Choosing a broker and/or brokerage firm for your futures trading can be a grinding task. The path of least resistance is to simply choose a firm that offers bargain-basement commissions and access to the exchanges, but most traders want more than that. Experienced traders know that the relationship between a trader and their broker is crucial to the overall success of his portfolio when trading in the highly volatile futures market. They consider service, experience, education, access to technology, and a diversity of options when choosing their broker. In reality, there are many factors to consider beyond cheap commissions.

Cannon Trading was founded in 1988, and has remained individually focused, and trusted brokerage firm since its first day. For over 30 years we have helped our traders navigate the ins and outs of the futures market. In addition to competitive commission rates, Cannon offers everything that most traders want when entering or re-entering the futures exchanges. These services include relationship-based brokers for both broker-assisted and self-directed traders, a large selection of trading platforms to suit most needs, up-to-date news and information to help traders make the best decisions about their portfolios and fast assistance from a live broker during all trading hours plus 24-hour support team access.

The first thing that separates Cannon from other affordable firms is our personal brokers. All of our clients, whether self-directed or broker-assisted, have personal brokers assigned to guide them with as much or as little input, advice, analysis as they prefer. Our brokers are here to evaluate the needs of the trader, make informed recommendations in setting up their portfolios and in day-to-day trading and help reduce their daily risk as accounts approach the day’s closings. Our brokers are experienced, and most-importantly, available. During business hours our clients never call-in to automation, but rather are connected to a broker immediately for service.

Another edge Cannon has over our competition is our large selection of trading platforms. In today’s fast-paced markets, having the right technology is crucial to successful trading. Many brokerages only offer one or a few trading platforms and are therefore obligated to sell their potential clients on those platforms, even if they’re not really the best for their trading needs. Cannon has one of the widest selections of trading platforms available and our brokers are experts in helping traders pick the one that’s right for them. Platforms include features like mobile access, built in risk monitors, high-grade encryption and hundreds of others to help our traders be the fastest, most informed, and most successful traders that they can be. With very few exceptions, all of our platforms include free demo periods, so that traders can decide if the platform is right for them before going live in the market. It’s important for traders to take advantage of this, to see if that platform’s definition of “user friendly” holds true to them and to determine if the features offered by the platform are advantageous to the trader’s personal needs.

In addition to a diverse selection of trading platforms, Cannon also has relationships with multiple Futures Commissions Merchants (FCM’s), so that traders can choose the best one for their needs, rather than be stuck with just one selection. We also offer Foreign Exchange and international trading and many of our brokers speak multiple languages. We want to make sure that whatever a trader’s needs are, we have them covered.

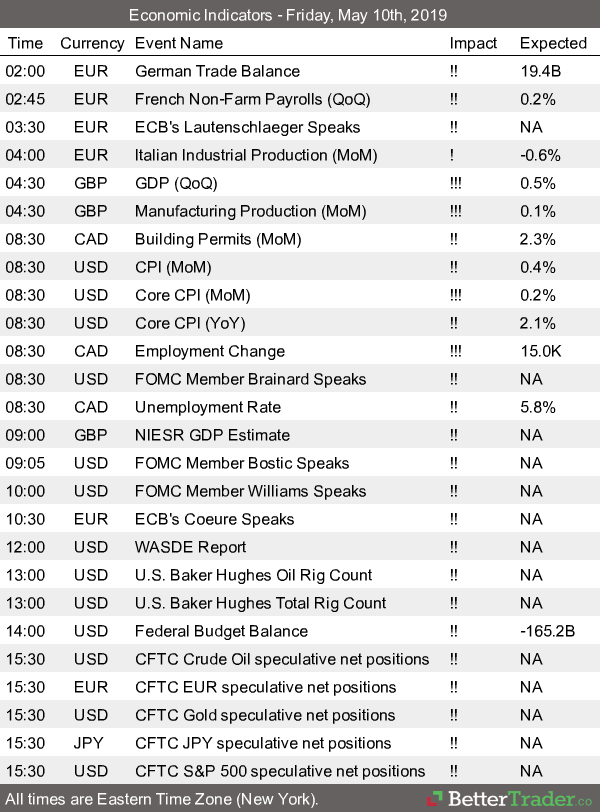

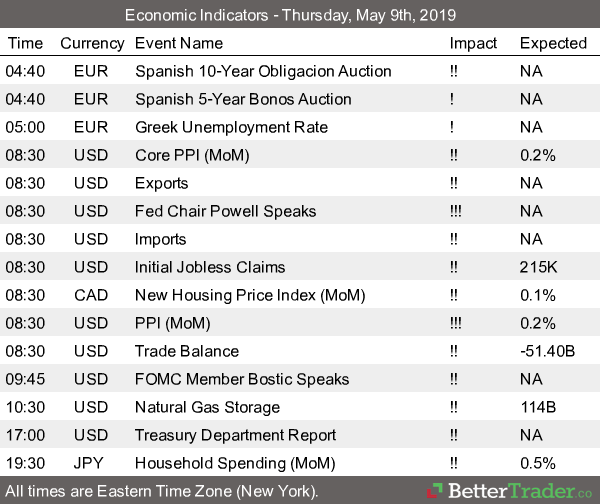

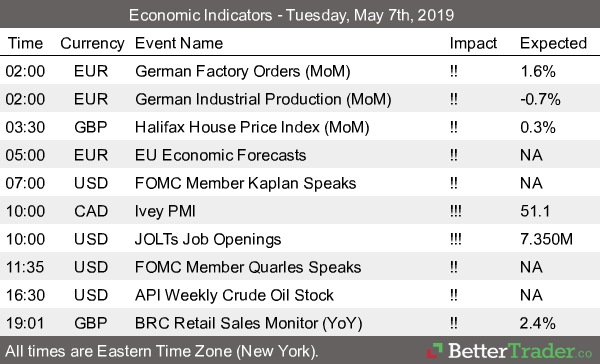

A unique benefit that we at Cannon offer our clients is access to daily newsletters, articles and up-to-date information about the futures markets. We believe a successful trader is an educated and informed trader, and so we offer our clients as much material as possible to help them achieve their goals in the market. Our website alone contains dozens of articles that are written by our brokers which are continually updated to provide our traders with as much information as possible about navigating the futures markets successfully. We also offer on-line seminars, daily research, optional daily e-mail updates, and optional text alerts to keep our clients up-to-the minute with the day’s market news. In addition to informing themselves, traders can always call in to speak to our highly informed brokers, who stay current with each day’s global and trading news.

The most important aspect of our service at Cannon Trading is our commitment to being available to our clients 24/5. Our brokers answer their phones – no voicemails, no automated systems with numbered extension choices during market hours Monday through Friday. Nights and weekends, we offer 24-hour access to any of our FCM’s support desks, in case our clients have questions when the markets are trading – and we’re sleeping. This is by far the most popular aspect of our brokerage. Our clients know that when they have questions, wish to make an assisted trade, or just want to talk to someone about the daily market, their broker or one of our experienced team will always be available to help. The futures market runs fast and volatile, and it is crucial to our clients that they are not answered by automated systems or connected to voicemail during trading hours. When clients need to speak to someone NOW, we are there. If traders do not have time for phone service, we are connected to email, live chat, and text as well.

At Cannon Trading, we understand that choosing a brokerage firm is one of the most important financial decisions that can be made. We are committed to offering our traders the strongest support possible to help them in the risky futures market. We know that in the futures market, small details are crucial and sometimes every second counts. We’re here to help our clients when it matters most. Our Trustpilot customer reviews speak for themselves:

“The customer service is amazing! I would recommend them to anyone looking for a broker.”

“The people at Cannon Trading are very professional and eager to help.”

In short, if you are a trader looking for excellent service, fast support, informed and experienced brokers, and a lot of options to create the perfect trading experience, Cannon is your firm.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time