Cannon Futures Weekly Letter

In Today’s Issue #1262

-

The Week Ahead – Fed Speakers Galore…

-

Futures 101 – Podcast: Insight into Day Trading Futures

-

Hot Market of the Week – Dec. Hogs

-

Broker’s Trading System of the Week – Mini SP Swing Trading System

- Trading Levels for Next Week

- Trading Reports for Next Week

|

|

Important Notices: The Week Ahead

By John Thorpe, Senior Broker

Traders, much like the Federal Reserve Board, are dependent on data that, during a government shutdown is barely existent. 17 Fed speakers! The markets are sure to move then, but wait, that’s not all, Fed Chair Powell on Economic Outlook and Monetary Policy.

As for earnings reports? Q3 begins next week! Major Banks report first. (see Below)

The on again off again nature of Tariff news has created golden opportunities for breakouts in some markets, rangebound trades in others. The gold market exploded out of its range I have been writing about for months. Watch Crude oil to see if it stays in its $60.00-$65.00 range and the Dollar index too! The longer the range trade the harder and faster the breakout typically is.

Continued volatility to come as next week all markets will be reacting to whatever comes out of U.S. Govt leadership relating to conflicts cessation and trade deals, China, India, Canada and Russia (looks like the EU is following Trump on this one) The Crude Oil market certainly believes so.. Also, remember that Mexico’s extension will end October 29.

We’ll see you next week! Please enjoy a safe and memorable weekend.

Earnings Next Week:

- Mon. Quiet

- Tue. JPM , JNJ, WFG, GS, BLK, C

- Wed. BAC, MS, ABT,

- Thu. SCHW, BK, USB

- Fri. AXP,

FED SPEECHES: (all times CDT)

- Mon. Paulson 11:55 am,

- Tues. Bowman 7:45, Fed Chair Powell 11:20am, Waller 2:25, Collins 2:30

- Wed. Bostic 11:10, Miran 11:30, Waller Noon,

- Thu. Barkin 7:00am, Barr, Miran, Waller all 8:00am, Bowman 9:00am , Barkin 10:45am, Miran 3:15pm, Kashkari, 5:00pm

- Fri. Musalem 11:15

Economic Data week:

- Mon. with the government shutdown, data will be suspended.

|

|

| Join us for an exclusive webinar on “Futures Spread Trading,” where you’ll discover the powerful strategies professional traders use to capitalize on market opportunities while managing risk. Whether you’re a seasoned investor or just starting out, this session will break down the essentials of spread trading, uncover actionable techniques, and show you how to navigate the futures market with confidence. Don’t miss this chance to learn from industry experts and take your trading skills to the next level—reserve your spot today! |

|

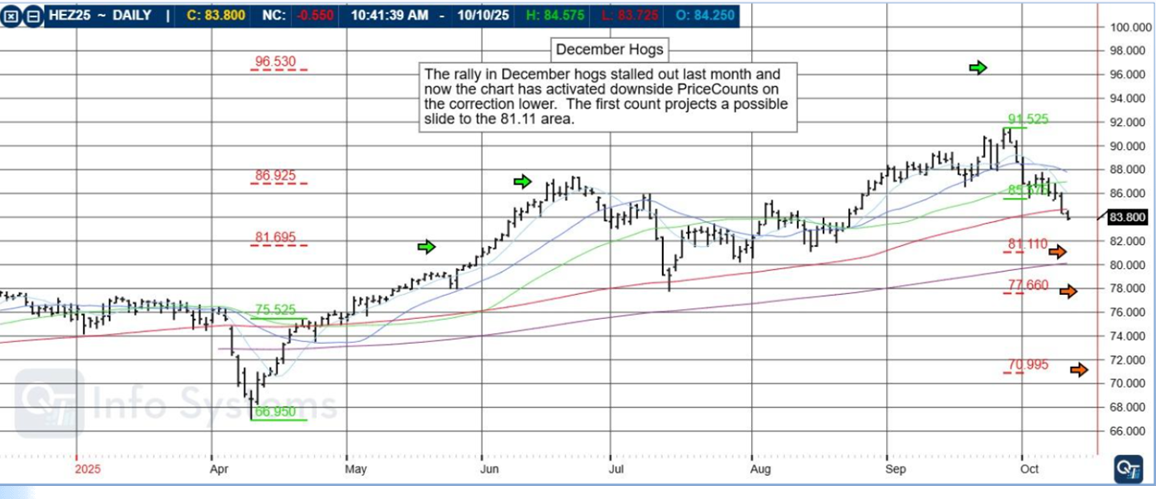

Hot Market of the Week

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

Dec. Hogs

The rally in December hogs stalled out last month and now the chart has activated downside PriceCounts on the correction lower. The first count projects a possible slide to the 81.11 area.” |

|

|

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|

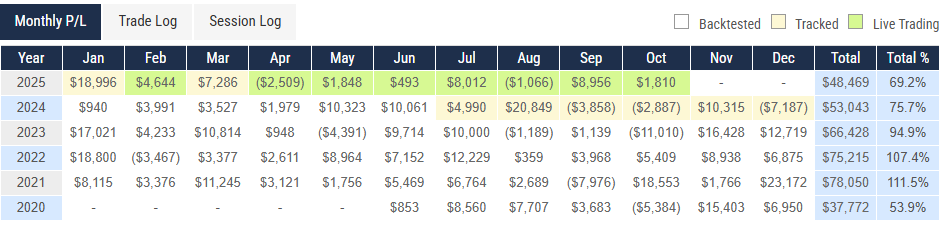

Brokers Trading System of the Week

ALGOsigmaX E-mini S&P ES

Markets Traded: Mini SP500 ES/EP

System Type: Swing Trading

Risk per Trade: varies

Trading Rules: Partially Disclosed

Suggested Capital: $50,000

Developer Fee per contract: $205 Monthly Subscription

|

|

| Disclaimer The risk of trading can be substantial, and each investor and/or trader must consider whether this is a suitable investment. Past performance is not necessarily indicative of future results.

IMPORTANT RISK DISCLOSURE

Futures trading is complex and carries the risk of substantial losses. It is not suitable for all investors. The ability to withstand losses and to adhere to a particular trading program in spite of trading losses are material points which can adversely affect investor returns.

The returns for trading systems listed throughout this website are hypothetical in that they represent returns in a model account. The model account rises or falls by the average single contract profit and loss achieved by clients trading actual money pursuant to the listed system’s trading signals on the appropriate dates (client fills), or if no actual client profit or loss available – by the hypothetical single contract profit and loss of trades generated by the system’s trading signals on that day in real time (real-time) less slippage, or if no real time profit or loss available – by the hypothetical single contract profit and loss of trades generated by running the system logic backwards on backadjusted data (backadjusted).

Please read carefully the CFTC required disclaimer regarding hypothetical results below.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT.

IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS.

THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

Please read full disclaimer HERE.

|

|

Would you like to get weekly updates on real-time, results of systems mentioned above?

|

|

|

|

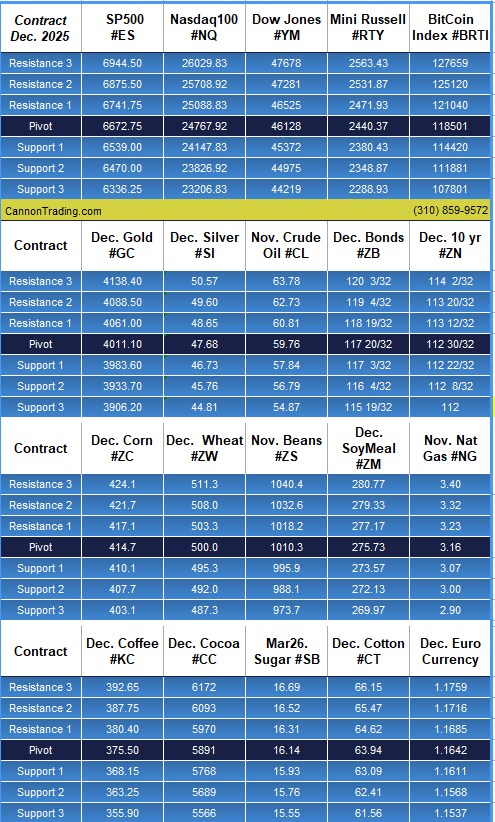

Daily Levels for Oct 13th, 2025

|

|

Would you like to receive daily support & resistance levels?

|

|

|

|

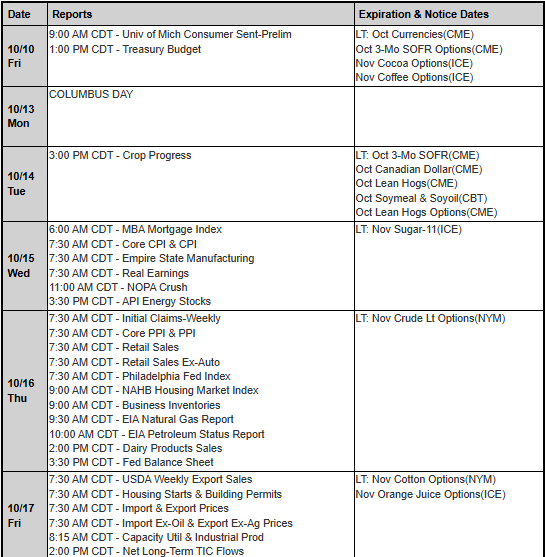

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week:

www.mrci.com

|

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|

|