Zero-DTE Options

by Ilan Levy-Mayer, VP

|

|

At-a-Glance Levels

| Instrument |

S2 |

S1 |

Pivot |

R1 |

R2 |

|

|

Gold (GC)

— Dec (GCZ5) |

3950.57 |

3995.13 |

4051.37 |

4095.93 |

4152.17 |

|

|

Silver (SI)

— Dec (SIZ5) |

48.38 |

49.17 |

50.14 |

50.94 |

51.91 |

|

|

Crude Oil (CL)

— Dec (CLZ5) |

58.65 |

58.18 |

59.74 |

60.27 |

60.83 |

|

|

Dec. Bonds (ZB)

— Dec (ZBZ5) |

116 |

116 11/32 |

116 22/32 |

117 1/32 |

117 12/32 |

|

Zero-DTE Options: Leveraging CME Liquidity in Volatile Markets

Recent volatility and sharp intraday swings in stock index futures and metals have created unique opportunities for active traders – possibly as an alternative for using futures with a stop loss. One increasingly popular tool for navigating these conditions is Zero-DTE (Zero Days to Expiration) options, available on CME Group’s deep and liquid markets.

What Are Zero-DTE Options?

Zero-DTE options are contracts that expire on the same day they are traded. CME Group offers same-day expiring options on major benchmarks like E-mini S\&P 500, Nasdaq-100, and key metals futures. These instruments allow traders to capitalize on short-term price action while avoiding overnight risk.

Advantages of Using CME Zero-DTE Options

- Access to Benchmark Liquidity: CME Group provides unmatched liquidity in index and metals options, ensuring efficient execution even during volatile sessions.

- Defined Risk Profiles for LONG options: LONG Options allow traders to manage exposure with clear maximum loss, unlike outright futures positions.

- Strategic Flexibility: Ideal for intraday hedging, directional plays, or advanced strategies like spreads and iron condors.

- Capital Efficiency: Lower upfront cost compared to futures, with margin benefits when combined with CME futures positions.

Key Considerations

- Rapid Time Decay: With only hours to expiration, options lose value quickly if the market doesn’t move as anticipated.

- Gamma Sensitivity: Price changes in the underlying can lead to significant swings in option value.

- Execution Discipline: Liquidity is strong, but spreads can widen near expiration—precision matters.

- Risk Management: Fast-moving markets require a clear plan and strict controls.

Consult with a Broker

Zero-DTE options on CME Group products can be powerful tools for active traders, but they require knowledge and discipline. Our experienced brokers can help you evaluate strategies, manage risk, and take full advantage of CME’s liquidity and product depth. Contact us today to learn more.

✅ Schedule a one on one No Obligation Broker Consultation

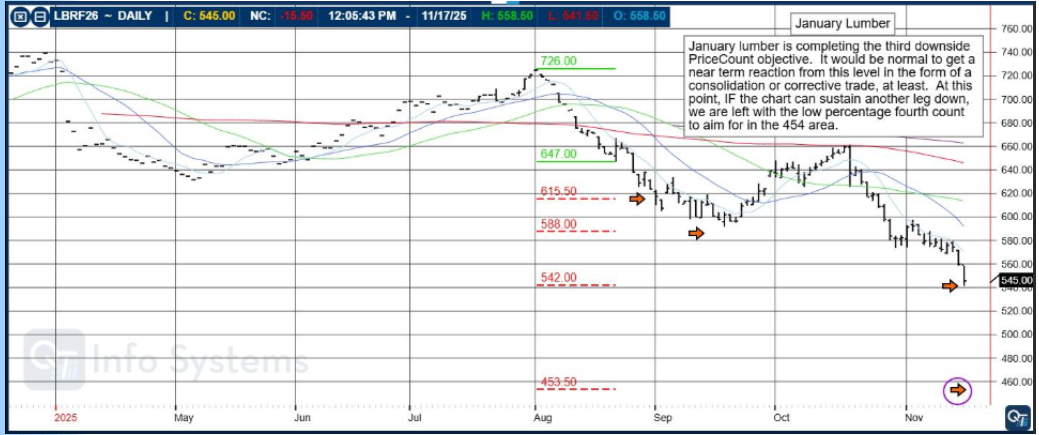

January Lumber

January Lumber is completing the third downside PriceCount objective. It would be normal to get a near term reaction from this level in the form of a consolidation or corrective trade, at least. At this point, IF the chart can sustain another leg down, we are left with the low percentage fourth count to aim for in the 454 area. |

|

|

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|

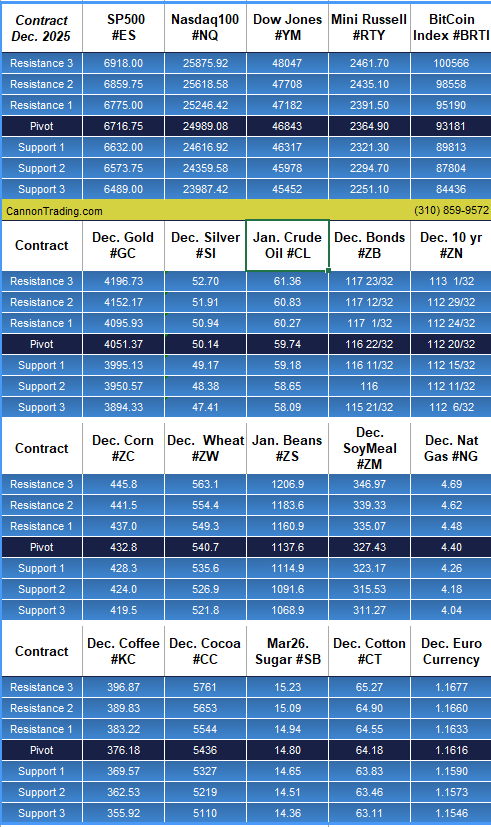

Daily Levels for Nov. 18th, 2025

|

|

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day!

|

|

Economic Reports

U.S. government data may be impacted by the shutdown. ‘Tentative’ events are subject to delay, revision, or cancellation

provided by: ForexFactory.com

All times are Central Time ( Chicago)

|

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|

|

|

|