_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

This was shared with me by a colleague of mine few years back and I can fully relate and wanted to share it with you as well:

“Look Before You Leap”

On the way to becoming (trying to become…) a successful Futures trader you will incur many losses.

That I can attest to.

One way to guarantee you will never be a successful trader is by taking “out sized” losses.

There was a time, in my 22 year career, that I would get an idea, in my head, that I had to be in a market, jump in and then look at where a proper stop loss would have to be placed and panic because the loss would be too great if the stop loss was reached.

So being the rookie that I was, I would place what was known as a “money’ stop, which is one that is based on how much money I was willing to risk rather one that was based on support or resistance.

Because this type of stop level was arbitrary I kept getting stopped out and then watching as the market turn around and go the way I thought it would.

Then it dawned on me. Look before you leap! So before jumping into the fray, look at where the stop goes first and if it is too far away you can just pass on it or place your “resting” or limit order closer to where a stop can be placed based chart support or resistance, not on “how much you want to lose”

Of course you can still get stopped out but at least you might have a better chance of keeping your losses smaller.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

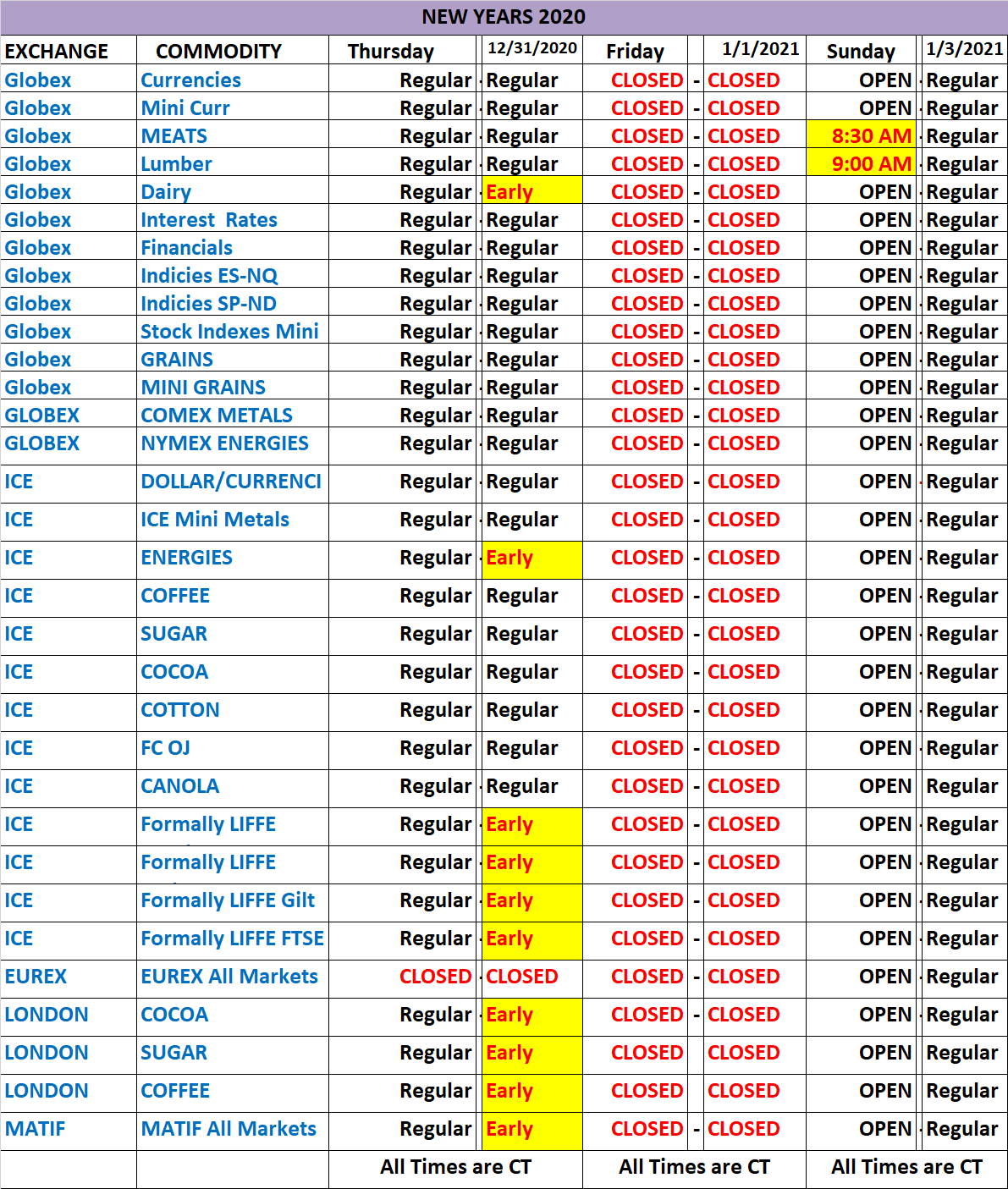

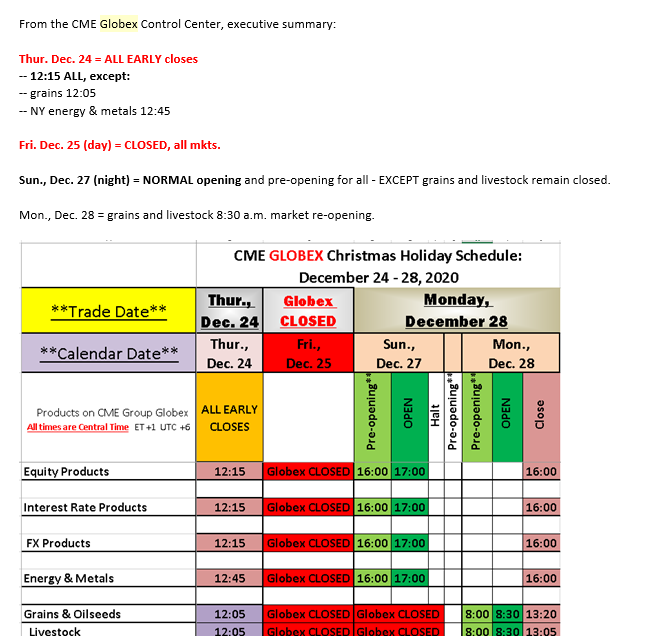

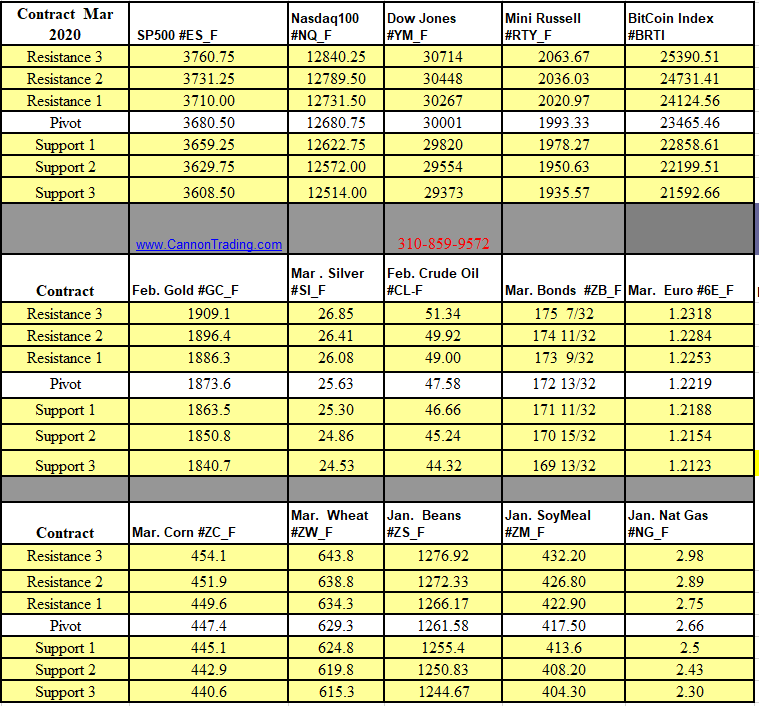

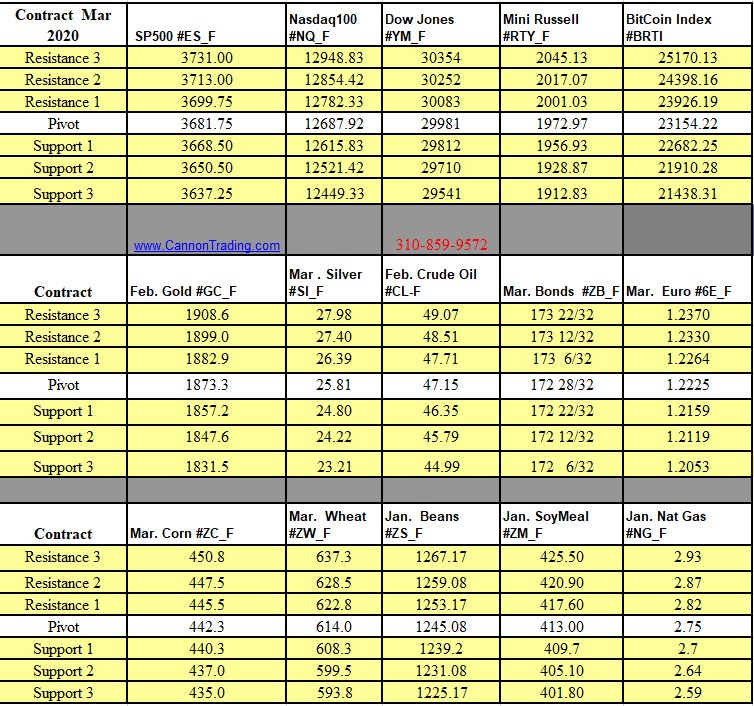

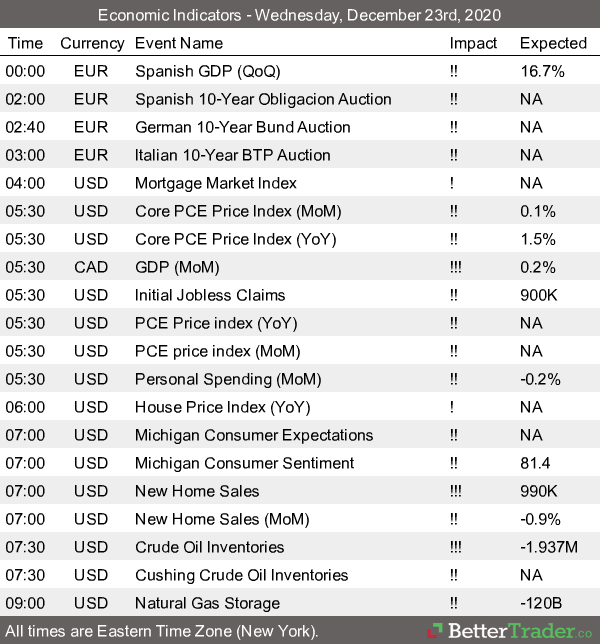

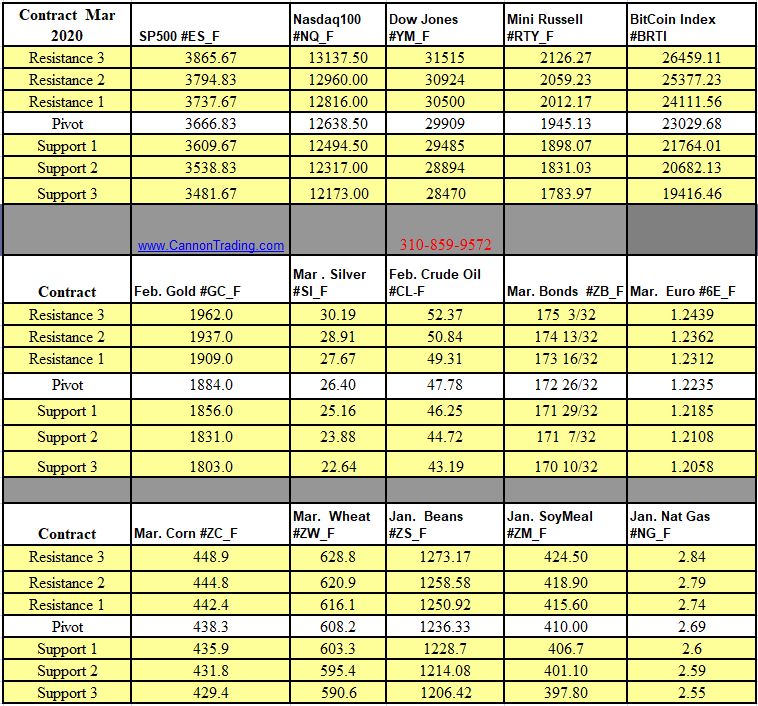

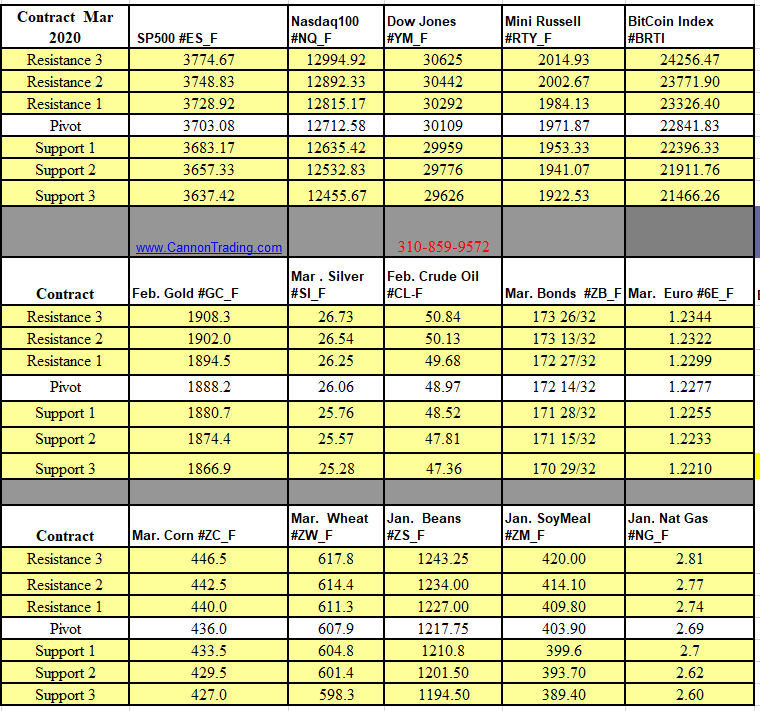

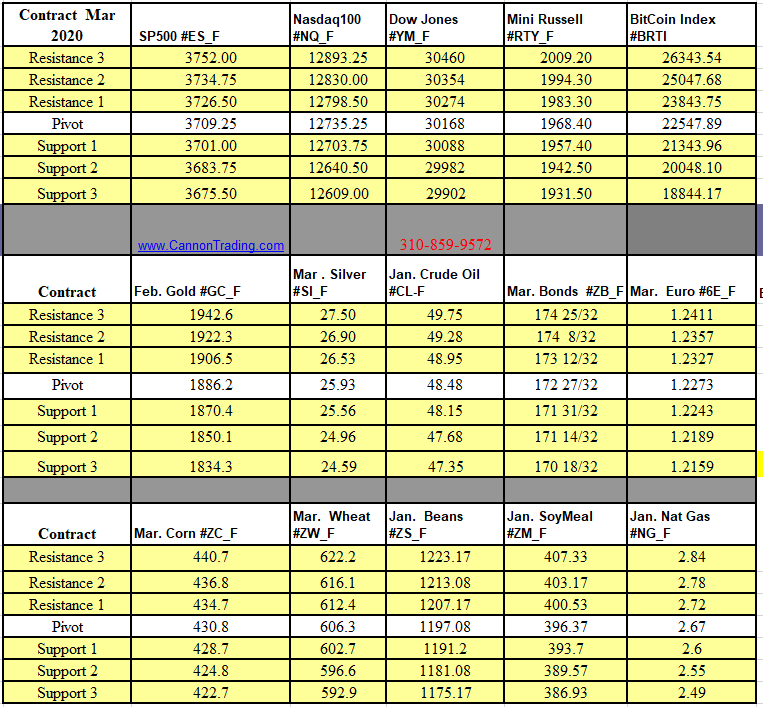

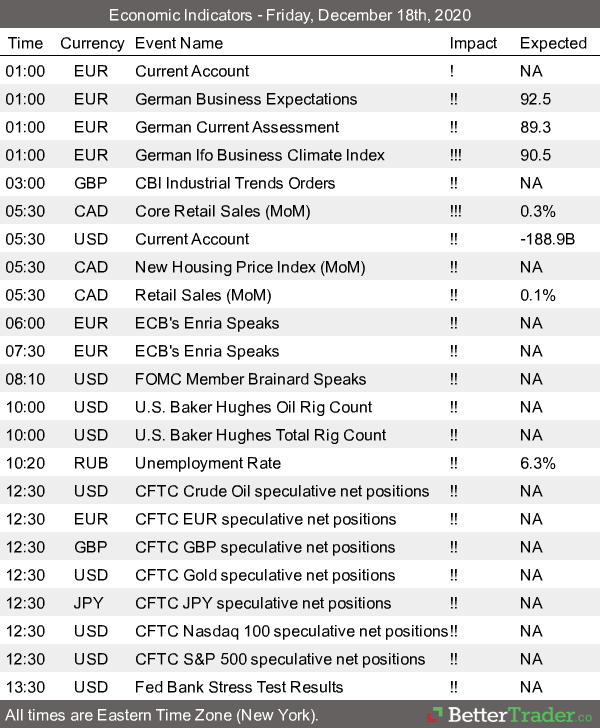

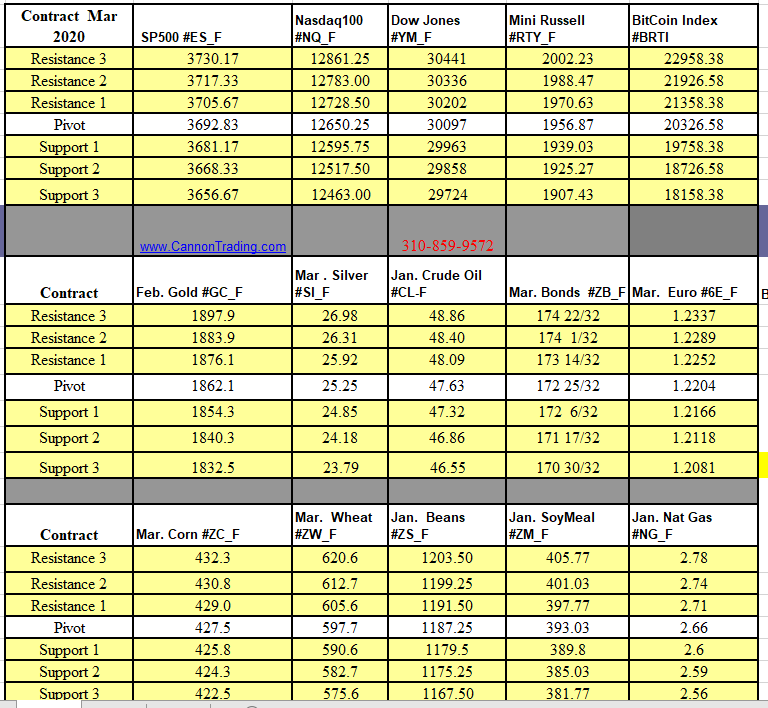

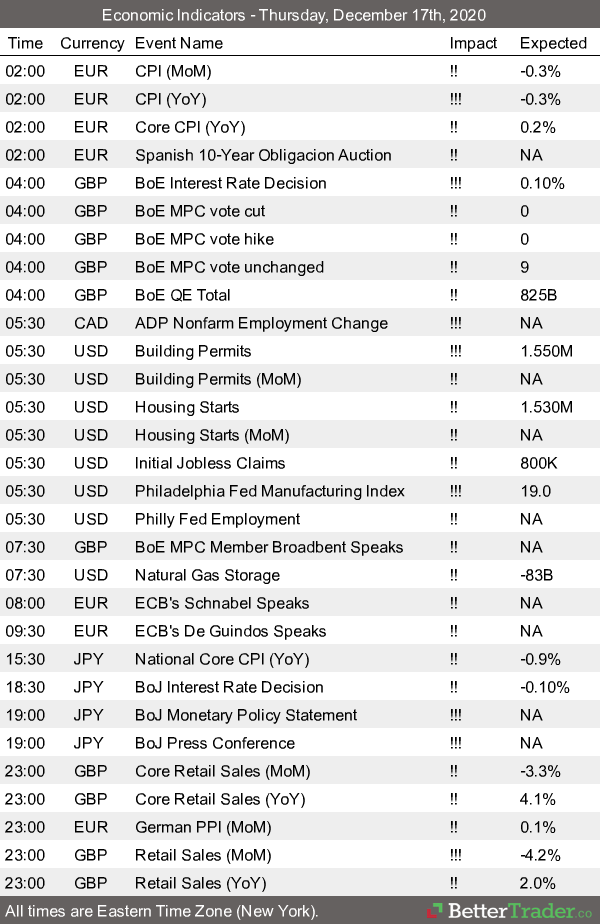

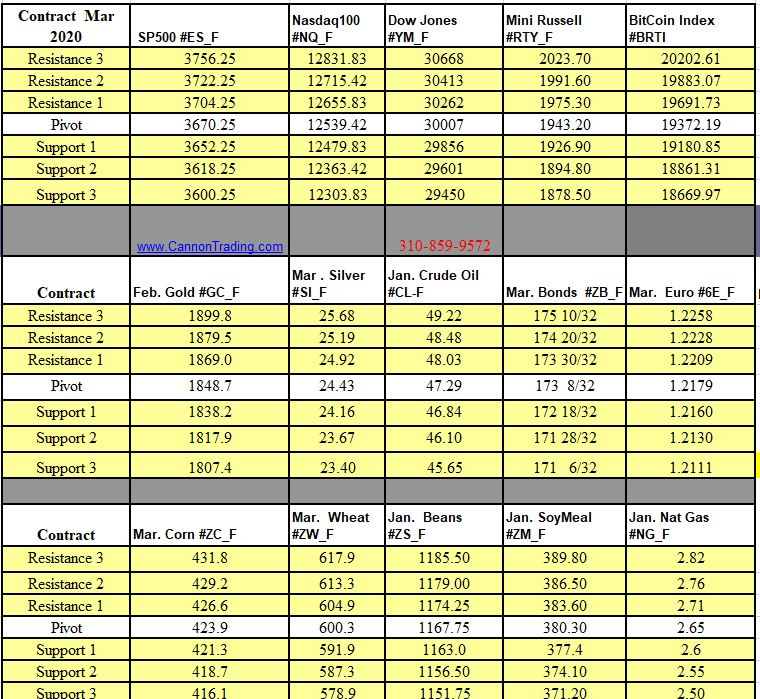

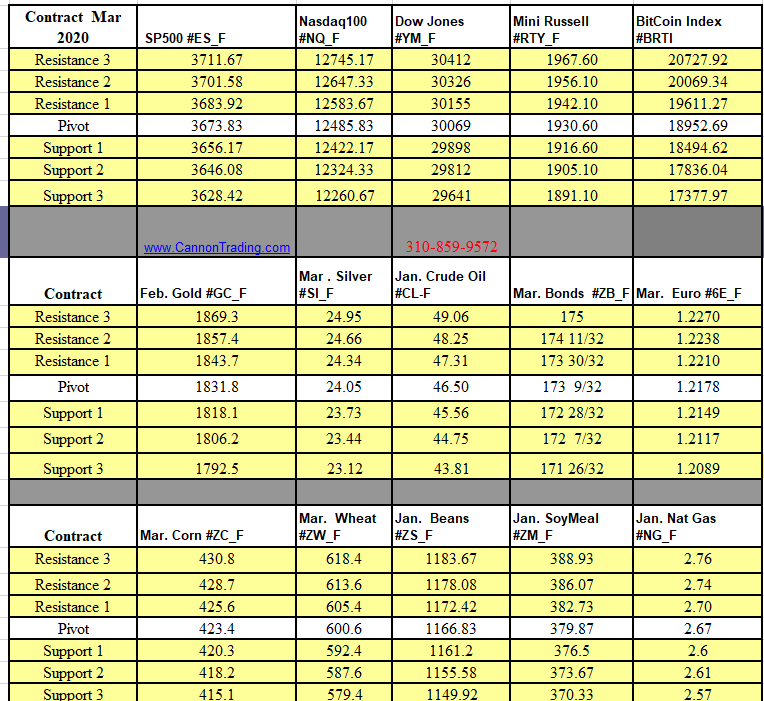

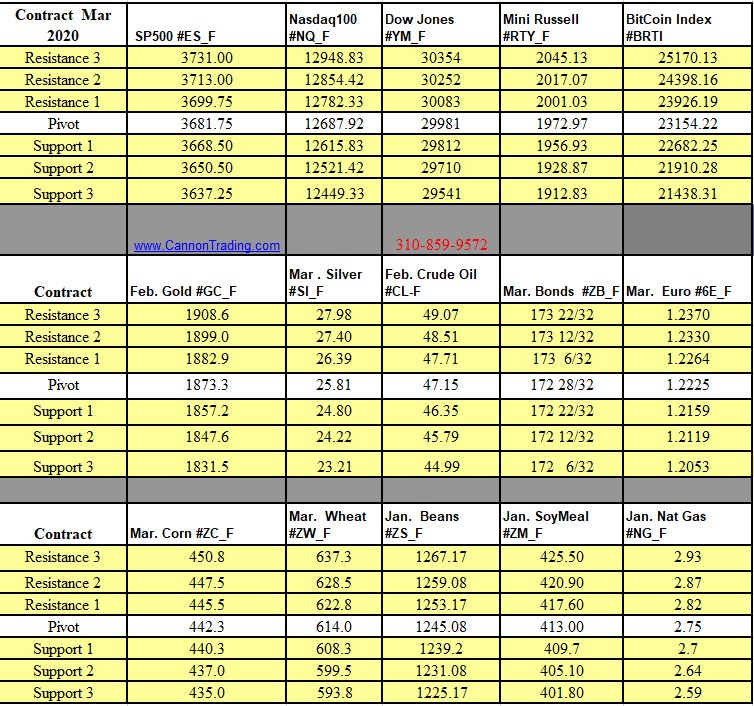

Futures Trading Levels

12-23-2020

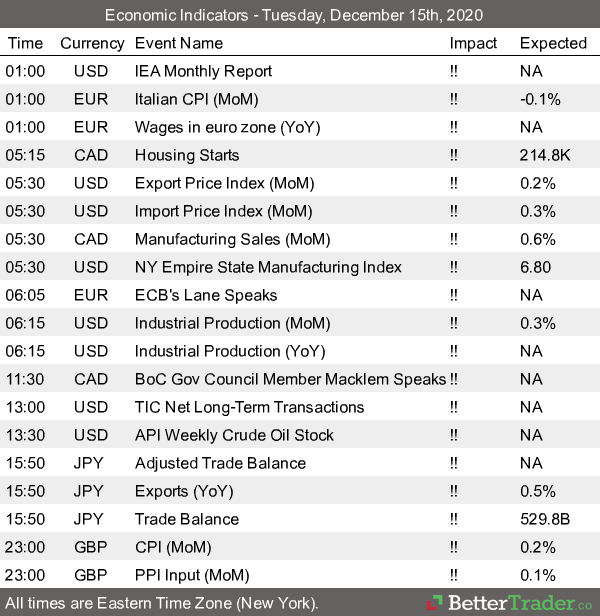

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.