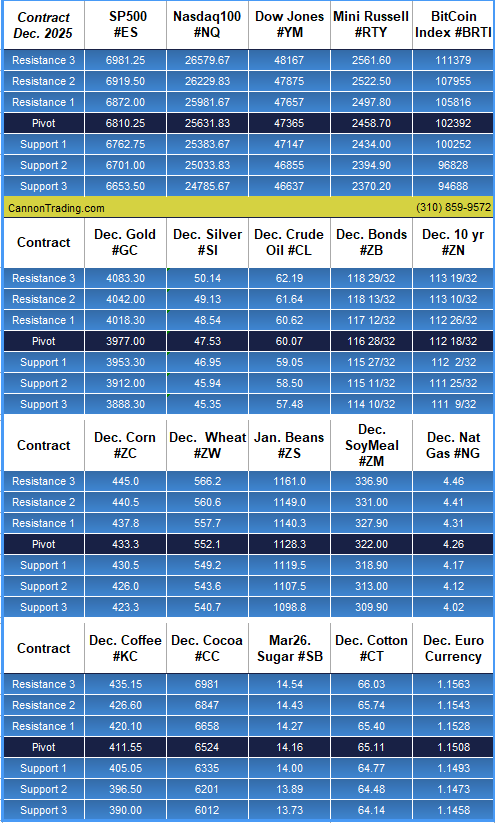

Crypto:

From its October 6th record high closing of 126,705, the Dec. Bitcoin futures contract entered a technical bear market yesterday, trading intraday below $100,000 for the first time in four months and down over 20%, closing at 101,545. For that full Bitcoin futures contract – with a contract unit of 5 Bitcoin – this is a >$125,000 per contract move.

For the micro-Bitcoin futures contract – with a contract unit of 1/10 Bitcoin – this is a >$12,500 per contract move.

Similar movement was seen in other CME crypto futures, including Ether and the new Solana and XRP futures contracts. All offer full and micro-futures contracts.

Energy:

Dec. crude oil fell below $60/barrel after U.S. government data showed an increase in crude inventories last week. Against this backdrop, some traders and analysts are bracing for further declines as the global supply glut looks to continue into 2026.

Even with U.S. sanctions on Russia’s top oil producers, Rosneft and Lukoil, and the OPEC+ decision to pause output hikes in the first quarter of next year, there is still concern about a potential supply glut.

The World Bank last week forecast that the oil glut “has expanded significantly in 2025 and is expected to rise next year to 65% above the most recent high, in 2020.” Reminder: it was April 2020 when crude oil futures traded briefly into negative territory and spent the latter 10 months trading below $50/barrel. |