Price Extremes

By Mark O’Brien, Senior Broker

|

|

General:

Day 15 of the U.S Government shutdown.

Stock Index Futures:

Dec. stock index futures returned to solid gains late today as markets remained alert over US-China trade tensions and amid hopes for interest rate cuts and strong quarterly earnings results from Wall Street banks. Traders have cemented bets on a rate cut later this month, and odds of a rate cut in December have jumped in recent days to around 96% according to the CME Group FedWatch tool:

Prices Metals:

It’s the broken record metals report. Dec. gold futures rose to new all-time highs today – its 47th new record of the year – trading up to $4,235.80/ounce intraday.

Alongside gold, Dec. silver rocketed up nearly $2.00/oz. today to set its own all-time record high, trading intraday up to $52.55/ounce. This after yesterday when the contract took out a 45-year-old record closing price of $48.70/ounce, during the time when the Hunt brothers tried to corner the market.

Prices Energies:

November crude oil futures have remained on their lows this week – with a new multi-month intraday low of $58.20/barrel on continued concerns about oversupply and the possible impact on demand of rekindled U.S.-China trade tensions – its fourth day in a row closing below $60/barrel.

Livestock:

Dec. live cattle and Jan. feeder cattle both closed little changed today and within pennies of their own all-time record high closing prices at the close of trading yesterday. Tight supplies and strong feeder markets pushed cash cattle higher and the futures markets followed suit. The supply of cattle has lingered at a near 75-year low, with the closure of the US-Mexico border to Mexican cattle imports further constraining an already tight supply.

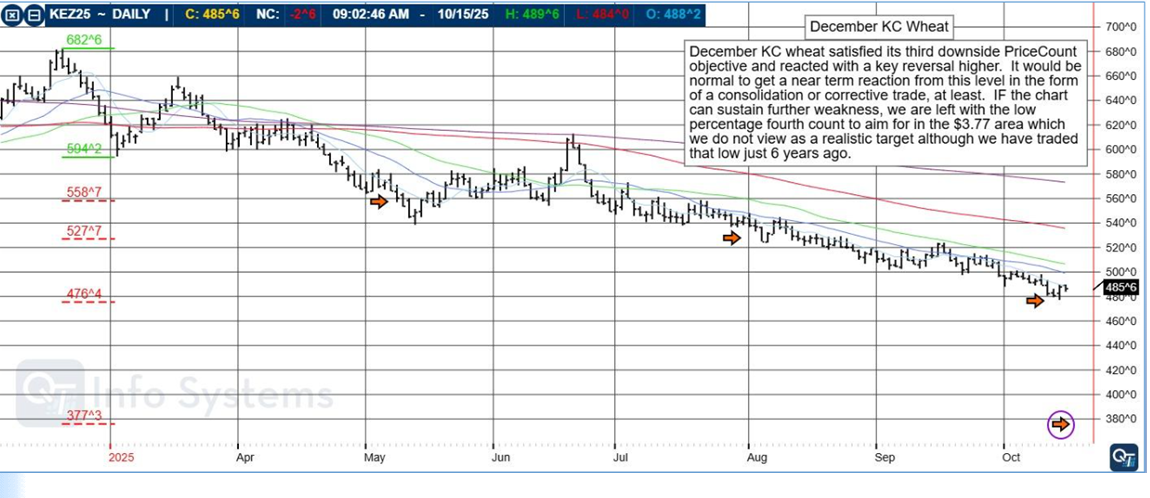

| December KC wheat satisfied its third downside PriceCount objective and reacted with a key reversal higher. It would be normal to get a mean reversion from this level in the form of a consolidation or corrective phase, at least. If the chart can sustain further weakness, we are left with the low percentage fourth count to aim for in the $4.37 area. That we trade down to this level is a realistic target although we have traded that low just 5 years ago. |

|

|

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|

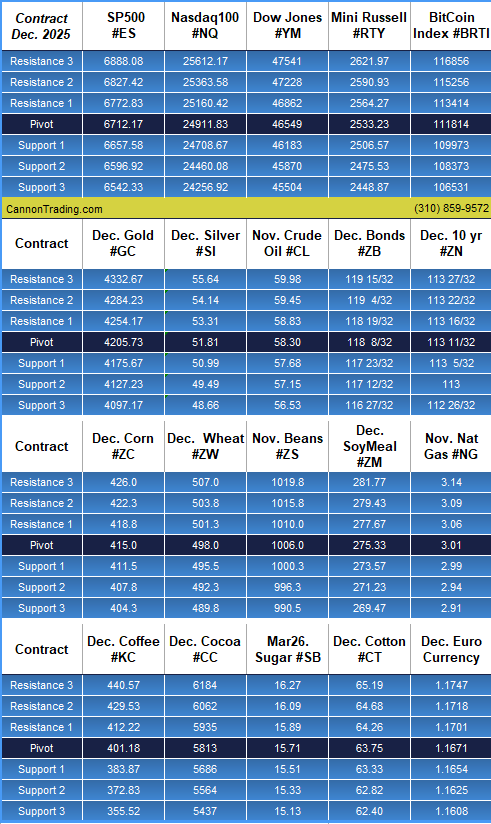

Daily Levels for Oct. 16th, 2025

|

|

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day!

|

|

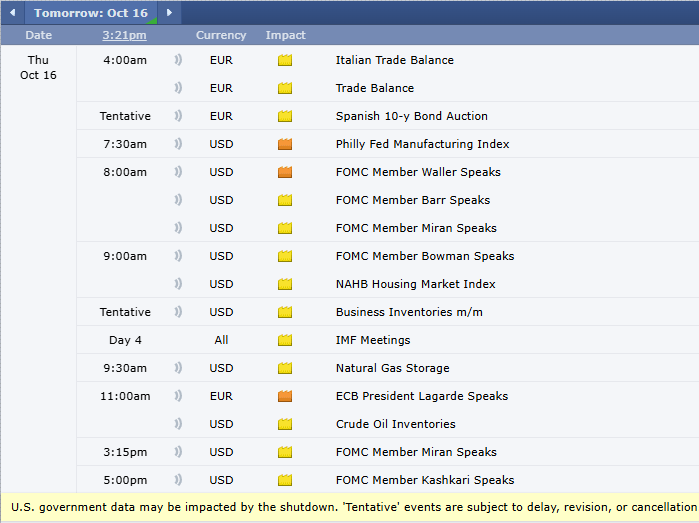

Economic Reports

U.S. government data may be impacted by the shutdown. ‘Tentative’ events are subject to delay, revision, or cancellation

provided by: ForexFactory.com

All times are Central Time ( Chicago)

|

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|

|

|

|