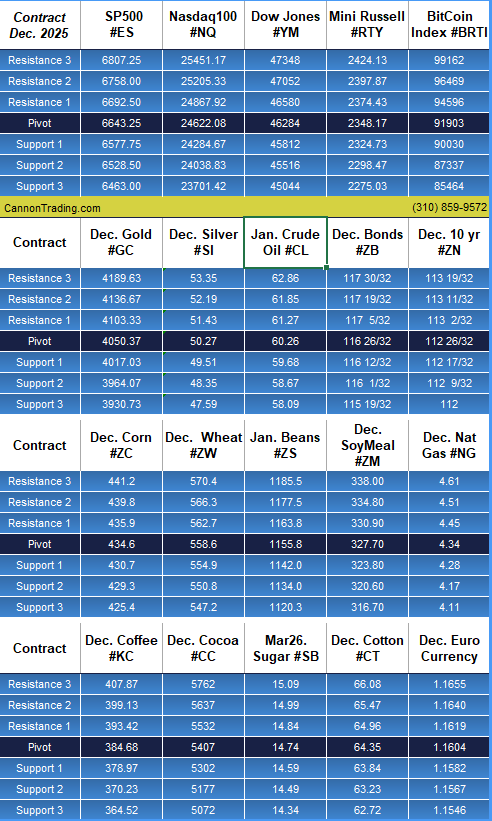

At-a-Glance Levels

| Instrument |

S2 |

S1 |

Pivot |

R1 |

R2 |

|

|

Gold (GC)

— Dec (GCZ5) |

3964.07 |

4017.03 |

4050.37 |

4103.33 |

4136.67 |

|

|

Silver (SI)

— Dec (SIZ5) |

48.35 |

49.51 |

50.27 |

51.43 |

52.19 |

|

|

Crude Oil (CL)

— Dec (CLZ5) |

58.67 |

59.68 |

60.26 |

61.27 |

61.85 |

|

|

Dec. Bonds (ZB)

— Dec (ZBZ5) |

116 1/32 |

116 12/32 |

116 26/32 |

117 5/32 |

117 19/32 |

|

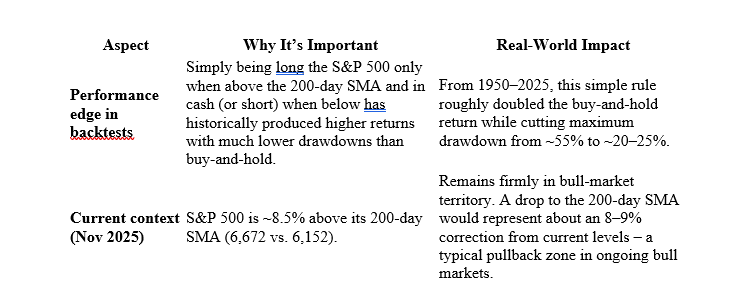

Bulls are surviving…. For now.

Financial news networks and pundits are repeating “Bubble” due to the recent sell off in equities, “AI Bubble” Google boss Pichai “AI investment boom has elements of irrationality., “No Firm immune!” Bob Michele, JPMorgan’s Chief Investment Officer, discusses lessons learned from the Dot.com bubble. Warning shots to be certain and perhaps the market is ripe for a change in tenor.

Rather than a blow the doors off rally or a sideways market (you can make a case the S&P 500 index has been trading in a range since mid-Sep.)

Where is the demarcation line that tells us we are in a Bear market? We are still in a Bull market so I thought I would do a deep dive into the technical indicator that has provided traders with meaningful support for a continuation of a Bull market. Or, once crossed, the resistance and the tenor of a Bear market.

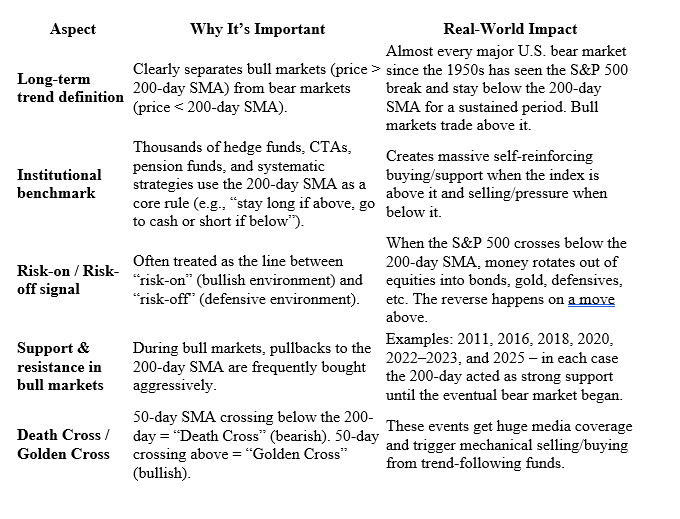

The 200-day Simple Moving Average (200-day SMA) is one of the most widely watched technical indicators in global financial markets, especially for the S&P 500. Its importance comes from a combination of institutional usage, psychological reinforcement, and historical track record. Here’s why it matters so much: |