What You Need to Know Before Trading Futures Tomorrow!

By Mark O’Brien, Senior Broker

|

|

At-a-Glance Levels

| Instrument |

S2 |

S1 |

Pivot |

R1 |

R2 |

|

|

Gold (GC)

— Dec (GCZ5) |

3861.93 |

3910.07 |

3978.13 |

4026.27 |

4094.33 |

|

|

Silver (SI)

— Dec (SIZ5) |

46.01 |

46.69 |

47.60 |

48.28 |

49.19 |

|

|

Crude Oil (CL)

— Dec (CLZ5) |

59.02 |

59.67 |

60.34 |

60.99 |

61.66 |

|

|

Dec. Bonds (ZB)

— Dec (ZBZ5) |

117 7/32 |

117 20/32 |

118 13/32 |

118 26/32 |

119 19/32 |

|

Interest Rates

It wasn’t even apparent during Chair Jerome Powell’s post-announcement news conference what triggered the price jolts in several of the futures markets this afternoon – including a ±50-point decline in the E-mini S&P 500 and a ±200-point decline in the E-mini Nasdaq in the span of eight minutes, or the ±$40 sell-off in gold in the span of two minutes.

Regardless of the cause, they served as the latest real-world examples of why it’s so important for traders of all types to assess the risks of their trades – before you enter into them – and have a plan to manage that risk. Day traders and position traders alike should be aware of important planned events – just like FOMC announcements and press conferences – and anticipate the potential risks to those events (these days it’s wise to include occasions when the U.S. president speaks, considering his ongoing involvement and influence in global trade relations).

These events certainly create opportunities for traders – outsize moves can also result in outsize favorable outcomes – but the most important aspect to trading – is always to manage risk.

General – Interest Rates:

Day 29 of the U.S Government shut-down, now the second-longest on record.

The Federal Reserve cut interest rates by a quarter of a percentage point today – its second consecutive rate cut, lowering the Fed’s benchmark interest rate to a range of 3.75 to 4 percent, its lowest level in three years.

Stock Index Futures:

We’re amidst earning season for the third quarter. Moving into full swing, all eyes were on Microsoft, Google-parent Alphabet and Facebook-owner Meta today– all releasing their latest earnings results after the closing bell.

Tomorrow:

Apple and Amazon

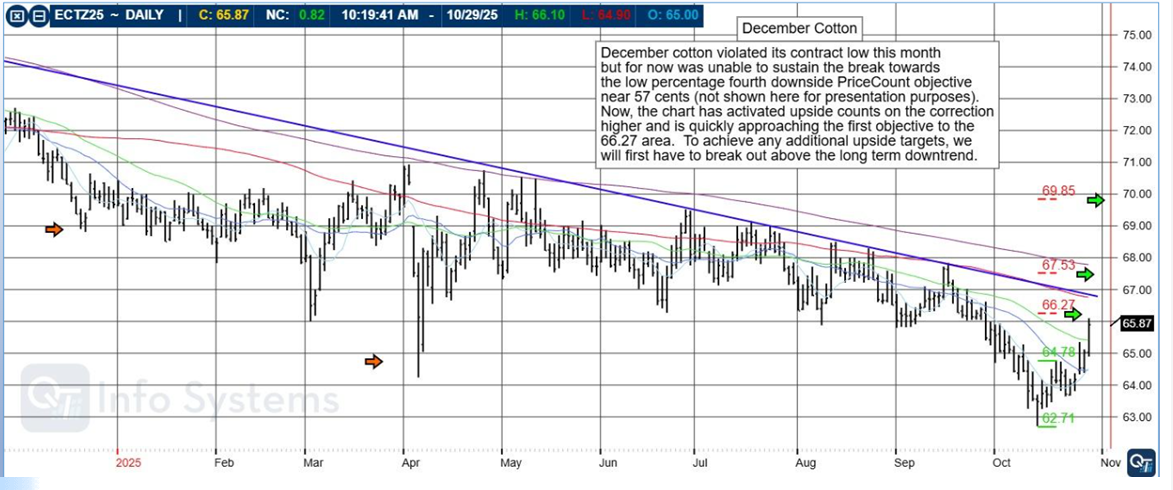

December Cotton

December cotton violated its contract low this month but for now was unable to sustain the break towards the low percentage drawn downside PriceCount objective near 57 cents not shown here for presentation purposes. The new chart has activated upside counts on the correction higher and is quickly approaching the first objective to the 66.27 area. To achieve any additional upside targets, we will first have to break out above the long-term downtrend |

|

|

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|

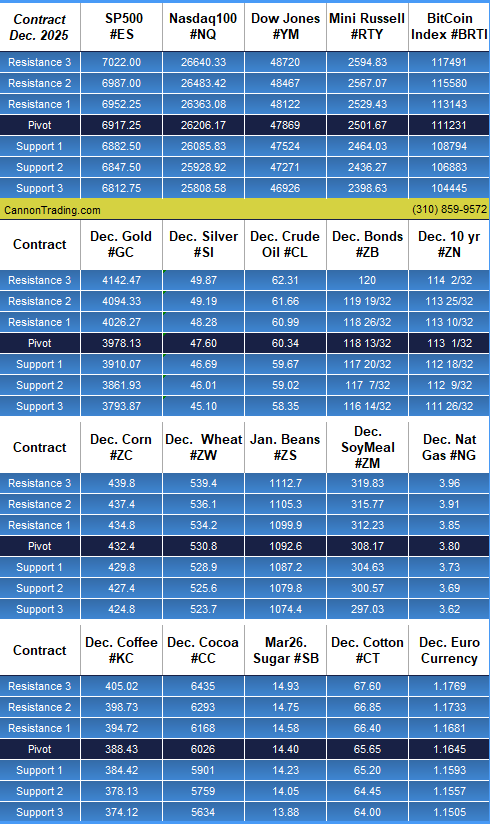

Daily Levels for Oct. 30th, 2025

|

|

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day!

|

|

Economic Reports

U.S. government data may be impacted by the shutdown. ‘Tentative’ events are subject to delay, revision, or cancellation

provided by: ForexFactory.com

All times are Central Time ( Chicago)

|

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|

|

|

|