 7:00am, Barkin 8:00 am, Bowman 12:00pm, Musalem 12:30 pm, Bostic 5:00pm

Economic Data week:

- Mon. Quiet

- Tue. Redbook, &P PMI, Richmond Fed

- Wed. Bldg Permits final, EIA Crude Stocks, 17-week Bill auction

- Thur. Initial Jobless claims, Core PCE, GDP Final, Existing home sales, EIA NAT GAS Storage, Fed Balance sheet,

- Fri. Core PCE index MoM, Michigan consumer sentiment, Baker Hughes

|

|

|

Micro Ether been averaging over 140,000 contracts per day last few weeks!

Micro Bitcoin trades close to 100,000 contracts per day as well!!

If you are a Crypto trader, it is time for you to explore trading Crypto Futures on a regulated centralized exchange!

Introduction to Cryptocurrency futures

Course overview

Cryptocurrency futures, available at CME Group, provide market participants with multiple products for cryptocurrency risk management or market expression. Expand your understanding of the cryptocurrency markets, products, and underlying reference rates. This course covers:

- Bitcoin

- Ether

- Micro Bitcoin

- Micro Ether

- Options on Bitcoin futures

- BTIC on Cryptocurrency futures

START FREE COURSE NOW

|

|

Hot Market of the Week

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

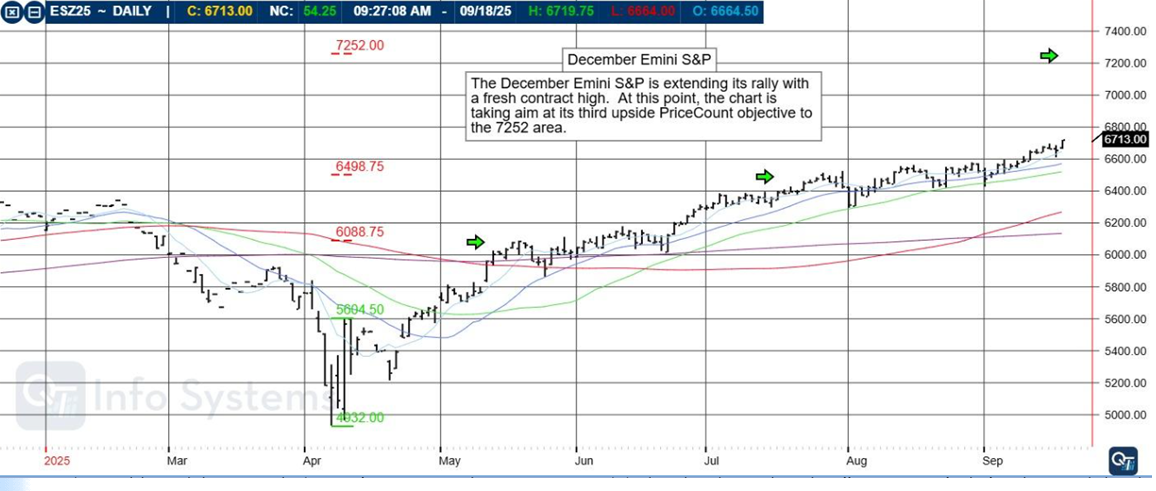

Dec. Mini SP 500

The December Emini S&P is extending its rally with a fresh contract high. At this point, the chart is taking aim at its third upside PriceCount objective to the 7252 area. |

|

|

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors.

Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|

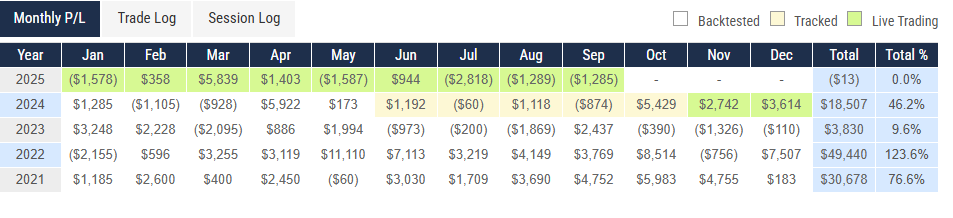

Brokers Trading System of the Week

NAT GAS

Markets Traded: Natural Gas NG

System Type: Swing Trading

Risk per Trade: varies

Trading Rules: Partially Disclosed

Suggested Capital: $25,000

Developer Fee per contract: $60 Monthly Subscription

|

|

| Disclaimer The risk of trading can be substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not necessarily indicative of future results.

IMPORTANT RISK DISCLOSURE

Futures trading is complex and carries the risk of substantial losses. It is not suitable for all investors. The ability to withstand losses and to adhere to a particular trading program in spite of trading losses are material points which can adversely affect investor returns.

The returns for trading systems listed throughout this website are hypothetical in that they represent returns in a model account. The model account rises or falls by the average single contract profit and loss achieved by clients trading actual money pursuant to the listed system’s trading signals on the appropriate dates (client fills), or if no actual client profit or loss available – by the hypothetical single contract profit and loss of trades generated by the system’s trading signals on that day in real time (real-time) less slippage, or if no real time profit or loss available – by the hypothetical single contract profit and loss of trades generated by running the system logic backwards on backadjusted data (backadjusted).

Please read carefully the CFTC required disclaimer regarding hypothetical results below. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT.

IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS.

THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

Please read full disclaimer HERE.

|

|

| Would you like to get weekly updates on real-time, results of systems mentioned above? |

|

|

|

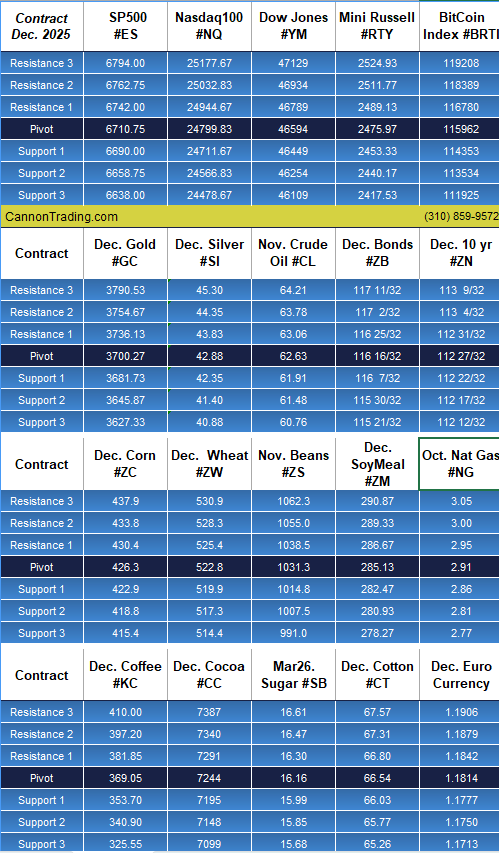

Daily Levels for Sept 22nd, 2025

|

|

| Would you like to receive daily support & resistance levels? |

|

|

|

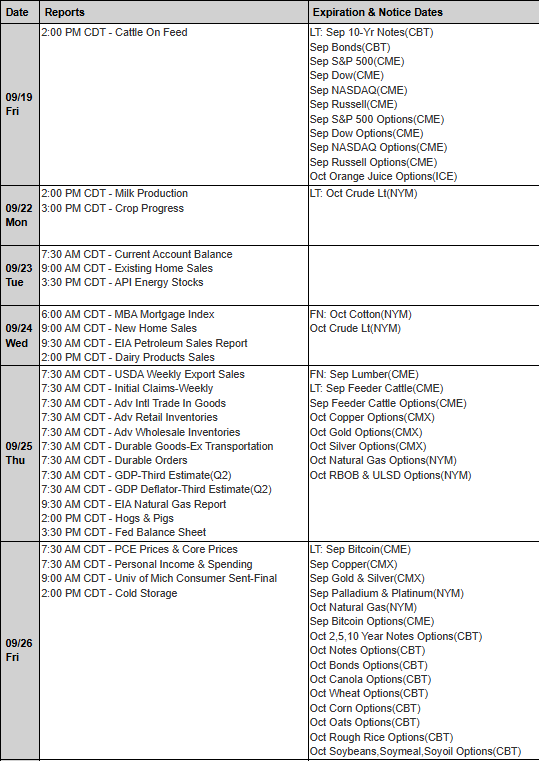

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week:

www.mrci.com

|

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|

|